[Part 3 of 4 ] 6 Ways to Structure Private Money Deals

Ok, we are back with Part 3 and going to cover the 2nd 3 Deal Structuring Scenarios.

As you recall in part 2, we covered deal structures where you were required to put up at least some of the cash for the deal in order to get your lender to fund the rest.

If you ended up on this page before reading the previous two parts, you can start from the beginning with part 1 on 6 Ways to Structure Private Money Deals.

While these are viable scenarios, you want to get to the point where your lenders are comfortable enough with you to fund 100% of the entire deal. That’s the only way you’re going to get to scale to the point where you’re doing multiple deals at once.

So now let’s look at a scenario for funding real estate deals where you put up zero cash.

Structure 4: Lender Funds 100% of Deal + Deferred Interest Payments

In this scenario, you have a lender who’s willing to fund 100% of the cost of the project, as well as pay for closing and holding costs. And this next point is important – your interest payments are deferred until the property is sold and the loan is paid off. So yes, a purely zero-cash deal for you.

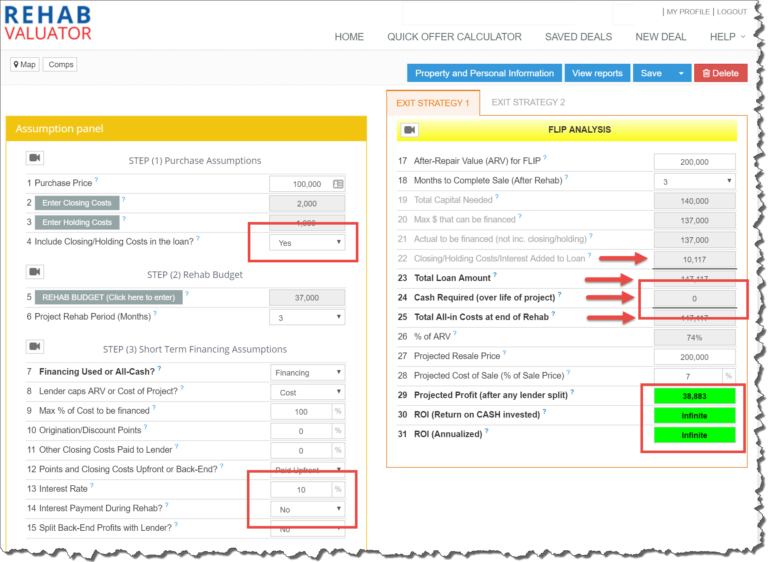

NOTE: The examples below use the Rehab Valuator Software to do the deal structuring and calculations. If you don’t have this software yet, you can create a FREE ACCOUNT here

Here’s what we’re changing on the left-side for this scenario from the last:

-

- Line 04 – Include Closing/Holding Costs in the loan? = YES

- Line 13 – Interest Rate = 10% (previously it was 8%, but this lender wants a little more in return for letting you put off your interest payments ?

- Line 14 – Interest Payment During Rehab? = NO

And here’s what that automatically impacts in your calculations on the right-side:

-

- Line 22 – Closing/Holding Costs/Interest Added to Loan = $10,117

- Line 23 – Total Loan Amount = $147,717 (previously was $137k)

- Line 24 – Cash Required (over life of project) = $0 (previously was $8,480)

- Line 25 – Total All-In Costs at end of Rehab = $117,117 (previously was $145,480)

