[Part 2 of 4 ] 6 Ways to Structure Private Money Deals

Hey, here we are back again for 2 of my 4-part blog series, and this one’s all about the ‘meat and potatoes.’ Yep, we’re going to cover – in depth and in great detail – six time-tested, proven ways to structure private money deals.

In Part 1, we talked about what it means to be a transaction engineer, the financing options available to investors, why private money is such an awesome option, and risk versus reward.

If yIf you ended up on this page before reading our first article, you can start with part one of 6 Ways to Structure Private Money Deals.

Now for Part 2, we’re going step-by-step through six different structuring methods for private lender deals using my Rehab Valuator program. We’ll walk through two lower risk scenarios, two higher risk scenarios, a debt and equity scenario, and a creative pure equity scenario.

Don’t worry, I’ll break this all down into terms that are easy to understand and easy to follow, including helpful screenshots all along the way.

NOTE: The examples below use the Rehab Valuator Software to do the deal structuring and calculations. If you don’t have this software yet, you can create a FREE ACCOUNT here

We have loads of valuable info on how to structure private money deals in this post – first 3 structuring scenarios – so let’s get to it.

Our Example Deal:

Here’s an example private lender deal we’ll be referencing for our deal-structuring scenarios:

Purchase price: $100,000

Required repairs: $37,000

Closing and holding costs: $3,000

_________________________________________________________

Your total cost basis (not including financing costs): $140,000

_________________________________________________________

After repair value (purchase value): $200,000

Keep in mind as we move through these examples of how to structure private money deals that I am using numbers for demonstration purposes only.

You’re buying the property at 50% of the After Repair Value (ARV). The ARV is what the property will appraise for (and also the price it will be marketed and sold for, if you’re selling rather than keeping) after all the repairs are made.

Once the repairs are completed, and you’ve accounted for the soft cost, your total cost basis is 70% of the ARV. That leaves you 30% for profit margin.

Okay, now let’s dive into the six ways you can structure private lender deals.

Structures 1 and 2: Lower LTV Debt Scenarios

Let’s start by walking through the lowest risk real estate lending scenarios – Low LTV debt.

I’ll walk through two different ways you can structure this.

Structure 1: Lender Funds 50% of Acquisition and Rehab Costs

In this scenario, the lender agrees to fund 50% of the total cost of the project – that is, 50% of the acquisition and also 50% of the costs of renovation.

By the way, please keep in mind that just because I’m explaining this scenario doesn’t mean that it’s ideal for you or your private equity deal. From a bottom line standpoint, this type of arrangement is clearly not optimal for you as the investor – it’s generally best when you don’t have to use your own money in the deal. But each of these scenarios is worth taking in, because you never know when one of them – even your 2nd, 4th or 6th choice – could be the one that actually gets the deal done for you, depending on the circumstances at hand.

Or you may start off with a new private lender at whatever terms make them feel most comfortable at first, but then once you prove yourself with a deal or three, it may well open the door for better terms together on future deals. Oftentimes, doing a deal with terms that may not be ideal can still get your foot in the door with someone you want on your side for the long-haul. Something to think about.

So again, in this first structure, the lender funds 50% of the acquisition and 50% of the rehab cost of the project, and you as the investor, are responsible for the other half of each, plus the closing costs and holding costs. So you’ll be making interest payments to your lender during the rehab.

