Commercial Real Estate Software

Our software takes the guesswork out of commercial real estate investing. Analyze deals with up-to-date comparable rents, project cash flow, and assess key metrics like NOI and cap rates, all in one powerful platform. Save time and make informed investment decisions effortlessly.

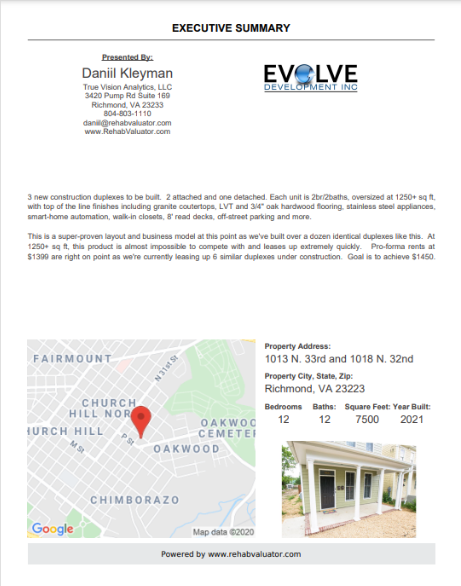

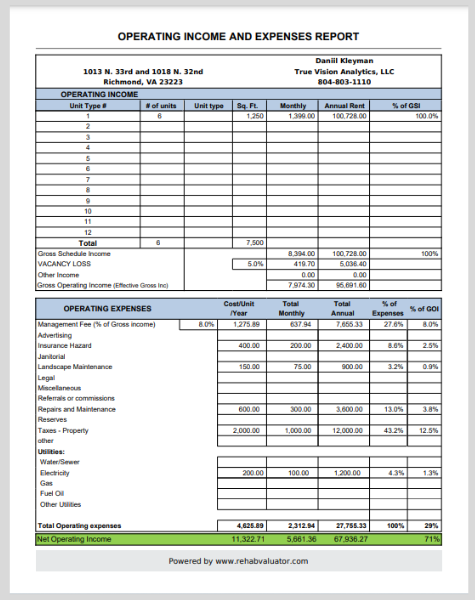

When investing in Commercial Real Estate, deal analysis starts before you even jump into your Rehab Valuator Commercial Real Estate Property Management Software. The location of a commercial property is crucial and can significantly impact its potential for success. Factors to consider include the neighborhood’s demographics, accessibility to major transportation routes, proximity to amenities, and the overall economic stability of the area. A prime location attracts quality tents, increases property value, and ensures a steady stream of income. Once you’ve found the perfect location for your next commercial real estate investment, it’s time to start figuring out the vital metrics of your deal.

When investing in Commercial Real Estate, deal analysis starts before you even jump into your Rehab Valuator Commercial Real Estate Property Management Software. The location of a commercial property is crucial and can significantly impact its potential for success. Factors to consider include the neighborhood’s demographics, accessibility to major transportation routes, proximity to amenities, and the overall economic stability of the area. A prime location attracts quality tents, increases property value, and ensures a steady stream of income. Once you’ve found the perfect location for your next commercial real estate investment, it’s time to start figuring out the vital metrics of your deal.

Now, it's time to consider the potential returns on your commercial investment!

You've found the right location, save yourself massive amounts of time, money and headaches using accurate, recent, nationwide comparable rentals available inside the Rehab Valuator Premium Commercial Real Estate Property Management Software.