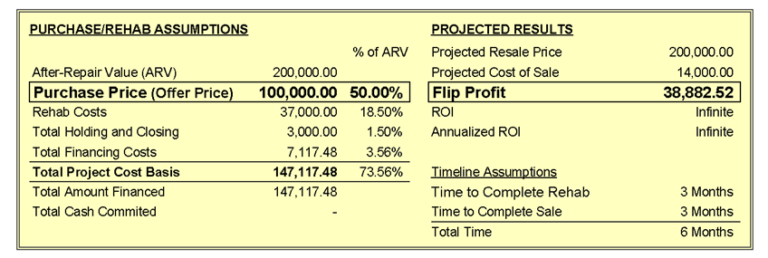

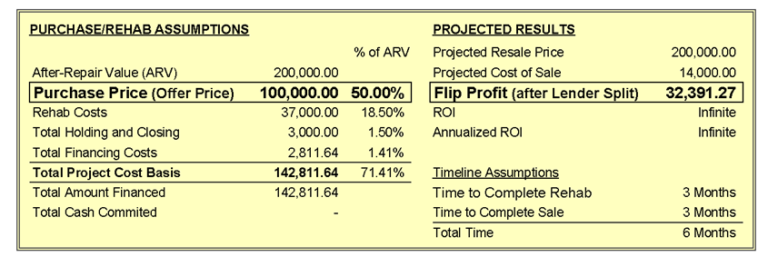

This is how this structure looks from your perspective (Marketing Sheet – Flip Exit):

As you can see here, when you add up the purchase price, rehab costs, holding and closing costs, and 6 months of accumulated interest, the total you’re asking your private lender to finance is $147,117.48 – but it’s still only 73.56% of the after-repaired value of $200k, which is still a pretty safe place for him or her to be in this deal with you.

So Let’s Quickly Recap Here:

Purchase price: $100,000

Required repairs: $37,000

Closing and holding costs: $3,000

Interest payments – 10% (deferred): $7,117.48

_________________________________________________________

After repair value (purchase value): $200,000

_________________________________________________________

Lender puts up: $140,000

You put up: $0

_________________________________________________________

Your project profit $38,883

Your cash/cash return and annual ROI: infinite

Not too shabby, eh? Clearly, best scenario for you is when your lender puts up all the cash, and you do all the work. Let’s move on, shall we?

Structure 5: Debt + Equity Scenario

So far we’ve looked at two “Low LTV Debt” scenarios (structures 1 & 2) and two “Higher LTV Debt” scenarios (structures 3 & 4).

Here’s where things get really interesting. In the “Debt and Equity” scenario we start getting a little more creative, in that your lender gets paid two different ways from the deal – you give them both interest on their money and also a cut of your end-profits in the deal.

You: Wait… what?!

Me: Yep, that’s right. Work with me here for a minute…

Structure 5: Debt + Equity

So let’s say your potential lender is not happy with a measly 10% or 12% return – maybe your guy’s like “Mr. Wonderful” from Shark Tank and he’s looking for more to get him excited enough to get out of bed in the morning.

When faced with a private lender who’s solid but wants more like this, most investors would simply say: “Okay, no problem. I really want this deal to happen, so I’ll just pay 14%… or 16%… or – gasp – 18%… because man, I really want to do this deal!”

Well here’s my perspective on this, which you can take or leave if you wish: If my lender wants a 14% or higher return, then okay I get it, but I’ll need them to be willing take some risks with me beyond just lending at 70% LTV.

So here’s one way I would handle it…

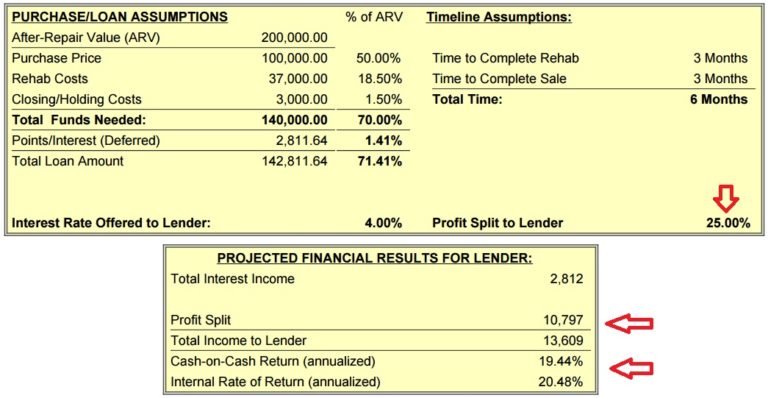

So the lender funds 100% of the project including rehab, closing and holding costs. And just like our previous example (structure 4) your interest payment is completely deferred until the property is sold and the loan is paid off. So also like the previous example, you are $0 out of pocket personally in this deal.

