The Worst Real Estate Deal I've Ever Done

I’d like to tell you a cautionary house flipping story about the worst deal I’ve ever done. Some would call it a nightmare real estate deal. It’s the side of the business that the shiny HGTV house-flipping shows rarely show you. This was the first fix and flip that I ever attempted and everything that could have gone wrong – literally everything – did! If you want to know what a “trial by fire” looks like, then let me paint you a picture.

Everyone Starts Somewhere

It was Spring of 2010. I already owned a bunch of rentals and had gotten my feet wet with rehabbing, but I was still a relative novice. The housing market was pretty depressed in Richmond, but that meant you could get really cheap houses.

So I come across this two story colonial that needs a lot of work but can be picked up for just $44k.

I was going to do a basic renovation and turn it into a rental, which was my strategy all along.

But then I got greedy.

You see, retail sales just started to slowly creep back in. And, this house was located on an edge of a pretty desirable neighborhood. And, I saw that an almost identical house across the back alley from this one just sold for $260k! And it wasn’t even fully renovated!

So, right off the bat, I made three key mistakes that would determine the trajectory of this deal.

Mistake #1: Not sticking to my sandbox and my house flipping strategy.

Mistake #2: Getting greedy

Mistake #3: Not doing my due diligence, researching comps accurately, and consulting with experts to determine my ARV (After-Repair Value – resale price). I misfired here in a big way (more on this later).

But my stupid house flipping mistakes were only beginning.

If it Sounds Like it’s too Good to be True…

My buddy at the time found this contractor that he absolutely swore by! The guy was Costa Rican – I remember him vividly because he had the world’s most terrible haircut. Bill was his name. When you met him, he struck you as the Rico Suave type that would be 50 years old and hitting on 20 year old college girls at a neighborhood bar (unsuccessfully). Think “Fonzie” but over the hill.

Anyways, Bill was renovating houses for my friend at some pretty crazy low prices. I was totally blown by the numbers Bill was charging, so I decided to get him to look at this flip I was about to do, prior to making an offer.

Sure enough, Bill told me he could fully renovate this 1600 sq. ft house for $27,000 top to bottom, including granite and stainless steel appliances! For those keeping score at home, that’s less than $17/ft for an almost complete gut renovation!

“Holy shit!”, I thought to myself. “I am going to retire on this deal!” Yachts, helicopters and hot chicks, here I come!

Buy for $44k, put $27k into it, another $5k in closing and holding costs. Sell for $250k. That’s a $174,000 profit! I was going to laugh all the way to the bank. And then all the way back from the bank. And then the rest of that day, I’d still be laughing. Like a crazy person. Crazy rich that is!

Free Wholesaling Software for Residential Real Estate Deals

Mistake #4: If something is too good to be true, it usually absolutely totally is. Almost always.

Come on Bill, Let’s get Rich!

So I close on the house, hire Ricco Suave Bill, write him a $5k deposit check to get started with demo, and think I am on my way.

If you think it’s bad so far, wait until you hear the rest of the story.

So Bill gets started on the demo with a $5k deposit, which should have covered demo and framing. Half way through the demo, he calls me and says: “I need more money.”

So obviously a red flag immediately goes up in my head and I say “Are you saying we’re already going over budget?”

“No no, we’re still on budget, but I need more money to pay my guys”.

“But that $5k was supposed to pay for demo and framing”, I say. “I am not giving you more money until demo and framing is done”. At least I had the common sense to do that.

So halfway through demo, with my $5k, Ricco Suave Bill walks off the job never to be seen again.

I now have a half-gutted house, no contractor, and this sinking feeling that the real cost of renovation is going to be much higher than $27k.

And his bid was much more in line with reality, though luckily he was still on the cheaper side (around $75k vs. the $27k magical fairy bullshit bid that I fell for with Ricco Suave Bill).

Even with those numbers, I was sure I’d make plenty of money given a projected $250k resale price!

Little did I know….