Let’s Plug and Play

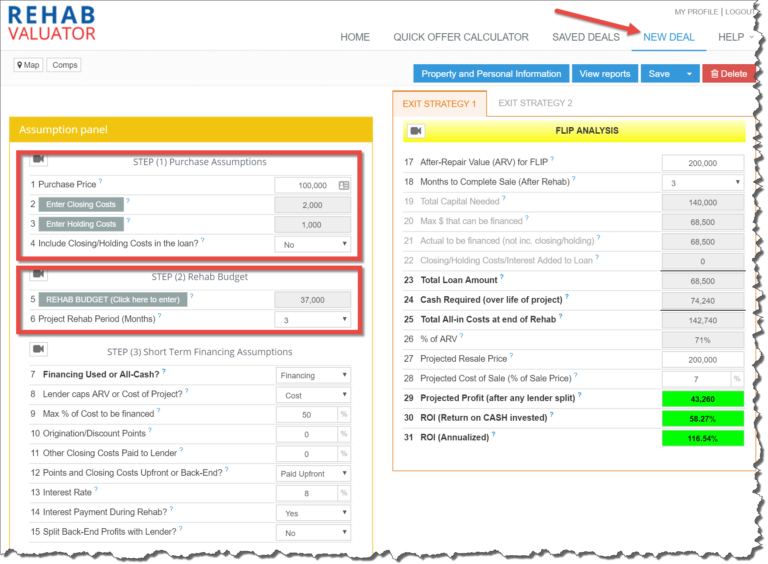

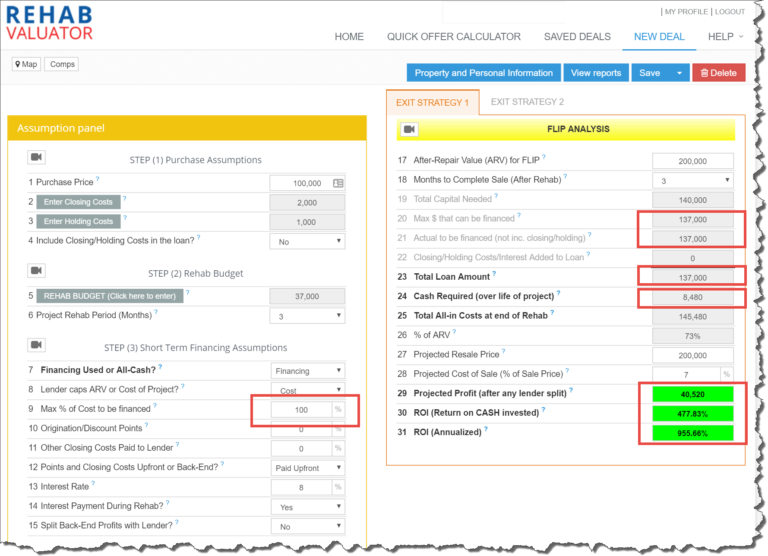

Here’s how this deal would look in the Rehab Valuator house flipping software (if you don’t have an account already, then create a free one here and follow along): Starting from the Welcome page, open up a “New Deal” for analysis.

Step 1 – Purchase Assumptions: Under Step 1, just fill in the fields for your purchase price and estimated closing and holding costs – we’ll assume about $2,000 in closing costs for the deal, and around $1,000 in misc. holding costs, like utilities and such.

Step 2 – Rehab Budget: Under Step 2, add your estimated rehab cost, and let’s assume it’ll take 3 months to complete the renovations.

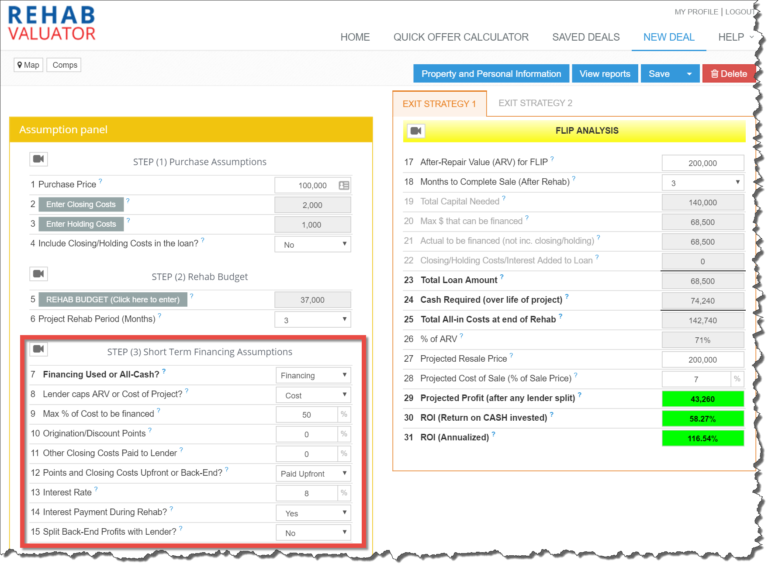

Step 3 – Short-Term Financing Assumptions: Since you’re definitely financing this deal rather than paying all cash, choose Financing from the drop-down menu on line 7.