But here comes the twist: You (i) decrease their actual interest rate, but then (ii) increase their potential return by cutting them into the deal.

So let’s say you only pay your lender a 4% interest rate, but then you add in a 25% profits split. Your lender would get a 25% cut of your net profits when the deal sells.

Yes, the lender still gets his first lien on the property to secure the 4% interest loan, but he also gets to enjoy more of the upside with you if the deal is successful.

How Does This Change Things?

Well, now your lender’s also got equity in the deal, and they will make more money if the deal is successful. On the other hand, if the deal is not successful, you will not owe your private lender nearly as much money.

This way, the lender stands to make enough money with you to still make his mouth water, but he’s also sharing more of the risk with you.

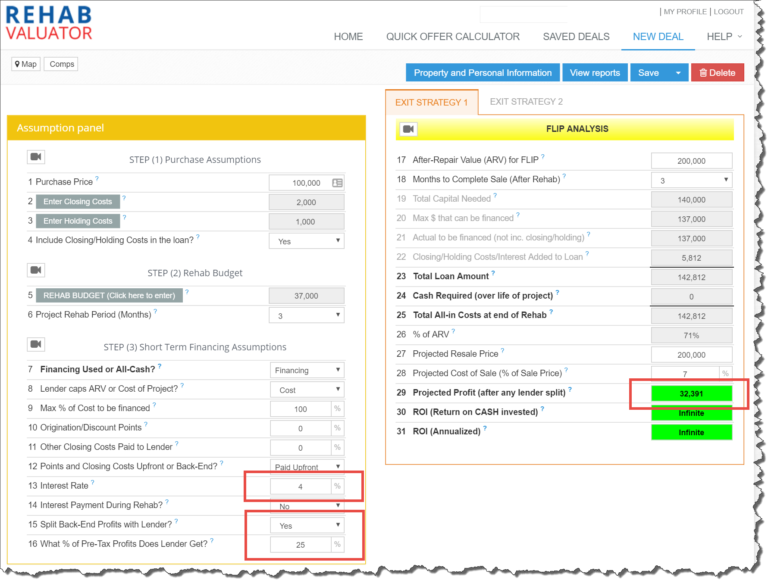

Let’s see how those numbers would shake out in Rehab Valuator…

On the right side you can see that you still need $0 out-of-pocket at closing (line 24), and your projected post-split profit (line 29) is now $32,391. Yes, this is a little over 6K less than your projected profit in the last scenario we looked at, but it’s still not too shabby, and by cutting your private lender into the deal like that, you were able to get the deal done, while spreading the risk out a little more than you would have otherwise.

Am I advocating that you split your profits with your lender? Not every time. Think of it as a more creative structure to keep in your back pocket and pull out when your lender is asking for a higher return than you’re willing to pay with a straight interest rate. Remember our goal is to be flexible enough to match your private lender’s desires with yours and with the deal itself.

