How to Build Your F.U. Wall: Become Financially Untouchable and Say “FU” to Bills, Bosses, and Money Problems!

Part I: The Why

I call this the “Fuck You Wall”. If you’re the type to get offended by my language then you probably don’t belong here. Because building a Fuck You Wall is not for the faint-hearted. It requires blood, sweat, tears and a good amount of patience. It requires hard work, determination, and perseverance. It requires hearing the word “no” many times before you ever hear a “yes”. It requires what we call in the good ol’ US of A: “hustle”. Continue reading our comprehensive guide to learn how to reach financial freedom through various real estate options.

And maybe, instead of being offended by my occasional F-bomb, you should be offended by some other things:

-

-

You should be offended by the school system that spends 16 years teaching you everything EXCEPT for how to be financially responsible.

They teach you everything BUT how to balance a checkbook or say “no” to bad debt.

-

You should be offended by the school system that aims to make wage slaves out of you and your children.

They teach you everything BUT entrepreneurship. You leave college with hundreds of thousands in debt and no real life skills.

-

You should be offended by a system where you are required to work 40, 50, 60 hours a week just to make ends meet

If a life where you live paycheck to paycheck just to survive doesn’t piss you off, then you’re in the wrong place

-

You should be offended by the government that, after you work that grueling 60 hour week takes, 40-50% for themselves

There are ways to legally beat taxes. Read on.

-

You should be offended by the financial advisors who tell you to put your money into the stock market!

Buying stocks at market value is not investing. And financial advisors (unless they’re fiduciaries) just want to work your money over for commissions.

-

You should be offended by the real estate gurus who tell you that wholesaling is the path to financial freedom!

Wholesaling is a good way to make a quick buck, but nobody ever got truly wealthy wholesaling. REAL wealth in real estate comes from ownership.

-

And speaking of walls, let’s get this out of the way: this has nothing to do with a physical wall, like a border wall. This is being written by an immigrant. An immigrant that came here (legally, though), fought like hell to build this wall for himself and his family, and is thankful and proud to live in this country. But this “Fuck You Wall” can be built anywhere, whether you live in Morocco, Australia, or the north freaking pole.

For the sake of brevity, going forward, we’ll refer to this as “the FU Wall”. And “FU Wall” can stand for some other things that are more palatable to you wussies that cringe at cusswords:

The Financially Unstoppable Wall

The Financially Untouchable Wall

Because that’s what this is. You’ll see…

And before we get any further, one more thing: this is a long education piece. We will go deep into a number of concepts and topics here that are vital for your future prosperity, independence and freedom. But in today’s world of instant gratification, 20-second Facebook videos, and Snapchat, most people have the attention span of a cocker spaniel on acid. So if you’re one of such people, again, you probably don’t belong here. Building an “FU Wall” will require you to become a master of your craft. It will require you to “get rich slow”.

So why is this such an important topic and why is it hugely vital you take the time to read this, bookmark this, and come back to it time and time again until you’re actually putting these concepts to work?

Let’s talk about that first:

Here’s how 99.7% of Americans (and it’s probably worse outside of the US) live their lives:

Go to work, get a paycheck, spend the entire paycheck on rent, mortgage, bills, etc. Wait until next payday. Rinse and repeat. God forbid they get fired or miss a paycheck. It’s a full on crisis if that happens. A recent survey by the Fed showed that 40% of adult American’s can’t cover a $400 emergency expense! That’s straight up crazy. And scary. And sad.

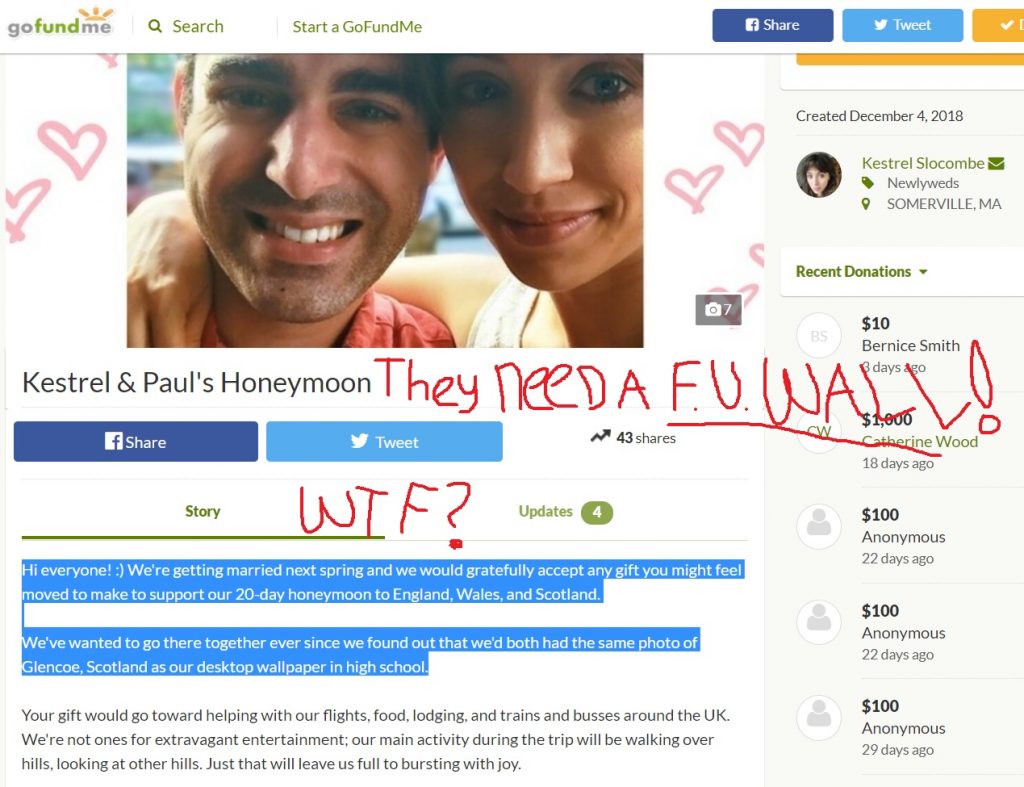

Now, maybe you’re reading this and you are further ahead than the average Joe. You have a solid job and career and some savings. Bad news though! A job NEVER means security. What if you get fired or laid off? What if there’s a recession and you can’t get another job quickly? How long will those savings cover your bills before you’re starting a GoFundMe campaign online or begging for change on the corner?

Millennials are particularly screwed but they're not the only ones. If you have student loan debt, credit card debt, car loans, a big house mortgage you're struggling to pay, things are only going to get worse unless you find a way to build your own F.U. Wall. Article link

By the way, I mentioned GoFundMe above, which is a crowdfunding platform where people get to ask other people for money. Your #1 goal in life should be to NEVER have to create a GoFundMe campaign for any reason, ever. Seriously. And no, I am not saying you shouldn't donate to other causes or people. The whole point is to be financially well off so that you can be VERY charitable! I am saying you need to get to the point of financial freedom where YOU never have to ask other people for money for any reason!

But let's move on….Maybe you’re even further ahead. You’re an entrepreneur! Maybe you wholesale houses. Maybe you fix or flip. If you’re on our Rehab Valuator email list and client base, then this is very likely. Congrats! You’ve found a set of balls (or lady-balls), said goodbye to the safety of a reliable paycheck and embarked on the road less traveled – entrepreneurship! But what happens if you stop doing deals next month? What happens if the market shifts (and it will)? What happens if you lose money on your next flip or it doesn’t sell quickly? Can you cover unforeseen expenses? Can you survive the next 6 months without any new deals or sales?

If you have an “FU Wall”, you can. If you have an “FU Wall” you have reliable, recurring, steady income coming in month after month even if you choose to sit on your couch all day and watch Fresh Prince of Bel Air reruns (hell yeah!). You have enough income coming in not only to cover all your monthly living expenses, but enough to put additional money aside. Enough to reinvest money into liquid assets, real estate, or other businesses. Enough money coming in to protect you against unforeseen expenses and emergencies.

Medical emergency? FU, here’s the money!

College tuition? FU, here’s gobs of money (that you’ll never get back)!

Boss being a dick? FU, I quit!

Wife lost her job? Fuck yeah! Great! Let’s go on vacation!

Kid needs expensive braces? Quick, little Debby – get behind our FU Wall and let’s give the orthodontist a call!

Little Johny has a drug addiction? Here’s some money for rehab. Let’s go to Malibu!