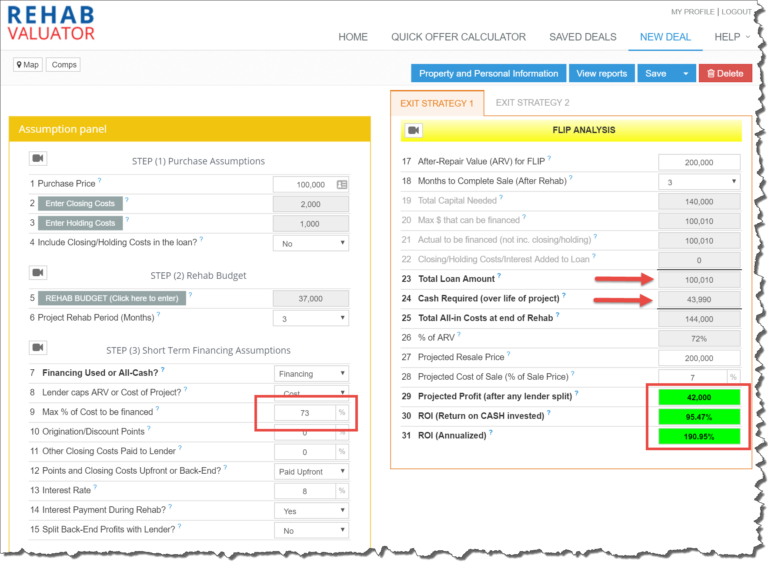

Next, you’re given different options for how your lender will finance your project. This is based either on cost, on a percentage of cost, or a percentage of the ARV. In this case, your lender has agreed to fund a certain percentage (50%) of the cost. So you’ll select Cost for line 8 and input 50% for line 9 – Max % of Cost to be financed.

Now let’s say your lender wants an 8% return on his money, and he also wants to receive his interest in the form of monthly payments over the course of the project. So for Interest Rate (line 13) simply input the 8%, then for Interest Payment During Rehab you select Yes. For line 15 select No, since there will be no profit split in this example.

Now let’s move over to the right side of the page for the final pieces.

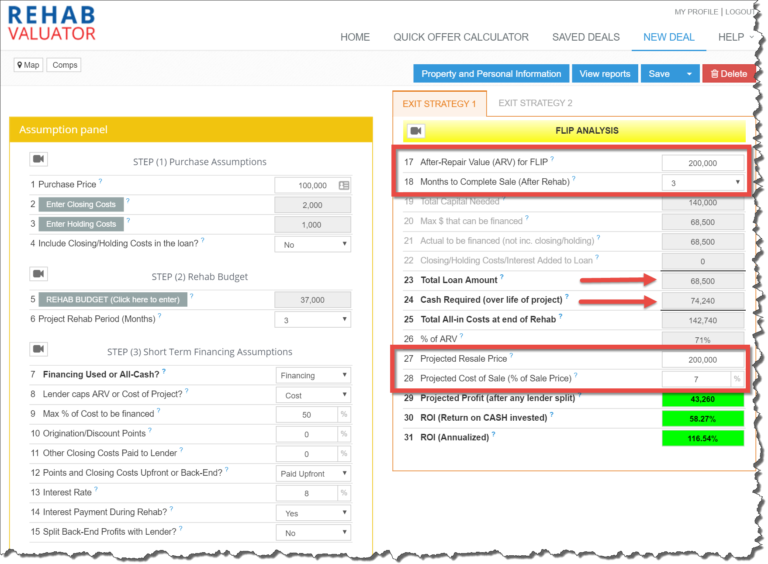

EXIT STRATEGY 1 > FLIP ANALYSIS: If you recall from earlier, our ARV is $200k, so you’ll input that on line 17. And let’s assume for line 18 that we’ll take around 3 months after the rehab is done to actually get this property sold. (So 6 months total for the whole project when you add to the 3-month estimated rehab timeframe.)