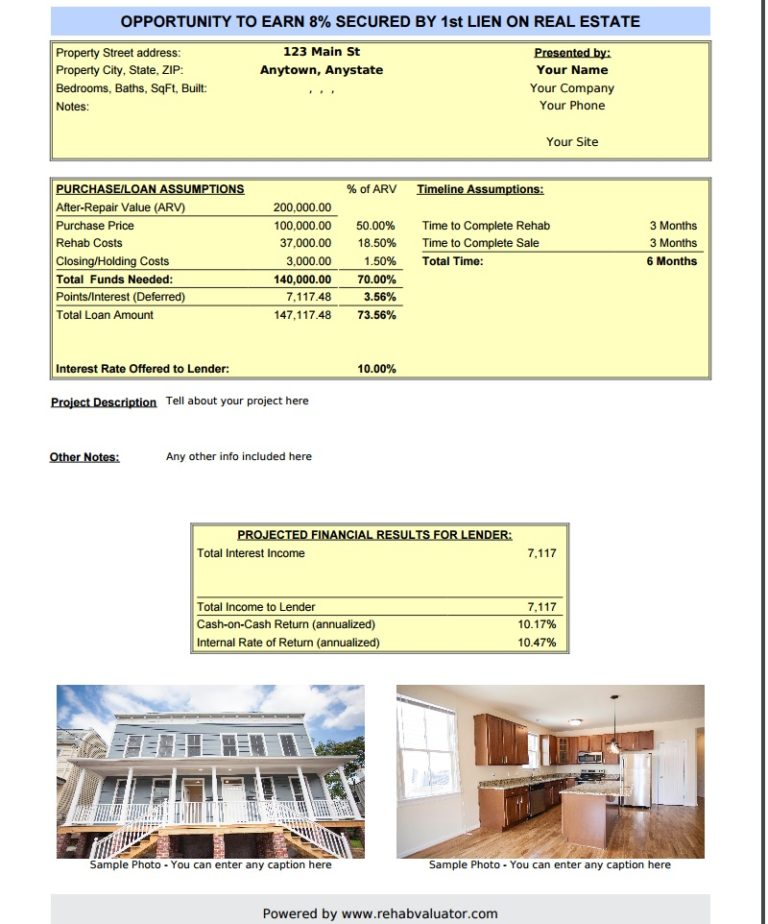

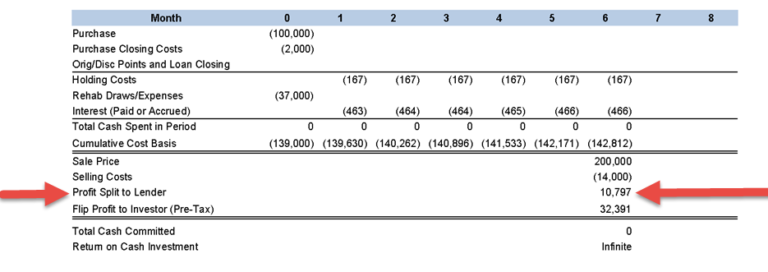

Again, here’s how this looks from your perspective:

So your lender puts up everything at ~$142k, and you’re deferring $2,811 in interest payments till the project is sold.

You: What?! The lender’s only making $2,811 in interest?!?

Me: That’s right, because we lowered them down to a paltry 4%. But their 25% profit split will net them almost $11k more…

… And trust me, this will make your lender very happy.

So Let’s Quickly Recap Private Lending Structure #5

Purchase price: $100,000

Required repairs: $37,000

Closing and holding cost: $3,000

4% Interest (deferred) $2,811.64

_________________________________________________________

After repair value (purchase value): $200,000

_________________________________________________________

Lender puts up: $142,811.64

You put up: $0

_________________________________________________________

Profit split to lender – 25% $10,797

Your project profit (after splits) $32,391

Your cash/cash return and annual ROI: still infinite

The bottom line is this: When deals turn out like this one, your lender will be more than ready to do more deals with you.

Could you be better off by giving 8%, 9%, or 10% interest without a profit split? Perhaps. But when you’ve got a solid, reliable lender who just wants a higher rate of return, don’t cave in and pay that high interest rate just because you’re asked to. Instead, try using a structure like this one to tie their success right into the success of your deal.