It’s called the “FU Wall” because you and your family can stand behind this wall and say “FU” to all of life’s problems without losing your marbles or taking a hit in your quality of life.

This wall can withstand shocks, earthquakes and hurricanes and can safeguard you in situations where most people would get swept up in a flood (enough nature channel references? I think so….)

And once you have built a wall where you are not just comfortably bringing in money to cover all your expenses and emergencies but also money that you can reinvest, it becomes a self-driving machine where your wealth snowballs! More on this later…

Here’s the important part and pay close attention here:

-

- This wall for most people, including you, doesn’t require huge sums of money coming in. We are talking $4k, $5k, $8k a month in steady reliable income. This, for most, is enough to cover their monthly nut and have money left over to set aside or reinvest.

- Magical things happen when you have this wall built. Being able to pay your bills and sleep soundly at night is just the beginning. The obvious side effect, of course, is that you don’t have to work. You don’t have to go to a job. And you don’t have to do new real estate deals if you don’t want to or if the market shifts against you.

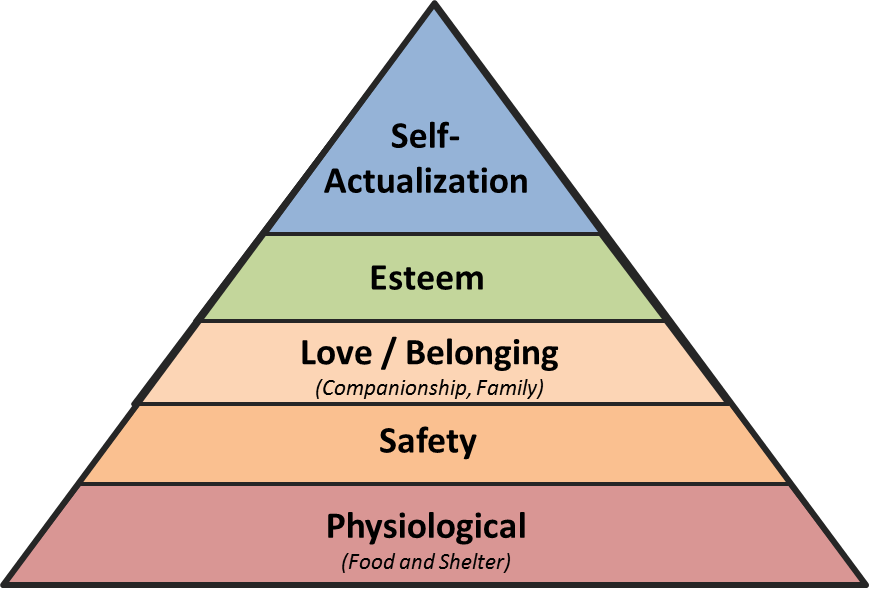

But let’s move past security on the Hierarchy of Needs chart. The magic happens as you cross the “all my needs are taken care of” threshold because now you can move into the Self-Actualization phase. Not only can you pursue a business or career that you’re truly passionate about but you can start making long-term, smart, strategic moves. Not just short-term moves to make sure your next bill gets paid. Those are 2 different worlds.

So what ends up happening is that right after you get to the point where you don’t have to work anymore to pay bills or have to build your business beyond what you’ve already done, you now have the ability to grow faster than ever. Get it? When you stop chasing short term money, more money than ever ends up coming in! It’s just like anything in life: when you stop chasing something, you’re way more likely to get it.

Part II: The What:

So now that you understand the “Why”, let’s talk about the “What” – what this wall actually consists of – the foundation, the bricks and the mortar! (See where I am going yet?)

While there are many tactics and actual sources of where the cashflow can come from, there are 2 key rules:

Rule #1: It has to be recurring, residual, repeatable, reliable cashflow. You have to have reasonable expectations that this money will come in next month, and the month after, even if you do nothing or very little (refer back to watching Fresh Prince of Bel Air reruns all day).

So this automatically disqualifies a job (because you can get fired or quit), and house flipping (because you have to flip another house to get paid again), and any business where you rely on one-time sales or revenue.

The income stream has to be recurring and locked in.

Do something once and get paid forever (or at least a very long time).

Rule #2: You have to have a way to make this at least somewhat “passive”, meaning you can put systems, processes, and/or employees in place to oversee this business or revenue stream without your constant, daily involvement. After all, if you gotta take little Johnny to rehab in Malibu, you want to be able to enjoy the scenery for a while (see above).

So…the best way I know how to do this (and have done it) is with rental properties. Sure you’ll hear real estate gurus and marketers yell from the rooftops: “No tenants, no toilets – don’t buy rentals. Flip houses instead!”. And yes, dealing with toilets and maintenance calls isn’t sexy.

But you know what’s sexy, though? What’s really sexy? In a life-changing kind of way?

Being able to leave for Europe for a month or two at a time while your portfolio puts $20k, $30k, or more into your bank account on auto-pilot. Courtesy of…wait for it..you guessed it: your tenants! (and an awesome property manager)

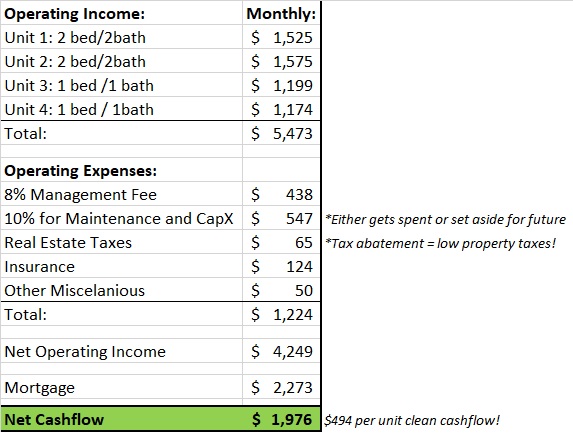

And before you think this is impossible, remember: it does not take a lot of “units” or “doors”. This little 4 unit building alone puts $2k of clean net monthly cashflow into my pocket. That’s after all expenses are paid, including mortgage, taxes, insurance, maintenance reserves, and 8% to my property management company.

$2k/month. That’s $24k a year, and it’s mostly tax free because of a magic thing called “depreciation”. So this is an equivalent to me having on a pre-tax basis a $40k/year job! This building is literally like me going to work every day making $40k/year except it does it for me!

Read that last part again. Having this quad-plex is equivalent to having a $40k/year job! You can go to work and grind it out every day for 8-10 hours a day for $40k/year or you can just have a building like this do it for you while you focus on whatever you want, like collecting butterflies or sitting on your front porch and yelling at the neighborhood kids to get off your lawn!

Which one would you prefer?

Just so that you understand the numbers, here’s how they stack out exactly on this 4-unit (this was a new construction project I finished 2 years ago):

Now, you may say to me: “All this sounds great, but…:

“What if your tenants leave?”

“What if they destroy your property?”

“What if the real estate market crashes?”

“Won’t your portfolio suffer? Won’t that monthly income of yours take a big hit? Is this truly a solid FU Wall built on a rock-hard foundation or is this flimsy?”

Great questions! I am glad you’re paying attention!

Here are my answers. And mind you, I don’t claim I have all the right answers or that what I do is the only way for you to do this. Not at all. There are many ways to build this and many ways to create an income portfolio that doesn’t involve rentals, and many ways to build a rental portfolio other than what I do. I am just one guy who found what works great for him.

But here’s why I feel confident hiding behind this FU Wall even in the toughest storm:

- When the real estate market crashes, my rentals will continue performing. A “real estate crash” usually entails sales prices of homes going down along with sales volume. More sellers than buyers. But that doesn’t necessarily spell doom for your rental portfolio. As a matter of fact, during the last crash in 2008, rents in a lot of markets stayed flat and even grew! As did the demand. The rent growth my market has seen since 2008 has been nothing short of explosive. If you owned rentals back in 2008-2009 and they were performing just ok, you're drowning in cashflow right now. When people stop buying houses, they still need a place to live so they rent. In a housing crash, I actually expect my rental portfolio to stay 100% occupied (as it currently is). Now, of course, you need to look at the market you’re in. Is there an oversupply of rentals right now? Is it being overbuilt? Be smart about where you buy. Location, quality of product, and barriers to entry in your market all matter.

- On that same point, most of the rentals I acquire and build are in a market with very little vacant land. That means there are massive barriers to entry to some big apartment developer to add a thousand new units. It’s a captive market. And that's important. You want to be in areas where ideally you can't go into over-supply quickly.