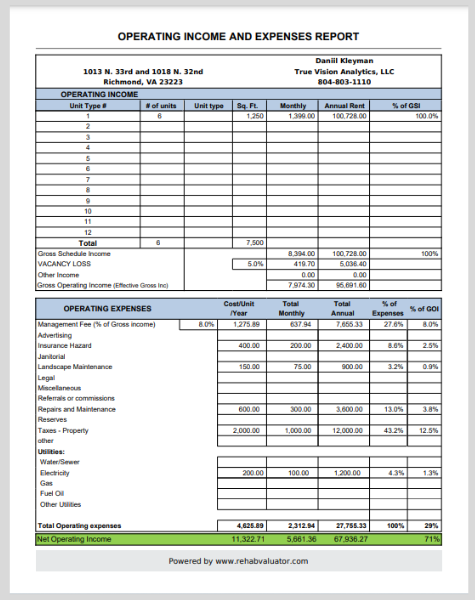

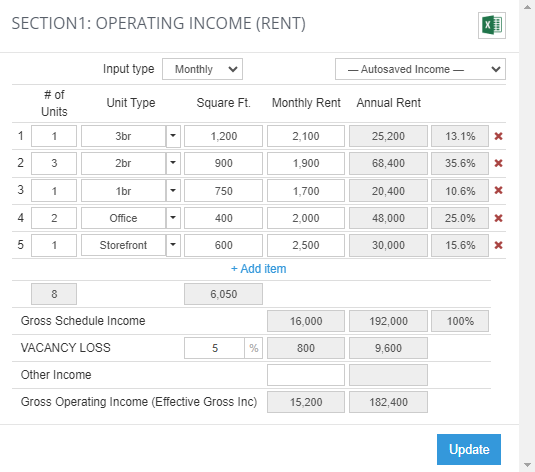

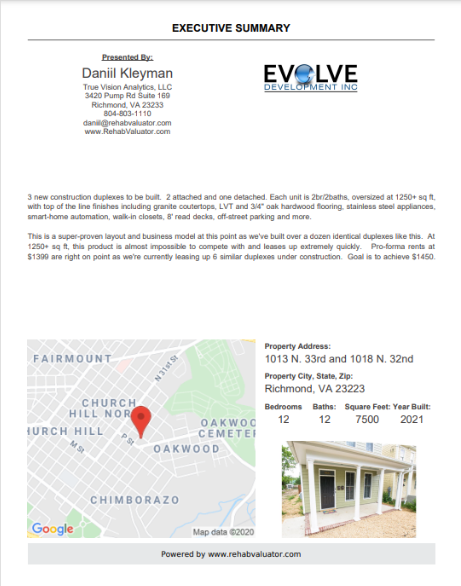

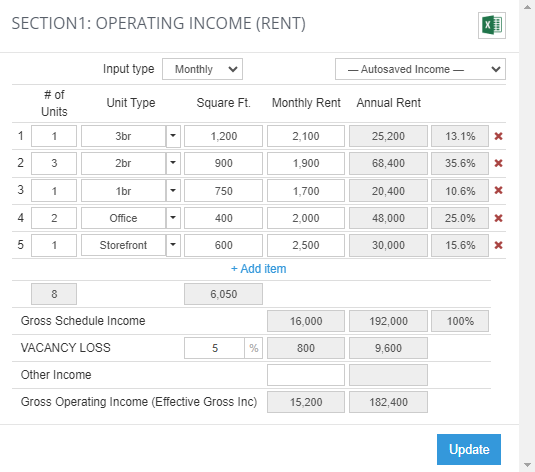

For properties ranging from 1 to 1,000+ units, start by entering your projected operating income including accounting for a vacancy loss. Vacancies are inevitable in the commercial real estate market. By factoring in a vacancy loss, you’re able to create more accurate cash flow projections which sets realistic expectations while avoiding an overestimation of rental income.

Additionally, assuming a vacancy loss makes you look more credible to lenders. The viability of your commercial real estate investment is based on its ability to generate stable and consistent cash flow. Factoring in a vacancy loss shows you have a thorough understanding of market dynamics and potential risks.