Then for Project Resale Price (line 27), let’s assume you’re going to sell it for the full ARV of $200k, and that your Projected Cost of Sale (line 28) is about 7% – this would be for your Realtor commission and closing costs upon sale.

Now based on the information you’ve entered, Rehab Valuator will calculate a number of helpful things automatically for you. But notice from the screenshot here that the total amount you’re borrowing from your private lender is $68,500 – which is 50% of the total capital needed for purchase and rehab; whereas you’ll be coming to the table with $74,240 – which is your 50% of the acquisition and rehab, plus the total estimated closing costs ($2k), holding costs ($1k) and interest payments (8% over 6 months).

Now can you see why we call this a low loan-to-value debt scenario? You’re essentially saying to your private lender, “Hey, I need you to fund half of this project at $68,500, which actually equates to only 34% of the property’s ARV.” Most any lender would feel very secure with this type of situation.

Making a Snappy Private Lender Presentation

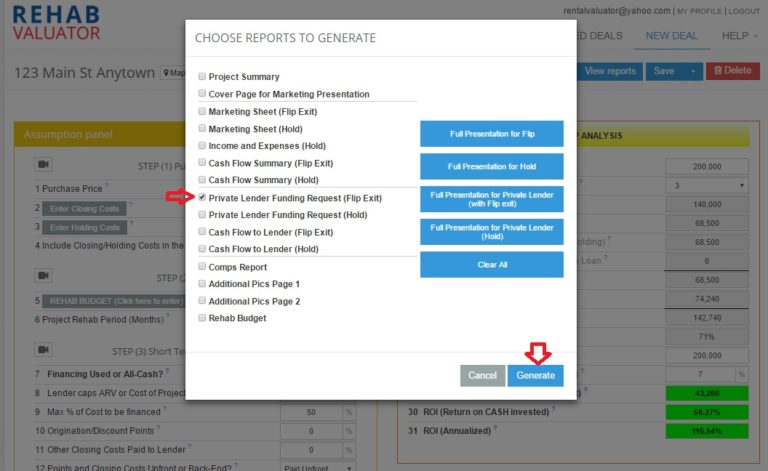

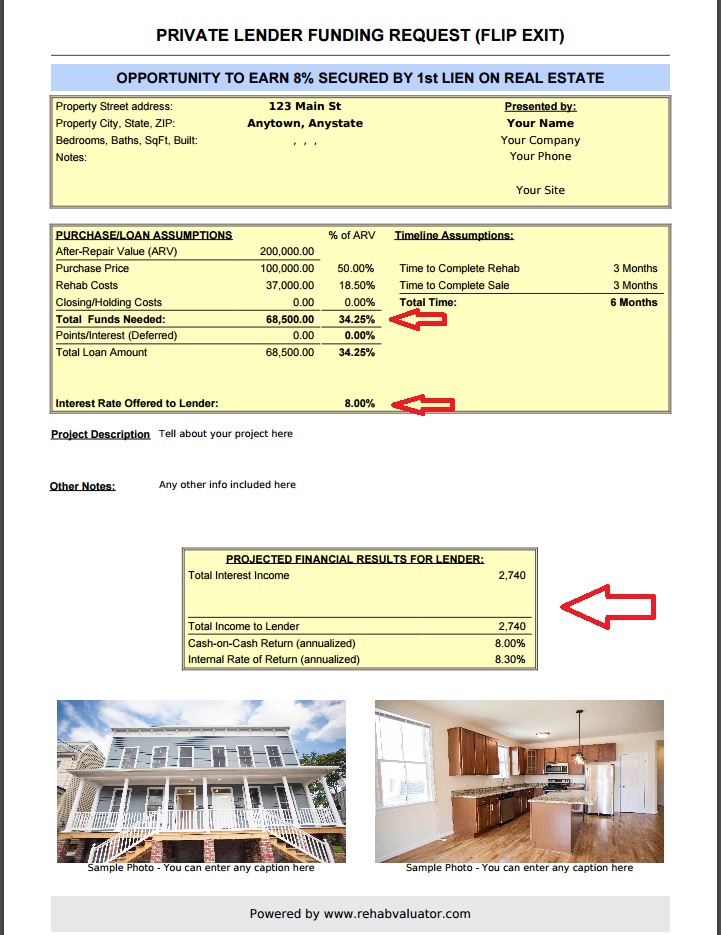

Another place where Rehab Valuator really shines is in how easy it is to create an extremely professional, easy-to-read report for your private lender, giving him or her all the key details in a clear, concise way of (i) the property (ii) the deal structure and (iii) their projected return on investment (ROI) in your deal. It very quickly summarizes the whole deal and makes you look like a total pro from the get-go.

Click “View Reports”, then select “Private Lending Funding Request (Flip Exit):

Rounding Up Private Lending Structure #1

So let’s quickly recap…

Purchase price: $100,000

Required repairs: $37,000

Closing and holding costs: $3,000

_________________________________________________________

After repair value (purchase value): $200,000

_________________________________________________________

Lender puts up: $68,500

You put up: $74,240

_________________________________________________________

Your projected profit: $43,260

Your cash/cash return: 58.27%

Your annualized ROI: 116.54%

From this, you can see that even though you’re putting up a good deal of cash, you’re making a great return.