- Most of my product is high quality, very attractive, easy to rent. Everything in my rental portfolio is either a full, gut renovation or new construction. As you can tell from pictures above, all of our “product” is fairly high end. Great floorplans, big closets, large bedrooms, granite countertops, nice flooring, etc. This “product” attracts high quality tenants, with 100% rent collection, and no vacancies. Easy to lease, easy to keep leased and easy to manage because great product attracts great tenants.

- I have room to cut rents and still cashflow. If the worst happens and rent deflation occurs, I have room to decrease our rents across the board and still maintain a healthy cashflow. Knowing your numbers is important! You should always be thinking about your downside!

- We have an in-house management company that manages all of my rentals. This means I have full quality control over every single tenant interaction, maintenance call, and overall experience. This is very important. Not to say anything bad about 3rd party property managers, but it’s kind of a crapshoot in terms of what you get.

For those reasons, I choose to maintain full control and manage in house. After your annual rent roll surpasses $750,000 (or about 50 units at $1200/month), you can afford to carve off an 8% management fee and pay a full time property manager $60k salary. When I reached this level and was able to hire a full-time person, it was a complete gamechanger for my business. - I am not over-leveraged. Unlike a lot of overzealous investors, I watch my leverage like a hawk. The quickest way to get in trouble is to borrow more money than you should. I maintain a high equity position in my projects (more on equity later).

Part III: The HOW:

So now that you understand the WHAT, let’s talk about HOW you can reach financial freedom through real estate. This is where things get really interesting and this is probably the part you should be paying very careful attention to! This, of course, is not meant to be a full blown real estate investing course, but I am going to point you in the right direction and also give you links to some pretty in-depth training videos that have been super popular with our subscribers and software clients.

If your goal is to build a rental portfolio, then you need to answer 2 main questions to get started:

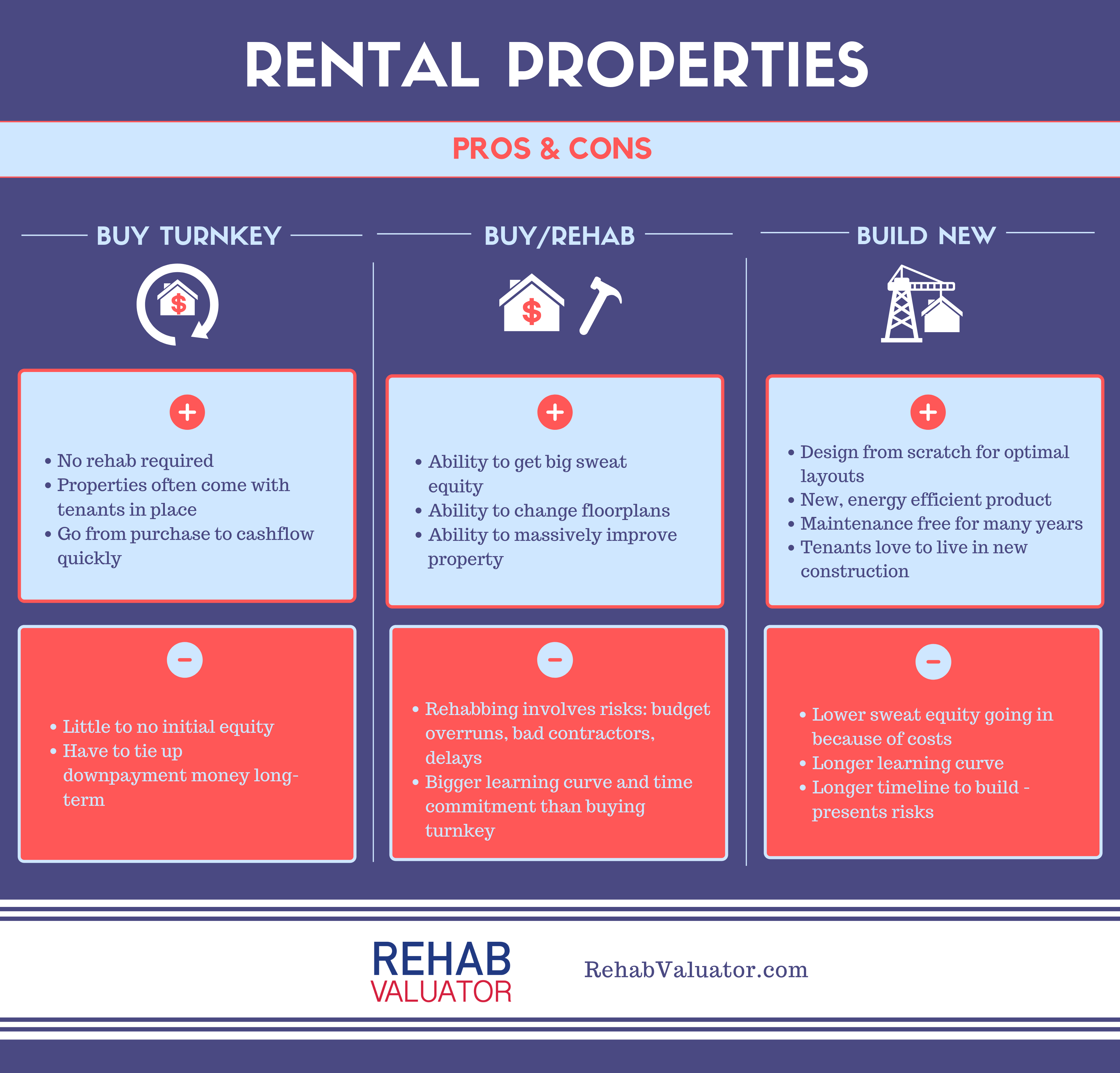

- Buy turnkey, buy/rehab or build new? Big differences between these strategies.

- How will you finance it? Where will you get equity and debt from? You may not have 2 pennies to scrape together right now so the entire concept here seems out of reach. I’ll go over some financing options below and how you can get in the game creatively with no money down.

Then, of course, there are going to be additional questions, not limited to:

- Which market? I suggest start in your own backyard

- How will you find deals?

- Who will manage these properties? You? 3rd Party Management? In-house?

So let’s tackle the “2 Main Questions” first:

Buy Turnkey? Rehab? Build New?

In anything that you do, generally the more difficulty something requires, the bigger the payoff is.

Option 1: “Turnkey”:

Turnkey means you’re buying a property that is either ready to be leased out or already has tenants in it. As a matter of fact, there are companies across the US that specialize in selling these types of properties to investors. Typically these investors have full time jobs and are looking to create a side income or retirement. These companies typically buy houses at a discount, rehab them, put tenants in place, sell the property at a profit to an investor, and then turn around and provide property management for a fee. The investor uses their savings or a retirement account such as a self-directed IRA to fund the property.

The nice thing about this strategy is that as an investor, in theory, you have to do very little. Thus the term “turnkey”.

The downsides are:

- You are not getting a big discount (if any) vs. today’s market value of the property. So very little to no equity other than the equity you bring in (downpayment)

- You have to put a downpayment in and typically leave that money tied up for a long time.

- Your cash on cash returns are usually decent but nothing to write home about (5% to 10% annual yields).

Analyzing turnkey rental deals isn't generally very hard. I would focus on a few factors:

- Cash on Cash return. Whether you're buying all-cash or financing, I would aim for a minimum of 8-10% first year Cash on Cash

- Equity. Again, I would aim to get a discount vs. today's market value to make sure that you have some built in equity from the get go (this means equity in addition to cash you're putting down). This will give you cushion to downside, should market go down.

Option 2: “Rehab/Rent”

This is how I got started and how most investors get started in building up rentals. Buy a cheap house, rehab it, and lease it out. The benefit of this strategy is if you’re buying houses in need of repair, you can typically get a bigger discount on them and build “sweat equity”.

Analyzing rehab/rent deals is a bit more complicated. This video shows you what to do.

There is a variation of this strategy that is literally one of THE most powerful wealth building strategies I’ve ever encountered and it’s called BRRRR: Buy, Rehab, Rent, Refi, Repeat. This is how I got started. This is how I built up the first $6 mil or so of my portfolio.

And the idea is pretty simple:

- Find a discounted house in need of repairs (you can do this with apartment buildings also)

- Rehab it to make it tenant-ready

- Lease it out

- Go to a local bank or whoever will do your permanent financing and get the property reappraised at a higher value

- Refinance out an amount high enough to pay off your full investment (or your short-term loan if you borrowed money).