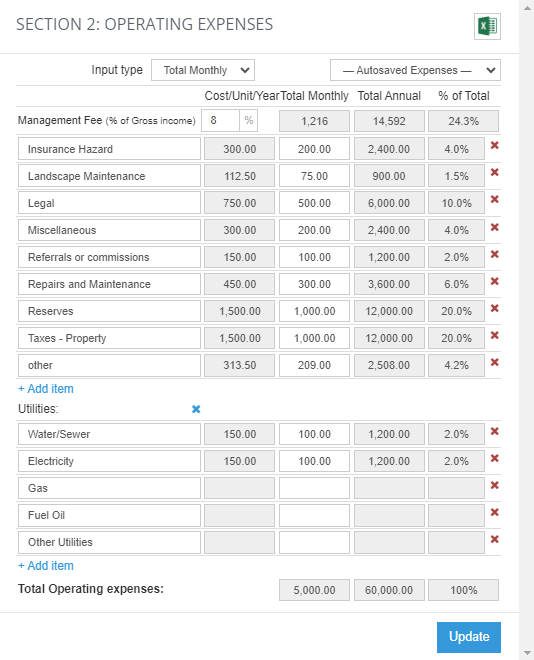

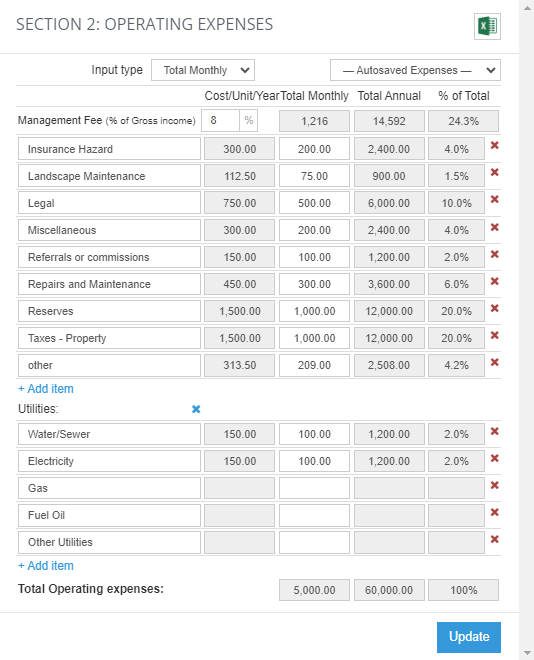

Next, you’ll want to enter your projected operating expenses. If you're not managing your own properties, you are able to enter your management fee in as a percentage of gross income.

Entering these expenses as accurately as possible helps when determining the viability and profitability of a commercial property by calculating the NOI (Net Operating Income).

Not only that but, operating expenses directly influence the ARV (After-Repair Value) of a commercial property. Therefore, it is essential for investors to effectively manage expenses and maximize income to enhance the property's value and ROI (Return on Investment).

Now to See Your

Cash Flow!