Structure 2: Lender Funds Your Acquisition but Not Rehab

This is our second Low LTV Debt scenario, and in this example the lender is willing to totally fund your full acquisition cost but none of the repair costs. So one way or another, you’ll need to come up with the cash for the rehab, and more than likely your closing and holding costs, as well as the interest payments during the rehab. This will be a slightly higher loan-to-value scenario than the previous example, but still considered a low loan-to-value debt.

Time to return to the Rehab Valuator so we can see visually how this plays out. And in this example, things get just a little tricky because you have to ‘backdoor your way’ into the calculations a little bit. But rest assured, it’s still super easy to do.

Here’s how it looks…

Almost all our numbers are input exactly the same as before, except this time the lender is willing to fund your full purchase price of $100,000 (line 1). But remember, when you take your rehab costs, closing/holding costs, etc. into account, this is still only a percentage of the $140K total capital needed to fund the deal (line 19).

So what you need to do is get your Total Loan Amount on line 23 to be $100K, however, since this isn’t an editable field, you’ll do this by:

First: dividing your purchase price by your combined purchase + rehab. So in this case, that’s $100k (purchase price) divided by $137k (purchase + rehab cost). In this case, you get 73% as your answer.

Then Second: Input your answer – 73% – into the field for Max % of Cost to be financed (line 9).

Then what you’ll see happen is the Total Loan Amount on line 23 will now reflect your purchase price of $100,000.

As mentioned, everything else in the equation stays the same.

How This Shakes Out For You

The result in this scenario for you is:

-

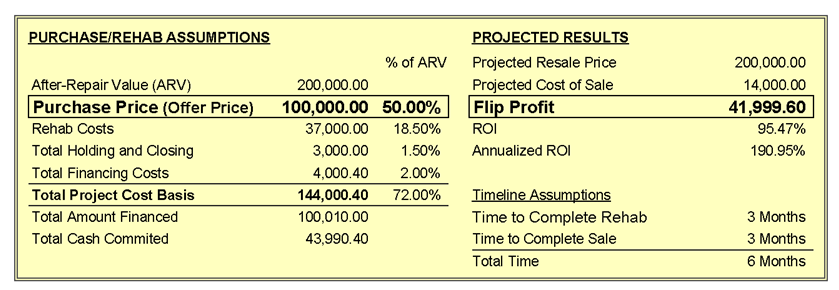

- Your projected profit will be $42,000 – which is around the same projected profit as the last deal structure we looked at (within around $1,000 bucks).

- But your out-of-pocket this time is only $43,990 – which is over $30k less than you had to bring to the table yourself in the first structure we looked at.

- And your Return on Cash Invested (yours, not your lenders) has now more than doubled.