- Now you have your entire original investment back ready to deploy into the next deal! And you have a property that cashflows with no money tied up!

Here’s a simplified numerical example. If you really want to see the nuts and bolts of this strategy, check out the 2 trainings below:

- Buy a house for $50,000

- Renovate for $20,000

- Put $5,000 of closing costs, holding costs and financing costs into it for a total cost basis of $75,000

- Lease it out for $1100/month

- House now appraises for $100,000.

- Your 80% loan gets you back your full $75,000 invested plus a $5,000 profit!

Option 3: Building New Construction Rentals:

Building new is what my business has evolved into over last 4-5 years. Rehabs are great but they are also a pain and come with a certain level of unpredictability. You're doing troubleshooting rather than executing a specific plan. You never really know what you're going to find when you open up the walls and that makes predicting costs harder.

With new construction, there are some very real benefits you should consider:

-

- You get to design a project from scratch. That means you have full control of layouts, closet sizes, bedroom sizes, flow, etc.

- You get to build a fully energy efficient product, which is very important for tenant retention.

- The construction process is predictable and scalable. Much more so than rehabbing. Once you have a good set of architectural plans, you can hand them off to a GC or if you're the GC, you can hand it off to subs and they can follow the plans. Foundation guy knows what to do. Framer knows exactly what to do. On commercial projects, you'll have mechanical, electrical and plumbing drawings that you hand off to tradesmen and they run with it. Etc.

- You get to build something that will (in an ideal world) be maintenance free for many years to come. And in running a stress free property management business and portfolio, this is KEY! All the landlording horror stories you hear are from people who bought shitty product and didn't improve it. Constant maintenance calls will not only eat away at your bottom line but will also piss off your tenants to no end and ruin your reputation.

- With #4 in mind, tenants LOVE to live in new construction. We often lease out our entire projects while the drywall is going up! That's how much people want to be the first to live in a place. It's pretty incredible.

It's not, of course, all roses and sunshine, so there are some “cons” that are worth mentioning:

-

- The learning curve here is steeper than rehabbing. First of all, you need to learn zoning and how that dictates what can be built on a certain piece of land. Secondly, there are new utilities and foundations – something that you may not necessarily deal with when you're rehabbing. But once you're “out of the ground”, meaning your foundation is done, everything else is a breeze!

- Building new, these days, isn't cheap. So your initial sweat equity may be lower than on cheap rehabs you pick up. My target is usually 15-20% sweat equity in the beginning. If I can hit that, it's a win! I also have a certain cash on cash I want to hit in the first year (usually min of 10%).

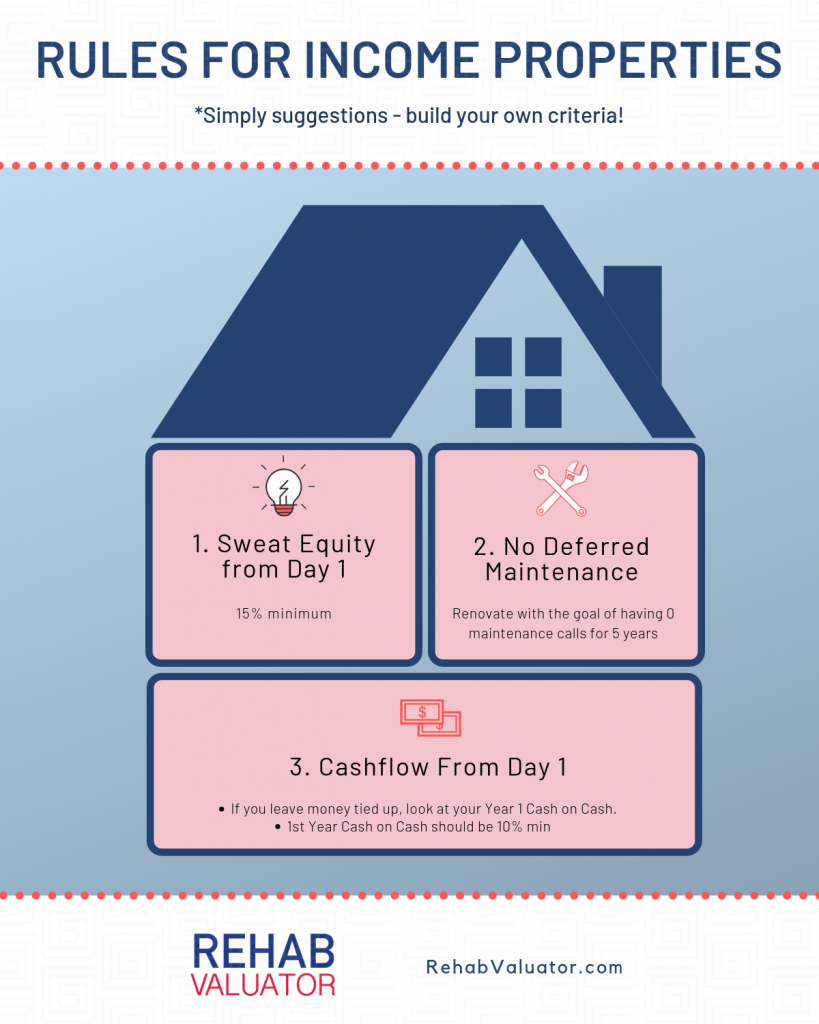

So let's talk about these investing rules. Because if you don't have a good set of investing criteria, you'll be dead in the water before you even start!

1. Sweat Equity

Buying at market value is for amateurs. It's how amateurs invest (look at the stock market) and it's how amateurs get burned when the market crashes. One of by far the best things about real estate investing is that you can buy below market value. Or you can buy something, rehab it and have it be worth more than what you invested (50+30 = 100). Or you can buy land, build on it, and have the new building be worth more than the total of what you put in!

The value you create is the “sweat equity”. In the equation (50 + 30 = 100), the 20 difference is the sweat equity you created. That's your compensation for doing all the hard work! It also protects you against the market shifting down!

In my rehabs, I aim for at least 20% sweat equity when I am done. In my new builds, I target a minimum of 15%. The more the better, obviously.

2. No Deferred Maintenance for 5 Years

Biggest mistake I see investors make is not rehabbing sufficiently to save money. You think you got a great deal and you have great cashflow, but then your cashflow gets eaten away at every single month with maintenance calls! That's why I like BRRRR (see above). You can do a thorough renovation now, refinance, get your money out, and have a great product where you won't hear from your tenants for 5 years except on the 1st of the month!

3. Year 1 Cash on Cash

When I invest in rentals, I look at my metrics for Day 1 of operations – not some fairy tales of what may happen in 5 or 10 years. So I want equity from Day 1. And I want cashflow NOW! There is an absolute $/unit that I look for ($250 or higher) and then I look at my cash on cash return in situations where I leave money tied up in a deal long term. I want my money to earn me a minimum of 10% in the first year. Then this # will grow (see the Flip vs. Rent training link below).

PART II

FINANCING: WHERE TO GET DEBT AND EQUITY

Ok, now let's tackle financing: where to get the cash and the loans! I am going to go over pretty detailed content here on how to get started!