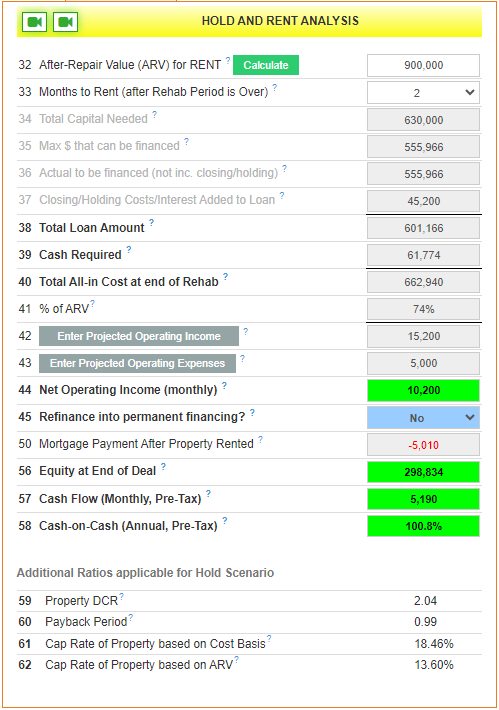

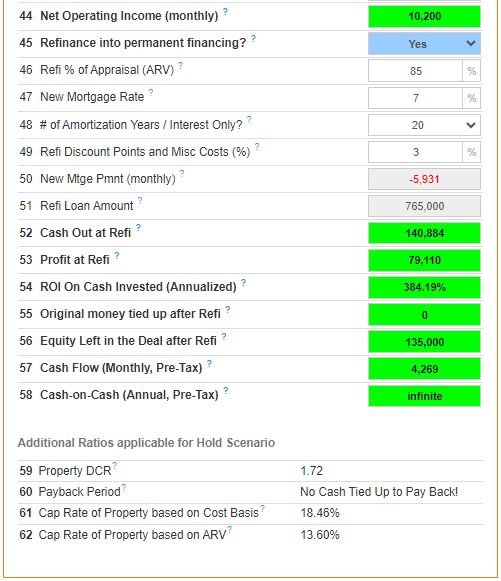

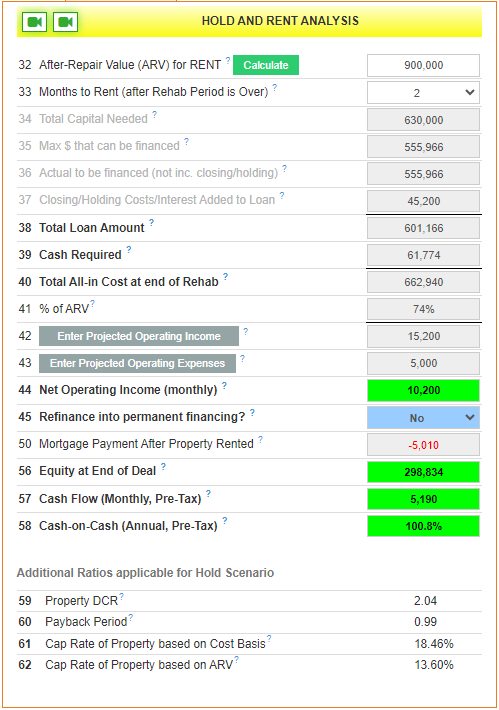

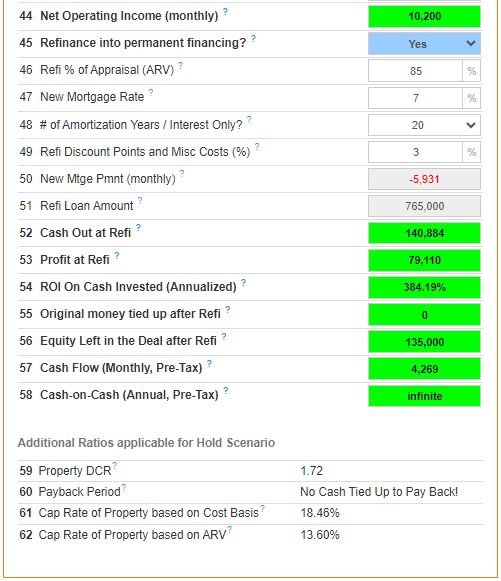

After you've entered your projected operating income and expenses, your software instantly calculates vital metrics such as:

- NOI (Net Operating Income)

- Monthly Cash Flow

- Cash-on-Cash Return

- DCR (Debt Coverage Ratio)

- Payback Period

- Cap Rates

Using the above metrics such as cap rates, DCR, and NOI, you're able to assess your commercial property's income-generating capacity. Having this information allows you to determine an accurate ARV.

As you enter financing and budgeting information, those metrics will become much more accurate!