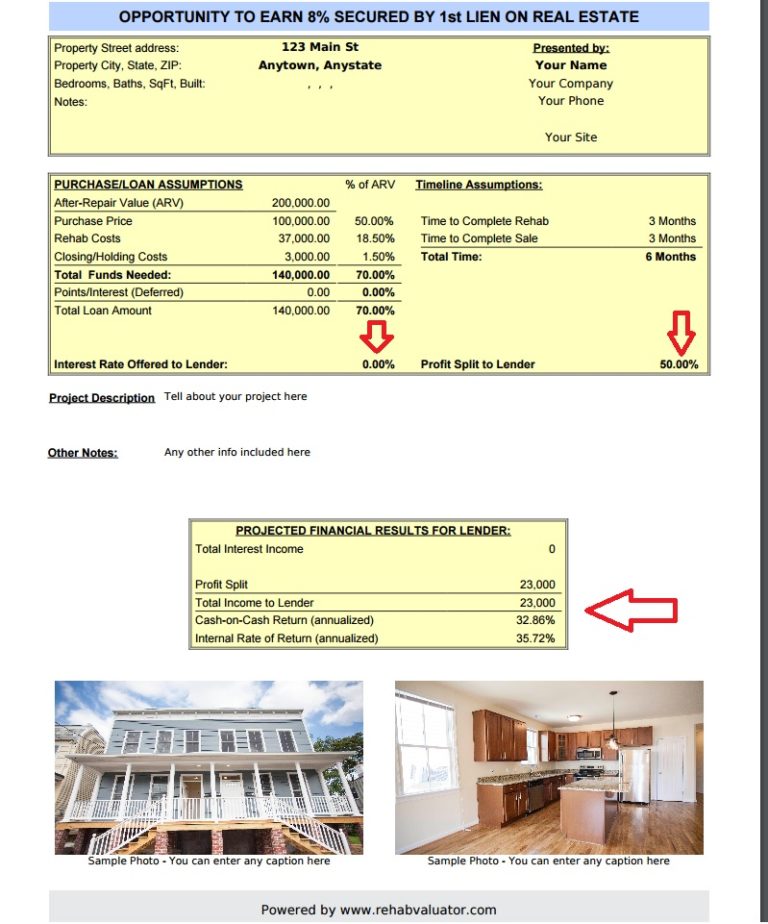

Structure 6: Pure Equity Scenario

As with the last scenario, your lender gets cut into your deal, but now to a much greater level. In fact, for all intents and purposes, this structure is really more like a single-deal partnership, where your lender’s getting paid exclusively based on a percentage of the deal profits, period.

Structure 6: Lender Funds All, Pure Profit Split (No Interest)

So as a partner, your lender brings 100% of the project funds to the table, inclusive of purchase, rehab, closing and holding costs, and whatever the heck else. You, in turn, are responsible for $0 cash in the deal. You bring the deal itself, the expertise, and your time and effort to manage the project to completion, whereas your partner puts up all the money, and you split the profits 50-50.

As you might imagine, there are no interest payments to make in this deal, because there’s technically no loan being made. Your partner gets paid if your deal makes money, plain and simple.