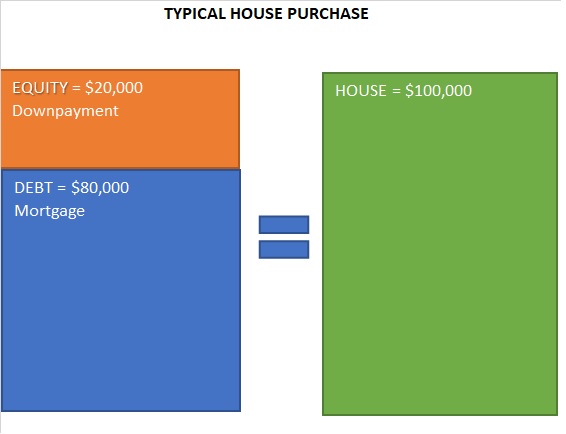

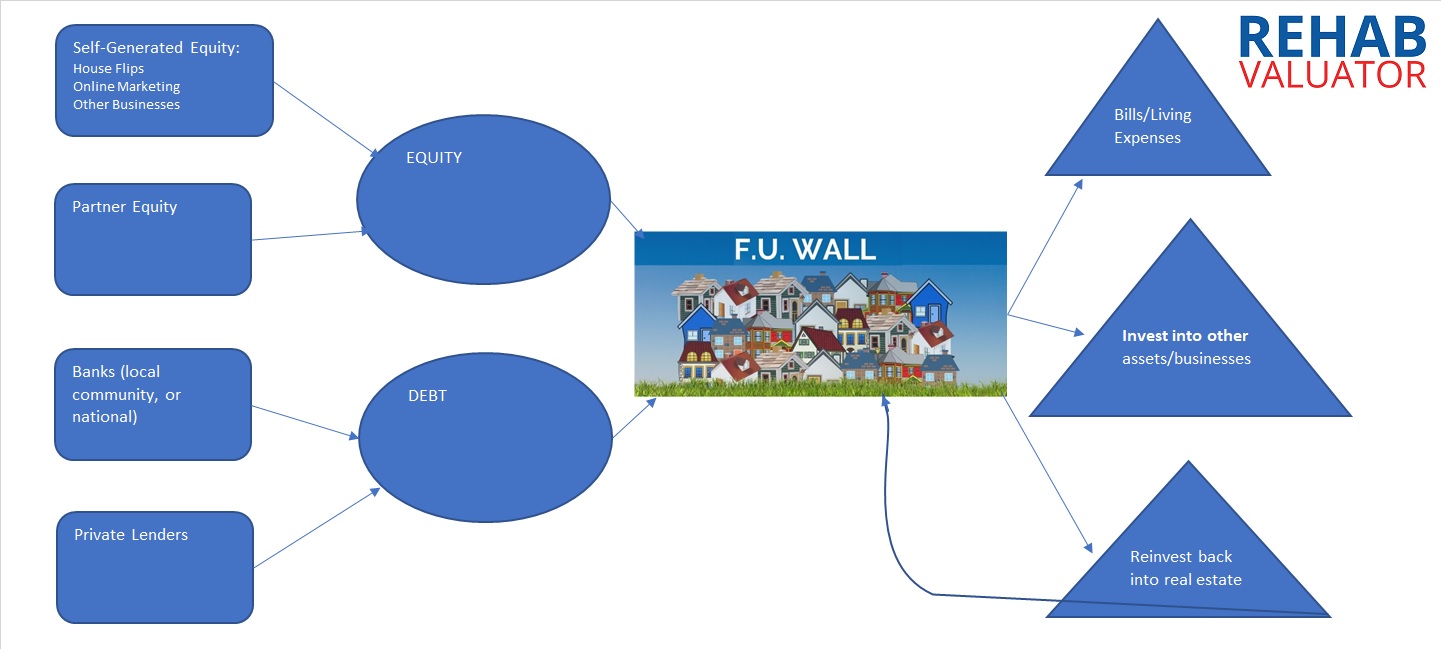

When you finance anything, from a house, to a car, to a business, there are 2 components:

-

- Equity

- Debt

Debt is money you borrow and owe. In real estate, debt can come from banks, hard money lenders, and private money lenders. We’ll discuss each in detail below.

Equity is usually either: actual cash that you bring to the deal or “sweat equity”. “Sweat equity” we talked about above – it’s what you create through work or adding value. Equity in the form of actual cash, though, doesn’t have to come from you. It can come from partners, credit lines, etc.

Here’s an easy explanation of debt vs. equity that everyone can relate to. This is how a typical person buys a house:

The downpayment of 20% is equity. Rest is a bank loan.

Now, primary residences can be bought with less equity. There are loans where you can only bring 3% downpayment and rest gets financed.

For investment properties, if you're buying “turnkey” (see this concept explained above), you will typically need to bring 20-25% equity to the table. This is one of the reasons why I wouldn't recommend this strategy unless you are a busy full time professional and this is your only way to get into the game.

If you have to keep putting 20-25% down, I don't care how much money you make. Even if it's $500k/year. You'll run out of cash and won't be able to build a scalable portfolio.

So out of the 3 options we discussed above (turnkey vs. rehab/rent vs. build/rent) let's focus on financing options available for rehabbing and new construction. Both methods allow for:

-

- Creating “sweat equity” which is incredibly important for both: wealth creation and protection against downside and

- Ability to refinance at some point soon, which then allows you to leave less $ tied up in deals long term. And that's key to scalability!

Both debt and equity are usually constraints for investors and will hold you back from building your FU Wall unless you figure out where to get both, consistently and affordably!

So let’s first talk about your debt options, then we’ll figure out where to get equity. Remember: you will need both!

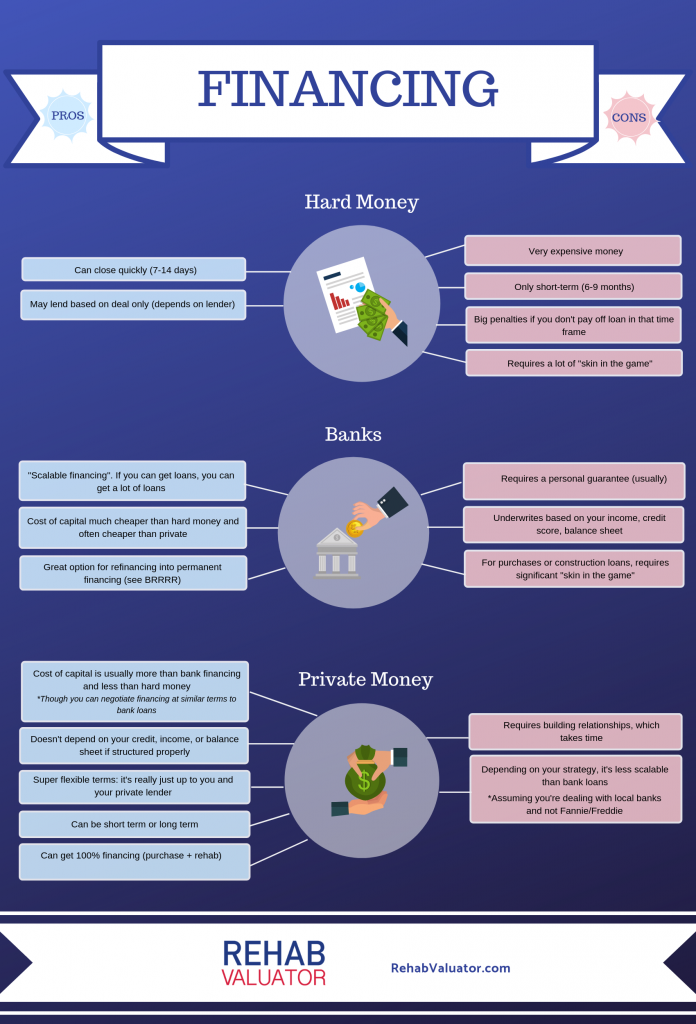

The graphic above pretty accurately summarizes the pros and cons of the 3 primary financing types for rental houses.

Let’s expand.

Bank Financing: This is going to be your most scalable form of financing simply because banks have a lot of money. Once you can build one good relationship with a local bank, that one relationship can lead to millions and tens of millions of dollars in financing. I primarily deal with 2 local banks and anytime I have a new project, getting money these days is almost too easy.

I use local banks 2 ways:

-

- Construction Loans. Every bank has different criteria so I can’t tell you what % each one will lend on or if they’ll fund rehabs AND new builds, one or the other. My advice is build relationships with as many local community banks as possible. But I use banks to fund my rehabs and new construction projects. For my new builds, I typically buy infill lots with cash, and bring them as “equity” to the table. Then I am able to fund 90-100% of my construction budget!

- Permanent financing. You can either refinance into perm financing or do what I do, which is get a construction loan that automatically rolls over into permanent financing. This is pretty great because I get an interest-only loan during construction period, then once project is done and my tenants are in place, the loan automatically changes to an amortizing loan without the need for a separate refi!

You can use this resource to find local community banks in your area: https://banklocal.info/locations

Hard Money: I would avoid using hard money unless you can’t build private money relationships and don’t have access to bank financing. Nothing against hard money lenders but this is simply expensive money and comes with too many restrictions.

That being said, if you have a deal that you need to take advantage of and this is your only option, use it. But it’s only good for short-term rehab financing. Most won’t lend on new construction. And HMLs don’t do long-term lending. So if you’re rehabbing a rental, you MUST have permanent take-out financing lined up. Or else you’ll have serious issues when the hard money loan balloons.