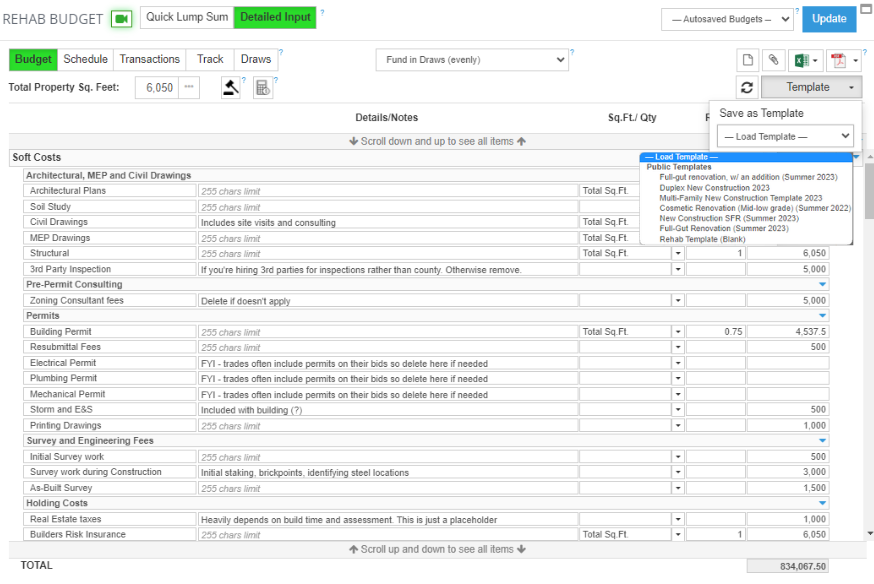

Inside Your Project

Management Suite

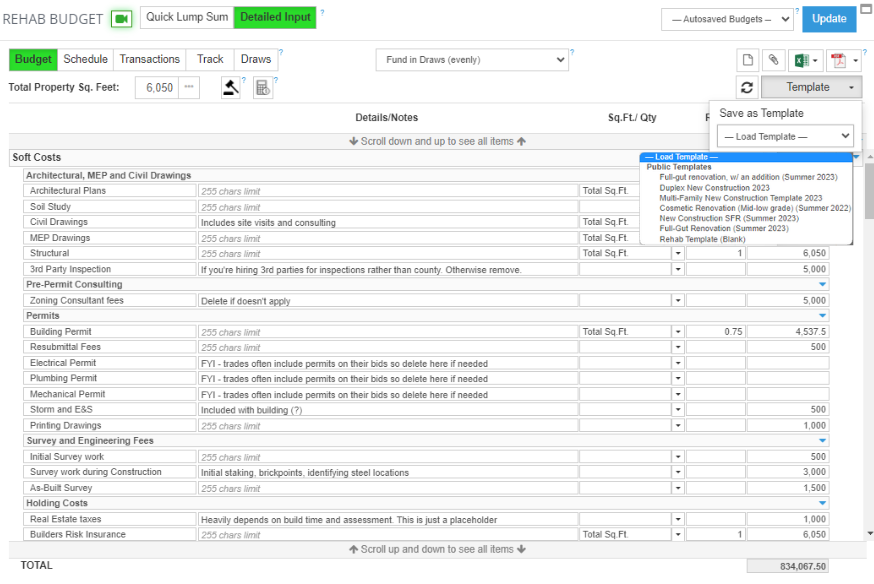

Use the built-in cost templates to save yourself massive amounts of time on your rehab budget. Then, keep track of bids, along with info on contractors and other notes – all in one place!