Here’s how the deal looks from your perspective:

Lower Lender Risk = Lower Lender Return

Up to now, we’ve established that low risk equals low return. To me, an 8% return is rather low, although for many private lenders it’s more than enough, as they compare it to what they’d be getting in the stock market.

The first two structures we covered here are considered low-risk because your private lender is loaning you such a low percent of the ARV, and you have to come to the table with so much of your own money.

Think about it this way: In either of these first two structures, probably the worst thing that can happen to your lender is for you to make all your payments on time and pay off the loan as agreed. They’d very likely end up making more money if you were to bail on the deal altogether. Why? Because they’ll have a first lien on the property at such a low LTV, that they’d probably end up making more money on this property even if they had to foreclose and sell the property to somebody else.

So these two are very low-risk structures for your private lender, which in my view warrants a relatively low return.

Structures 3 and 4: Higher LTV Debt Scenarios

Now let’s walk through a couple of Higher LTV Debt scenarios, which bring a bit more lender risk, but also a greater potential reward for your lender.

Structure 3: Lender Funds It All + Gets a Straight Interest Rate

In this scenario, the lender funds 100% of the cost of the project, and you are responsible for the closing and holding costs, and of course for making your monthly interest payments during the project.

And let me clarify something here: I am not recommending you structure private money deals where you have to make monthly interest payments if you don’t have to. It’s all in what you can negotiate, and it certainly makes sense to try and avoid having to make monthly payments during your project if you can. But at the end of the day, it’s just not always possible.

There are always so many ways to structure private money deals, and I’m simply showing you how to flexibly structure deals to accommodate your lenders. Hopefully this helps you think outside the box.

Okay, so let me show you what this situation would look like by going back to our financing scenario. Almost all of our numbers are exactly as before, except this time you’ll factor in that your lender will finance 100% of the purchase and rehab costs, and assume that there are no additional points to pay.

Side Note: If this were a portfolio lender, you would probably have points to pay and closing costs associated with the loan. But because this is private money, I’m assuming you’ve negotiated that there are no points to pay.

So let’s see how it looks…

Here’s how the numbers have changed:

-

- You’ve updated the Max % of Cost to be Financed (line 9) to “100%.”

- This automatically updated the fields for (i) Line 20 – Max $ that can be financed (ii) Line 21 – Actual to be financed and (iii) and Line 23 – Total Loan Amount to “137,000” (that’s your $100k purchase + your estimated $37k rehab).

- This also takes your own out-of-pocket cash required (Line 24 – closing + holding + interest payments) down to only $8,480.

And here’s something especially cool to make sure you don’t miss: Your projected profit of $40,520 (line 29) is around $1,500 less than the last scenario, but both your cash-on-cash return and your annualized return on this deal (lines 30 & 31) are actually huge because you’re only putting in $8,480 dollars of your own money into this deal (line 24), which is waaaaaaay less than in the previous two scenarios we looked at.