Private Money: For short term financing, especially if you want 100% funding, this is definitely the way to go. You can use private lenders for long-term funding as well and for long-term joint ventures (more on this later).

There is a huge amount of misconception, false advertising and general mis-education around who “private lenders” really are. This blog post explains in great detail what private money really is and how to go about finding private lenders.

I will just say here that private lenders are not professional lenders. They never advertise online or on Facebook. They will never approach you first. Private lenders are regular people like you and me who you build relationships with. This takes time. These are people you work with, go to church or temple with, attend PTA meetings with, work out with. These are people in your network or people you meet once you start expanding your network.

So building REAL private money relationships in the beginning takes time and isn’t as easy as calling up a hard money lender. But the payoff is amazing.

Why?

Because the beauty of private lending is that there are no set guidelines to the loans you structure. It’s really just up to you and your private lender. So if you can build enough trust and credibility and show your lender the benefits of the deal, you can structure 100% financing deals. This is rarely available with banks or hard money lenders.

Additionally, you will rarely come across a situation where a private lender will want to run your credit or ask you for a personal financing statement. With banks, this is normal. So if you have bad credit, past bankruptcies, etc., and other doors close to you, private lending offers a solution. (I would highly advise you to disclose any past bankruptcies or other skeletons to your lenders. You either build full trust or you don’t).

No matter what option you choose, you need to understand:

- The pros and cons of each

- How much in added costs financing will add to your project

- What exit strategy each financing method is best for

Here is a really good, detailed training that goes over these 3 financing methods and how to evaluate the cost of each:

https://rehabvaluator.com/case-studies/financing-types-for-real-estate/

My story:

I left my corporate job back in 2008 during the recession and didn’t really have cash sitting around. I also wasn’t bankable on my own. But that didn’t stop me.

I started out building my FU Wall with the help of one private lender and a “credit partner” that went on the perm financing with me (I’ll explain this in more detail later). I took that chunk of private money from the one private lender and bought a house. I renovated that house, put tenants into it, then went to a local bank and had the house reappraised higher. Then I refinanced and fully paid off that private lender (who was also my credit partner). End result was a house that we both owned with NO money tied up, and with a $300/month cashflow! And we had the full chunk of private money back in the bank to use on the next house and the next house!

That’s how I built approximately the first $6 million or so of my portfolio!

This is the BRRRR method I explained above (Buy, Rehab, Rent, Refi, Repeat). If used correctly, it can be an incredibly powerful method for building cashflow and wealth.

After I had my fill of rehabbing single family houses, duplexes and quads, I transitioned into new construction and commercial development in order to scale my portfolio.

—————–

So here’s the framework to do BRRRR if you have some cash of your own or don’t have 2 nickels to scrape together:

Phase I: Short Term Acquisition and Rehab:

- If you have your own cash or a credit line you can tap short term, use that to buy and renovate the house

- If you have none of the above, find a private lender who will lend you enough to buy and rehab the house

- Make sure the numbers work. Accurate BRRRR analysis is crucial here. You have to be confident that the new renovated house will appraise high enough to allow you to refinance and get the entire investment back out (either your cash or your private lender’s cash). Otherwise you’re leaving money tied up and if you have a lender on the deal, they’ll have to stay in 1st That will prevent your refi

- Alternative Option: If you don’t have a private lender but some cash, you can use a hard money lender to finance your purchase and rehab short-term. But you’ll need some cash to bring to the deal. Unlike private money, hard money won’t do 100% financing Except some rare instances where they’ll require a profit split.

Phase II: Refinancing into Permanent Financing:

- Go to local community banks. They’re in every market in the US and they’re mandated to lend in those local markets. Moreover, these banks are usually “portfolio lenders”, which means they typically keep loans they originate on their books instead of selling into the secondary market.

- This means that these banks can be much more flexible in how they structure their loans and who they originate loans to. In particular, benefits for you are:

- No seasoning requirements. You don’t have to wait to own a property for 6 or 12 months before you can refi, as you would with conventional lenders. This is important to achieve “velocity of money”.

- No limits on # of loans to a specific individual. Now, that is not entirely accurate. Banks will limit at some point how much they will lend to you but it won’t be a 5 or 10 loan limit. They’ll max you out at x $million. This also depends on size of the bank and their appetite at that time for loans.

- Local banks have a smaller bureaucracy framework. Often you’ll deal directly with a loan officer who can make loan decisions himself on smaller loans. Bigger loans go to a committee but that is also done quickly.

- If you are not yourself bankable, then find a credit partner. A credit partner is someone that will go on the loans with you in exchange for a piece of the deal. This is someone usually with a provable, high income and great credit. We have a detailed training on using credit partners inside the Art of Private Money course

Deal #2:

- After your successful refinance, you now have the entire investment back out. You have your cash back if you put cash in or you can pay off your private lender in full.

- Now take same chunk of private money or cash and put it into deal #2!

- Again, super simple example:

- Buy house for $50k, rehab + interest + closing + holding = $27k

- Total investment = $77k

- House now rents for $1100 and appraises for $100k

- 80% loan gives you $80k. After loan closing costs you have $78k.

- $78k pays off your entire $77k private loan off or gives you back the $77k you invested

—————–

Let’s talk “Equity” and How to Find It.

First of all, what is “equity”? Equity is required for any real estate project or investment. Equity is that portion of the purchase price (or purchase + rehab) that your lender will not cover.

Equity is either “Self-Generated Equity”, “Partner Equity” or “Borrowed Equity”.

The most standard form of equity that the average Joe understands is the downpayment you have to make to buy a house. Your downpayment (3%, 5%, 20%) is the equity you bring along with any closing costs you pay. The rest is debt provided by your lender. But putting down 20% into each house from your own equity won’t get you very far. How many houses can you buy if you have to wait to save up 20%? I doubt very many.

So equity can come in many other forms. Let’s define them:

-

- “Partner Equity”: This is money that your partners bring to the deal. This is one way to get into deals with no money of your own. I’ll expand on some strategies below.

- “Borrowed Equity”: Instead of earning the money or bringing in partners, you can borrow it. Obviously you’ll need a strategy for repaying it. I’ll explain more below.

- “Self-Generated Equity”: this is money that you bring. You’ve earned and saved this money through your job, your business, robbing liquor stores, scamming lonely widows, etc. I’ll drop some awesome (legal) ideas on you below on how to generate your own equity.

Let’s go through each of the 3 equity options.

Let’s talk “partner equity” first since this what most people are familiar with in real estate investing.

[I] Partner Equity:

The partner, or “equity partner” or “equity investor” model is very common to real estate. It’s even more common when it comes to multi-family investing, both repositioning and ground up. In larger commercial deals, you will often have the “syndicator” who will pool together a number of equity investors for the large equity piece required to do the deal. In exchange for putting the deal and the investors together, the syndicator will take a piece of the deal for themselves, along with a number of fees (acquisition fee, developer fee, etc).

You can apply the same exact model to residential rental deals in a number of ways:

-

- “Equity + Bank”: Partner puts up the equity and you get a construction loan for the rest. After rehab and refinancing, the partner gets (hopefully) his equity back (see BRRRR) and gets to keep a piece of the deal (ongoing cashflow and upside when you sell).

Alternatively, if this is a VERY strong BRRRR deal where you’ll generate a profit on the refi, you can pay a profit split at refi to partner and take them out of the deal

-

- “Equity Only”: Just like above, but get rid of short-term construction loan. Partner puts up the entire amount necessary to buy and rehab the deal. Then refinance and pay partner off.

- “Long-term JV”: Here you do not involve banks at all. JV Partner puts up the money needed to buy and rehab the property. You then rent it and hold it long term. No mortgage to pay at all. You simply divide the cashflow and future resale upside 50/50, 40/60 – up to you and your partner. This is a great strategy to avoid banks completely. The only downside is scalability. A lot of cash ends up getting tied up in deals and you’ll need to keep finding new JV Partners to scale big.

Here’s how a 100% Joint Venture structure would work:

You and a joint venture partner form a new LLC.

Your JV partner funds the LLC bank account with enough money to buy and renovate the property

When the house is rehabbed and leased, there is no mortgage to pay. You and JV Partner own it 50/50. Rent comes in, expenses are paid such as taxes and insurance, and the remaining cashflow is split 50/50, 60/40, etc – up to you!

Down the road, when the house is sold, JV Partner recoups his entire investment and the remaining profits are split 50/50, 60/40, etc

Pros to this strategy: no debt! The investment is all equity, funded by your JV Partner!