Know How Much Your Commercial Real Estate Deal Will Cost

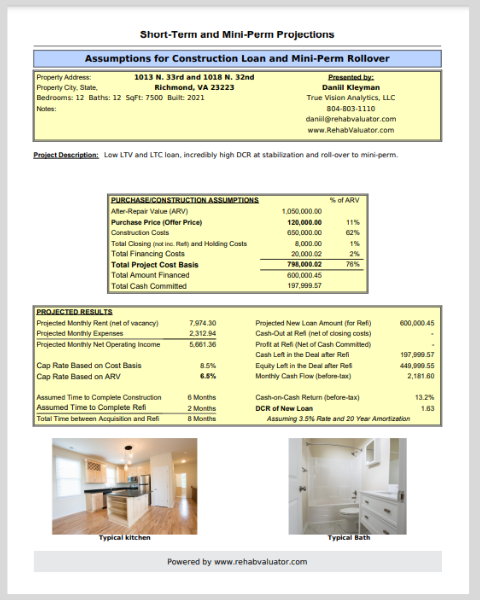

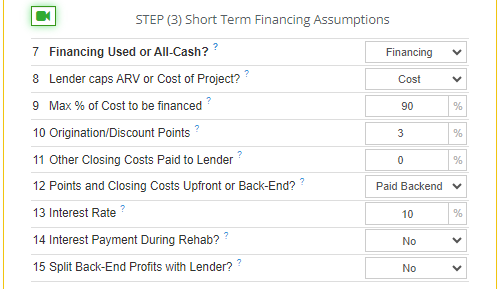

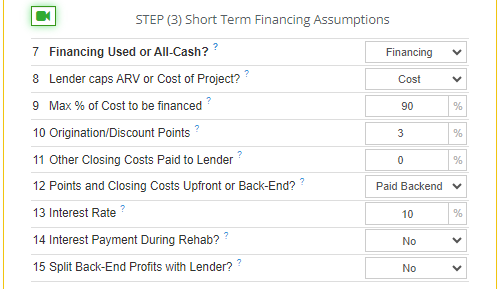

Know if you can afford the deal by determining the outcome of using different financing and payment options for your first short-term loan.

- Cash

- Bank Loan

- Private Lender

- Hard Money

When refinancing, most lenders won't lend with a DCR less than 1.25 so, do your own research and keep an eye on your cap rates and DCR accordingly to make sure you can pull cash out and don't get stuck in a refi trap!

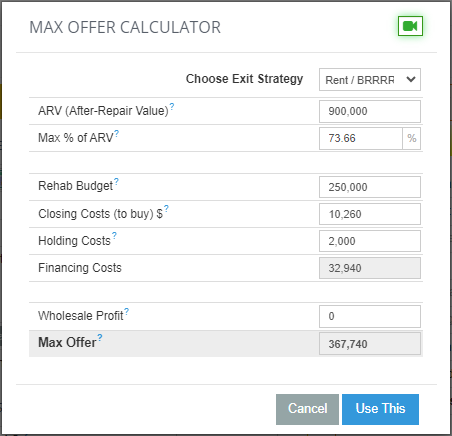

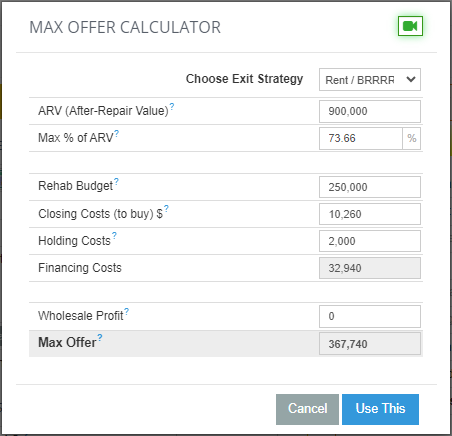

Feel Confident in Your Offer Knowing You'll Never Overpay

Before making an offer, double-check the accuracy of your purchase price by using the in deal max offer calculator. If this is the last step in your commercial real estate deal analysis, almost everything should be filled in! All you'll have to do is decide the Max % of ARV you want your entire project cost basis to be and click calculate.

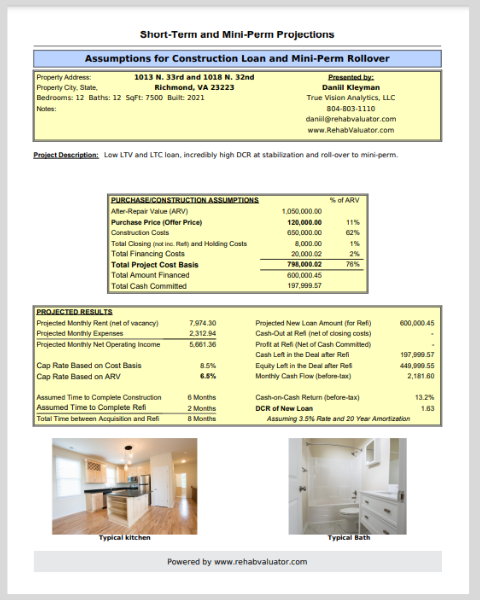

Seal the Deal

with Professional, Comprehensive Reports & Have Lenders Chase You

Haven't Tried Rehab Valuator Premium Yet?