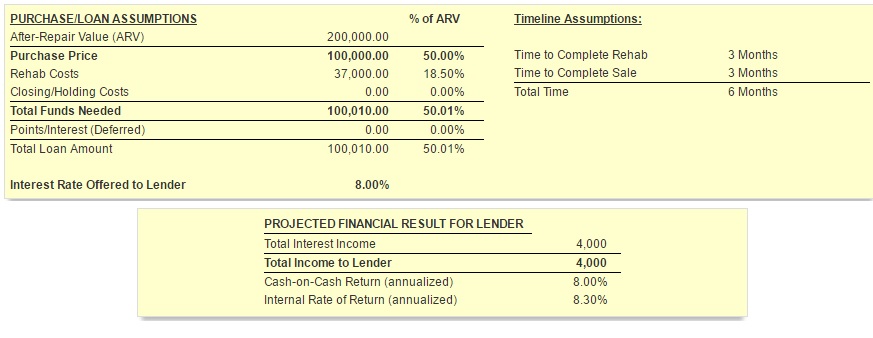

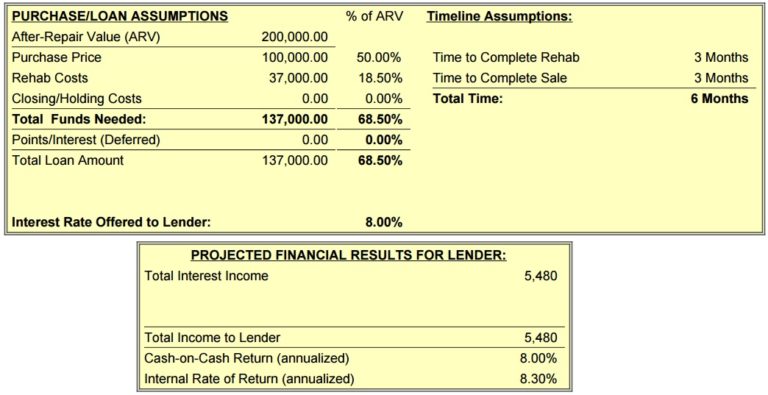

How This Looks to Your Lender

So here your lender puts up $137,000, which is only 69% of the ARV. This scenario leaves plenty of cushion for them and is a very palatable risk to most private lenders – especially if the rehab is done properly, so the property ends up truly worth $200K in the end.

As shown previously, Rehab Valuator gives you 1-click access to a simple, 1-page, professional report to make this proposal to your private lender.

Pro Tip: You also have the option to print a “full presentation,” which generates a robust, 5-page presentation, which includes a cover page, the 1-page summary report, cash flows (when money is to be dispersed), a comparable sales report, and an array of additional photos of the project property.

Just something to keep in mind when the times comes.

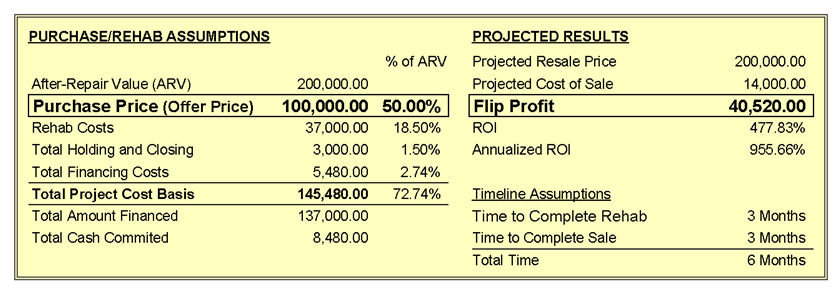

Rounding Up Private Lending Structure #3

So again, let’s quickly recap how the numbers stack up here…

Purchase price: $100,000

Required repairs: $37,000

Closing and holding costs: $3,000

Interest payments – 8%: $5,480

_________________________________________________________

After repair value (purchase value): $200,000

_________________________________________________________

Lender puts up: $137,000

You put up: $8,480

_________________________________________________________

Your cash/cash return: 477.83%

Your annualized ROI: 955.66%

You see the pattern here, right? With each structuring scenario, we’re moving from you putting up a lot of cash to putting up only a little cash.

This wraps up the first 3 Deal Structures (out of 6) that we’ll be covering.

In the next section, we’ll look at private lender deal scenarios where you put up zero cash, which is really where you want to be as an investor! This is where things will get really interesting!

Hello Danill wow what an amazing software you created . This will benefit anyone else in the Presentation to private Lenders & On 1 Note i must say this Software really works well , when presenting your – ( HAMP ) Home Analysis Marketing Presentation , I Tell you of a Truth i used this software in 2020 to present a home that i wanted to wholesale to a local REI & i was able to present long term as well as short term with ROI projections and the sale was completed just because of the presentation with accurate details , this Investor presented the presentation to a Broker that he was working with & He was impressed with the present HAMP documents .

So this software must be 10x better with all the major improvements than 4yrs ago . I really can’t wait to dive in Thank You Danill Kleyman for such an amazing software & making it available ….

Thank you for taking the time to share with us Hector! The Rehab Valuator software has come a long way in four years so you will definitely enjoy diving in and exploring. 😊