Cons: hard to scale without finding more and more JV partners.

There are multiple other creative strategies you can use to bring in partner equity and get into deals but those 3 are the most common ones.

[II] Borrowed Equity:

Let’s talk “borrowed equity” next and then we’ll talk about ways you can “self-generate” equity, which I am actually a huge fan of. I’ll explain why later.

The “borrowed equity” concept is pretty simple: instead of bringing in equity from someone who you have to pay a big chunk of the profits from, simply borrow it instead, hopefully at a low interest rate. This is a way to lower your overall cost of capital significantly.

Borrowed equity ideas:

-

- Equity can come from a credit line.

This can be a home equity line on your personal residence, or a credit line backed by other assets or properties you own. Tap this only if you’re employing a strategy where you can sell or refi quickly (see BRRRR). - Equity can come from a private lender. You borrow the money for the downpayment or entire purchase price from a private lender. Either they become a long-term lender or you refinance the property and pay that lender off.

- Equity can come from seller financing. Get the seller to finance the deal for you, either short term while you rehab or long term!

- Equity can come from a credit line.

[III] Self-Generated Equity:

Everyone will tell you that you should never put your own money at risk in real estate deals. “Borrow money, raise it from investors, borrow it from banks, find partners, etc etc.”

I’ve always thought this was bullshit.

Now, sure putting everyone else’s money at risk puts you at risk less in case something goes wrong. It’s smart. But raising capital, building relationships with equity partners and private lenders takes a lot of time and work to do properly. And once you put somebody’s money to work, you’re just getting started! Now you have to manage that relationship, update them about returns and status of the projects, and work overtime to protect their investment. (Some people neglect that last part).

But let me give you a different perspective on equity. Ask yourself these questions:

“What’s better: 50% of the deal or 100%?”

“Do you want full control or partial control?”

“Would you rather manage 300 units and get paid for 150 or manage 150 units and get paid for 150?”

See where I am going?

If you can “Self-Generate the Equity”, you can become your partner and control the whole deal.

So how can you “self-generate” the equity? Well, there is only about a million ways to do it. The most common way that someone does this is by working a full time job and saving the money to eventually put down on an investment property. That’s not a bad way to go but it’s obviously pretty limiting.

Another common way is to have an operating business that then feeds your investment portfolio. An operating business is any business that produces ongoing revenue and income. It can be a wholesaling operation or a house-flipping operation if we’re sticking to real estate.

It can be an accounting practice or a grocery distribution business.

Many generational wealth real estate empires have been formed and built by people and companies that had strong operating business that generated significant equity that then went into real estate.

The point is this:

- Anything you do operationally will essentially produce one-time profits. Wholesale a house? It’s a one-time check. Bill your accounting client? You had to do the work and you got paid once for that work.

- The real beauty of the FU Wall is that it allows you to take those one-time profits and checks and invest them into something that will then spit out potentially lifetime-lasting cashflow, on repeat. Month after month.

- “Residual” ==> “Recurring”

- THAT is where your money starts multiplying year after year. THAT is where real compounding happens.

If you can generate your own equity and then deploy that equity to earn you a 10%, 12%, 15% or even an infinite rate of return, you will:

-

- Retain more of the deal (percentage and control)

- Turn your transactional (one-time) income into residual (recurring, autopilot money)

- Grow your wealth exponentially over time

- Be answerable to less people (less investors, partners, etc)

My Story/Strategy:

Even though I have raised money in the past and teach others to do so, I actually prefer the “self-generation” equity method for my current portfolio building.

I use 3 primary methods to generate equity:

-

- House flipping. I build new construction spec houses and sell them to retail buyers. I do this primarily through joint ventures so that very little of my time goes into this. I buy the land and finance the deal, while a partner builds the house and markets it.

- Software as a service business. Our Rehab Valuator software has thousands of paying clients and is an amazing resource to those who wholesale, rehab/flip, rehab/rent or develop new construction projects. It allows investors to perform deal analysis, structure funding presentations to secure financing, sell their wholesale deals, and do a full range of project management functions including rehab budgeting, tracking of bids, ongoing accounting for projects and real-time reporting. I bootstrapped this business 10+ years ago, grew it through an immense amount of hard work and dedication to our clients, and continue evolving and expanding our products and customer base on a regular basis. Because I bootstrapped it, I have no outside investors and thus am able to reinvest a significant portion of the profits into my FU Wall.

- Affiliate marketing. Affiliate marketing is simply a business where you market someone else’s products in exchange for a commission. And most people do this wrong. Very wrong.

Most people sell anything and everything that will make them a buck. I, on the other hand, carefully vet any outside products and resources that we bring to our client base and usually say “no” to 97% of the offers we are approached with. This way, our subscribers and clients know that anything that we bring to them that is not our own product is VERY relevant to their business, fully vetted and is worth their attention.

The good news is that affiliate marketing is a great way to create a side income online without having your own products or having to build your own funnels.

How do you get started with affiliate marketing? Very simple. Start by signing up for the Rehab Valuator affiliate program. We pay 25% recurring lifetime commissions on any software sales you generate and it’s incredibly simple to market our software. Plus, you know you’re marketing an awesome product with amazing support behind it

Conclusion:

I hope this has been eye-opening for you and has given you some ideas to head towards financial freedom through real estate soon. I am going to be adding more content to this page and deeper illustrations of some of the concepts so check back in a few weeks or be on the lookout for my emails.

In the meantime, please leave me a comment below with your thoughts and share this on your social media accounts. More people should get exposed to this type of information.

Next Videos

Get Rich Slow

Should You Flip or Rent?

Hi,

I was 8 yrs old or so, surrounded by about 10-12 persons including my mom (very gentle and mild creature) and was telling a very animated story to my listeners, then WAM! I got slapped… the one and ONLY time my gentle mom abuse me!:) just because I unintentionally spit out a swear word that I don’t even know. I now sometimes think it, occasionally voice it to myself… nobody heard me swear again ever… but I’m cool with hearing others Daniil. But side story aside, thank you so much for wonderful and genuine care to take time out giving us leading insights into a challenging but very interesting entrepreneurship! Please give us more FU!

Great information. I have a goal to build an FU wall that at least will get me retired from my job. The concept is one I want my adult children to see and understand before they get much older. Thanks for all the info you take the time to teach others.

HI Daniil, Man I’m blown away with all the great information you provide to

us/me much, much appreciated. I’m going to use it as well. I love the software, as you know I have the premium version, And I would not run my business with out it.

Thank you so much for putting your soul into your training.

We love hearing how much value you’ve found with us! If you ever have any questions or issues with your software, reach out to our support team and they’d be happy to walk you through. Daniil puts out awesome information so don’t stop learning and always let us know how we can help 🙂

Way cool! Some very valid points!

I need to talk to some one about your products..

Hey Ken! Our support team reached out to you at the number provided but your mailbox was full so we sent an email to see how to help. Please let us know!

so much good info, I wish I had more time to read and watch everything you offer, so I guess i will have to buy another few properties so I can have the time for that (:

Let’s get you those properties, David!

Thank you, Daniil for a ton of excellent information all done in a nutshell. It’s very impressive that you were able to accomplish all you have accomplished since coming to the USA. Well done!

Thank you for your sharing your positive feedback! We are so happy to hear you have found value in our content. Your friends at Rehab Valuator 🙂

Thank you for always giving a wealth of awesome information! You are inspiring and a great investor and the detail you put into explaining to us your information so we can understand and grasp it is so appreciated. Thank you Daniil!

Hi AnneMarie, I couldn’t agree with you more! Daniil does a FANTASTIC job of clearly spelling things out and making the information he shares easily digestible. Have a great day and thank you again for posting your positive feedback – ALWAYS appreciated!

Wow! Excellent Daniil I live in Canada and love your information. Cheers to a FU wall – working on this.

Hi Susan,

You’re welcome!

I enjoyed reading this great content put together by Danill Kleyman. I will bookmark it and always come back to it. Thank you Danill for the good and educative ideas.

Hi James,

Thank you for your kind words. Glad to hear you are bookmarking our content!

I AM 22 years old, just starting out in the industry. I was previously very deep into the whole concepts of rich dad poor dad / escaping the rat race via “YouTube University”. I have been using the software for about 3.5 weeks. The confidence in my number and systems due to the program has been unreal. It gave me the confidence to take the steps and start sending my projects to investors. The return on this $49 program, is almost difficult to put into words. $49 for a life of freedom and passion.