Commercial Real Estate Software

Our software takes the guesswork out of commercial real estate investing. Analyze deals with up-to-date comparable rents, project cash flow, and assess key metrics like NOI and cap rates, all in one powerful platform. Save time and make informed investment decisions effortlessly.

When investing in Commercial Real Estate, deal analysis starts before you even jump into your Rehab Valuator Commercial Real Estate Property Management Software. The location of a commercial property is crucial and can significantly impact its potential for success. Factors to consider include the neighborhood’s demographics, accessibility to major transportation routes, proximity to amenities, and the overall economic stability of the area. A prime location attracts quality tents, increases property value, and ensures a steady stream of income. Once you’ve found the perfect location for your next commercial real estate investment, it’s time to start figuring out the vital metrics of your deal.

Now, it's time to consider the potential returns on your commercial investment!

You've found the right location, save yourself massive amounts of time, money and headaches using accurate, recent, nationwide comparable rentals available inside the Rehab Valuator Premium Commercial Real Estate Property Management Software.

For properties ranging from 1 to 1,000+ units, start by entering your projected operating income including accounting for a vacancy loss. Vacancies are inevitable in the commercial real estate market. By factoring in a vacancy loss, you’re able to create more accurate cash flow projections which sets realistic expectations while avoiding an overestimation of rental income.

Additionally, assuming a vacancy loss makes you look more credible to lenders. The viability of your commercial real estate investment is based on its ability to generate stable and consistent cash flow. Factoring in a vacancy loss shows you have a thorough understanding of market dynamics and potential risks.

Next, you’ll want to enter your projected operating expenses. If you're not managing your own properties, you are able to enter your management fee in as a percentage of gross income.

Entering these expenses as accurately as possible helps when determining the viability and profitability of a commercial property by calculating the NOI (Net Operating Income).

Not only that but, operating expenses directly influence the ARV (After-Repair Value) of a commercial property. Therefore, it is essential for investors to effectively manage expenses and maximize income to enhance the property's value and ROI (Return on Investment).

Now to See Your Cash Flow!

After you've entered your projected operating income and expenses, your software instantly calculates vital metrics such as:

- NOI (Net Operating Income)

- Monthly Cash Flow

- Cash-on-Cash Return

- DCR (Debt Coverage Ratio)

- Payback Period

- Cap Rates

Using the above metrics such as cap rates, DCR, and NOI, you're able to assess your commercial property's income-generating capacity. Having this information allows you to determine an accurate ARV.

As you enter financing and budgeting information, those metrics will become much more accurate!

Inside Your Project

Management Suite

Use the built-in cost templates to save yourself massive amounts of time on your rehab budget. Then, keep track of bids, along with info on contractors and other notes – all in one place!

Know How Much Your Commercial Real Estate Deal Will Cost

Know if you can afford the deal by determining the outcome of using different financing and payment options for your first short-term loan.

- Cash

- Bank Loan

- Private Lender

- Hard Money

When refinancing, most lenders won't lend with a DCR less than 1.25 so, do your own research and keep an eye on your cap rates and DCR accordingly to make sure you can pull cash out and don't get stuck in a refi trap!

Feel Confident in Your Offer Knowing You'll Never Overpay

Before making an offer, double-check the accuracy of your purchase price by using the in deal max offer calculator. If this is the last step in your commercial real estate deal analysis, almost everything should be filled in! All you'll have to do is decide the Max % of ARV you want your entire project cost basis to be and click calculate.

Seal the Deal with Professional, Comprehensive Reports & Have Lenders Chase You