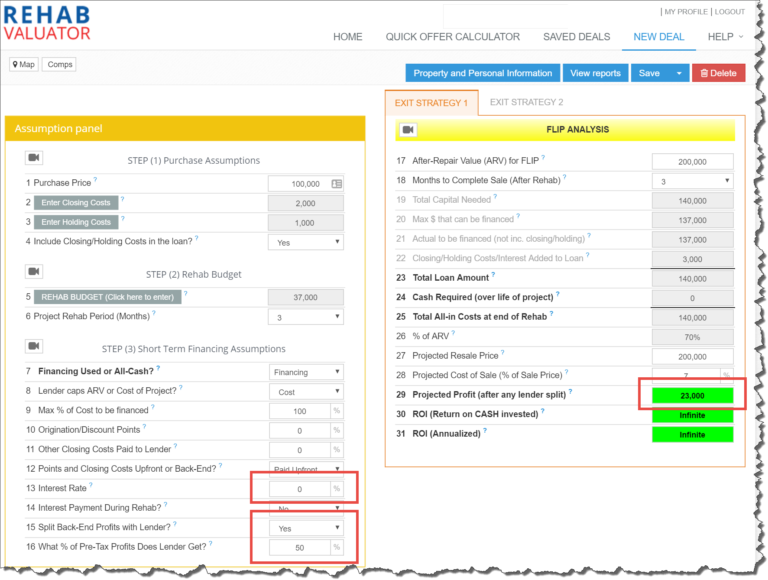

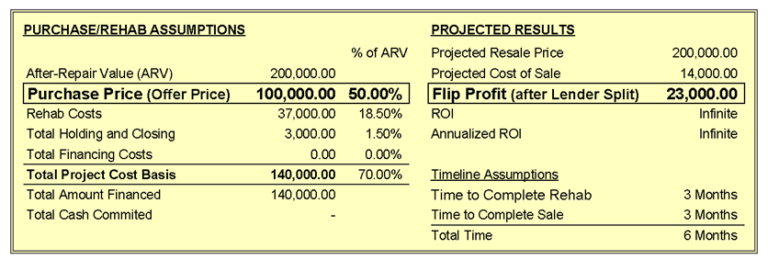

Here’s how the same deal we’ve been working with all along looks like in Rehab Valuator, but structured with a pure equity type scenario like this:

So as you can see:

-

- Your interest rate (line 13) becomes zero

- Split back-end profits with lender (line 15) is still YES

- The percentage split (line 16) is now 50%

Again, here’s how it looks to your lender in your Rehab Valuator report:

Realize that in this structure, your lender (i.e. partner) is really sharing the risk with you in a substantial way, because if the deal goes bust, you don’t technically owe them any money. But on the other side of the coin, they also stand to make a whole lot more money if/when the deal successfully comes to fruition.

So they put up all the money, you do all the work, and at the end, you split the profits down the middle, each standing to make $23,000 at the end of the day. That’s a lot more than your private lender would have made in any other scenario we’ve looked at here! But the deal warrants it, because you’re asking them to take on quite a bit of additional risk.

Bottom line, generally speaking as the potential risk to your lender goes up, so does their potential return.

So Again, Let’s Recap Private Lending Structure #6

Purchase price: $100,000

Required repairs: $37,000

Closing and holding costs: $3,000

Interest: $0

_________________________________________________________

After repair value (purchase value): $200,000

_________________________________________________________

Lender puts up: $140,000

You put up: $0

_________________________________________________________

Profit split to lender – 50% $23,000

Your project profit (after splits) $23,000

Your cash/cash return and annual ROI: still infinite

More to Come…

So this wraps Part 3 in my 4-part series. We just covered an incredible amount of useful and actionable information about structuring private funding for real estate deals. But there is definitely still more to come…

In part 4 I have another awesomely creative 7th bonus deal structure I want to share with you. It involves reaching out to people you are close with – friends and family – and tapping into borrowing potential from their equity. As you’ll see, I like this strategy because it typically has very low interest rates, which means it’s very cheap money.

See ya for that next time.

No such thing really. Read this please: https://rehabvaluator.com/content/private-money-explained

Hey Daniil,

I just want to thank you for sharing 6 Ways To Structure Private Money.

The Rehab Valuator software with each possible deal structure scenario

really came to life, where all the info and numbers as produced in the

reports explain everything about the deal. I’m going over to part 4.

Robert

Michael, Connecticut, very good strategies, I like the 50/50. When I become a lender, I would take that strategy. Thank you!!

Thanks, Ed! Part 4 coming very soon

This has been awesome so far … I can’t wait for the next installment.

You have really put this in a great easy to apply format.

Thanks again

i NEEDA LIST OF PRIVATE MONEY LENDERS ,i HAVE THE DEAL

Thanks for your compliments Jalo!

Nothing like a Mental Mindset Shift to make the day seem brighter………I just restructured a Deal using Method #5……..He flipped and asked..”Where do I send the Wire Transfer??”

Thank you my friend!!!!!!