Thanks for your willingness to share your journey.

Alec – love hearing this. Congrats on starting at such a young age. You’re going places!

Does software analyze what you need to buy the vacant land for to build from the ground up ?

Yes. Here’s a tutorial: https://rehabvaluator.com/real-estate-development-training/analyzing-buildable-lots-value/

Everybody thinks they have all the answers for ll of us. I get tired of BS testimonials that mean nothing, and showing me someone success or bank account which just proves they have nothing to offer. The real solution is just access to funds. If I had the money I would be much more receptive to those who are really doing the biz.

Do you have a program that teaches all of the above content for a novice investor and if not what do you suggest I do to get started and get my first deal done?

I link throughout the content above to various training (most of it free). Bulk can be found here: https://rehabvaluator.com/developers

Daniil, I have been following you for years. You’re one of the very few people that has consistently kept my attention because I have a lot of experience myself and I know you know what you’re talking about. Thanks for all you do. I admire the hell out of you. One thing I need to get better at is finding deals. I turn down most deals due to competing with amateurs that over pay for everything in our competitive market. What’s your best advice for finding rehab deals?

Hey James – appreciate the compliments! Honestly, almost everyone is facing a challenge finding good deals right now. They’re still out there, but you have to do more work to find them. Most of my deals right now are coming from 1) Wholesalers and 2) Tax auctions. I don’t do my own marketing but if you want a consistent pipeline of deals and you want the best negotiating position for those deals, you’ll want to market direct to sellers. It takes work and requires both time and a marketing budget, but doing it correctly will allow you to bypass wholesalers, MLS, etc. We have a pretty good primer on finding deals here that you may find helpful: https://rehabvaluator.com/wholesaling/how-to-find-off-market-real-estate-deals/

Excellent information. Could have left the whole FU verbiage out.

I suppose I could have. But I didn’t 🙂

Daniil,

Excellent ideas woven into a great plan. Thanks so much!

Daniil, as you may or may not be aware, I’ve been involved with affiliate sales of your software products, and you’ve always been honest and fair, so I’d like to take things to a new level. Thank you, Steve.

Appreciate you already being an affiliate, Steven! Let’s get you even bigger checks going forward!

Thanks, Daniel…great insights as always, particularly on financing options.

This is real gold to hold especially when you are just starting your real estate portfolio. It gives me confidence to start on this journey of building my FU wall, Thank you Daniil for creating this free content.

You’re welcome, Charles. Glad you’re starting your journey. The sooner the better!

Thank you once again. This is great material to hold. A great guide for my FU Wall

You’re welcome!

Thank you for the content. I am beginning my rental journey by taking those wholesale checks and moving them to rentals.

Right on, Cy! I remember talking to you at lunch over a year ago about this. Nice work!

Daniil, Your timing on this couldn’t be better.I have been a part of your system for just over a year now and have seen great updates in the last year. We are wanting to build a better system to build wealth for our family (My wife and daughter are part of the business). The content here is fantastic and got us thinking again about your BRRRR system and this really helps getting us going again.

As far as the FU Wall it really gets the message across on what kind of wall we are trying to build and if people can’t get past the FU part of your write up they haven’t worked with contractors.

Looking forward o part 2…

Appreciate the feedback, Ed!

Daniil,

I’ve been following you for a couple years, always enjoy your content and have implemented some of what you’ve taught with the intent to do more of it.

This content is very powerful, important and motivating and I’m glad to have received it. My issue with “fu**” is that I have two grandchildren who are in their late teens that I’ve been talking to about real estate investing and I would have liked to forward this information to them so that they could get it first hand, from the horse’s mouth. I don’t use profanity and wouldn’t encourage anyone else to do so.

It’s not for me to give you advice. Just saying that not all of your mentees and potential mentees need the saltiest of language in order to get your great message.

Thanks!

Craig – I appreciate your feedback and I think it’s valid! I would just say that, no matter how much you want to shield your late-teen grandchildren against occasional foul language, they’re already massively exposed to it in 1) school 2) television and 3) basically anywhere in the real world. But what they consume in media and television won’t be 1% as important to their future as consuming content like this, bad language and all

Great content and very well formulated.

Thanks, Cory!

Good commentary…did not read in detail as I recognized the concepts which are known to be valid by any “thinking logical” person. As to your choice of using “fu**, I perceive that you don’t really understand what that actually means or represents. Not the way a person with your knowledge and experience should try to persuade people who really need your good message. If you want to know why, you know how to contact me.

Because Truth Rules!

To each, their own I guess. I love how in the same paragraph you tell me you didn’t actually take the time to read this, then proceed to offer me advice and feedback.

Good Stuff!

Thanks, Polly!

Good to see this info in black and white. Your wording is appropriate. Had we learned the art of entrepreneurship and finance in our school days, we would all be more financially prepared for what’s ahead. You continue to present timely and valid information on an ongoing basis and I am glad to continue to be a prime member of your organization.

Appreciate the compliments, Lorelei!

I’ve red it all.

Good! Now implement it!! 🙂

Great article, you always provide good information, which is why I continue to be a prime member.

Thanks Joseph!

Well articulated and great information. Thank you for ALL the knowledge you share.

Do something once and get paid forever (or at least a very long time).

Exactly right, Darius. Do the deal once, then get paid for years to come. Thanks for reading!

Nice article Daniil! Great stuff!

Thanks, Mark. I am trying to catch my site up to yours in terms of great content!

Great content! I love the fact you say “Get rich slow” I’m beyond tired of these real estate seminars that are set up like MLM’s and scream get rich quick! I’m absolutely okay with get rich steady and smart. So much information here. Thanks!

Slow and steady 🙂

Great Info as Always!

Thanks, Ty!

Excellent article Daniil….thanks for all this great information!!!

You’re very welcome, Eddie!

I wanna build that wall

Let’s build it!!

Great content on building a life based on total freedom!

What is the hardest part? There is nothing here that every reader can not implement and succeed with!

Excellent content!

Jim

Jim – you are living this and have been for years. You’re a great example of how to build this properly

Great, practical content from Daniil! He is the real deal helping the average person get out of the rat race by sharing his knowledge and wisdom with beginners and seasoned pros. Thank you Daniil!

Thanks, Gary!

Excellent! Well written and easy to comprehend! Daniil Kleyman Appreciate the effort you put in to help the serious Real Estate Investor???

Appreciate your compliments Godfrey!

Daniil, I see your language as a necessary tool to combat our pc world. Having all this great content in one place is invaluable.Thanks and keep up the great work

I’d rather be free and politically incorrect then be a nervous PC wage slave 🙂

Very informative and excellent post. I am in the second category of buying and slight rehabbing and renting. When refinancing, what duration do you generally use. 10, 15 or 30 Years. Also do you replace all HVAC, appliances to brand new, even though they are currently working

Hi Venky,

Thank you for commenting on our post.

Daniil recommends updating appliances during rehab to the standard that there will be no need for maintenance on the appliances for the first five years. If the appliances are in working condition and no maintenance issues will arise for the five years after rehab then you may not need to replace that appliance.

Daniil, as always, great info and very generous with your insights and knowledge.

Hi Daniil, How are you my friend?

I moved my operation out of Nevada and now back in CA.

I love reading everything you offer. The content and information you always put out is top notch for any Real Estate investor and a must read.

Daniil as you know I am a seasoned investor and have built over 52 high end executive homes in Danville /Alamo CA. in the 3 to 7mil range.

I have a lot of experience in what you talked about; however, as always I still picked up many new tips and added knowledge from all of your new articles

For all investors no matter what experience you have, read all of Daniil’s material and you just might learn something new.

Daniil, thanks for sharing again.

Your friend Bart

Anytime. Always good to get your feedback!

Amazing content, more people need to hear your message. Brilliance at its best, I am a seasoned investor with over twenty years of experience. I am trying to evolve into a commercial building flipper and the long term hikder

Appreciate the compliments, Charles!

Hi Daniel! I enjoy your straight talk. Thanks for all the valuable info and the great Rehab Valuator tool. (Congrats on bootstrapping that too btw) I look forward to working with you into the future. 🙂

Wow. Again. Excellent information. Appreciate that you shared that.

Very clear and easy to understand.

Thank you.

Very informative and inspiring. You are definitely right nothing worth something is easy to achieve but definitely worth it in the long run. Keep up the great work Daniil!

Thanks, Ron!