Whew. Back on the Road to Riches… Right?

So this new contractor actually turns out great. He does good work. Does what he says he’s going to do and stays on budget and on time.

We complete the renovation and get ready to put the house on the market.

——————————————————————

BEFORE PICS:

——————————————————————

——————————————————————

AFTER PICS:

——————————————————————

But just when I think things are finally going my way, two totally messed up things happen that fully complete this “renovation circle of hell” that I’ve invited myself into:

The First Totally Messed Up Thing

When it came time to list the house, I called an experienced agent over and told him I wanted to list for $250k.

He started laughing so hard I thought he was going to have a heart attack.

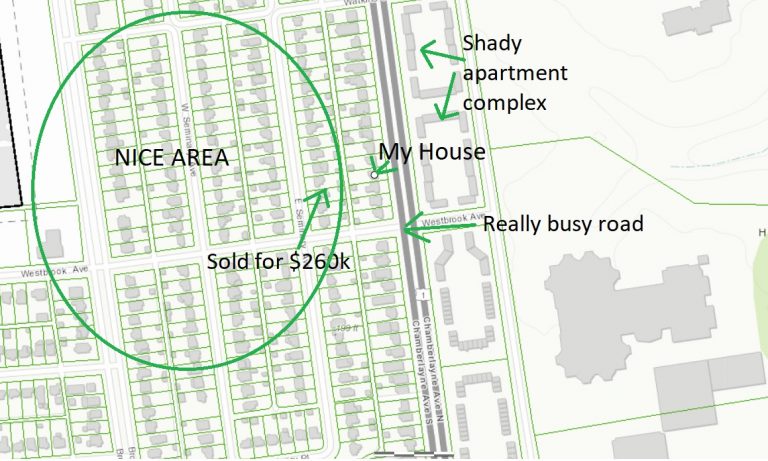

While I was getting ready to dial 911, his face straightened out and he proceeded to explain to me that while the nearest comps indicated a $200k+ resale value, NONE of them were on this busy street across from a shady, crime-ridden apartment complex.

Then he dropped the bomb on me. He said “I don’t think you’re getting anything over $150-$155k.”

Mistake #5: I failed to realize that a house on a nice, quiet street will sell for much more than the same house on a super-busy and highly trafficked street, directly across from a huge, shady, low-income apartment complex. Even if those houses are just an alley from each other. It’s night and day!

Check out this pic:

All those comps came in in the $200k+ range. If I calculated my ARV for this house correctly and knew my market, my ARV here would have been in the mid-150s!

So we listed the house at $160k (wishful thinking) and then, because the agent said we must, I spent $1500 to stage the house with furniture and accessories.

It was beautiful. Master bedroom was fully furnished. Couches and a coffee table in the living room, beautiful dining table down to actual dinner ware and napkins, etc!

Now it was time to sell this freaking thing and try to make a small profit (I was looking at $30-$35k profit at this point given the money already spent on renovations).

That’s when the 2nd really really really crazy bad thing happened, just as we were crossing the finish line.

The Second Totally Messed Up Thing

I remember it like it was yesterday.

It was Friday afternoon around noon. Sunny and beautiful outside. The house has been listed and staged for about 3 days at that point, when I get a call from one of my contractors that goes something like this:

“Hey, Daniil. I just came over to Chamberlayne ave to take care of the punch list…and…well…you need to get over asap. I’ve already called the police”.

You NEVER want to get a call that starts like this.

So I jump in the truck and rush over to the house. As I walk in, my heart literally drops to the floor.

In broad daylight, someone pulled up with 2 trucks (as I later found out from a neighbor who sat on his back porch and watched this).

They took every single piece of staging furniture out.

They took every piece of staging ANYTHING out – down to the plates and the napkins.

They took all the new stainless steel appliances.

They took the washer/dryer.

They then took both of the heat pumps (the outdoor AC units).

But it gets even worse:

They ripped the dishwasher out of the wall and left the water line to just spew water out all over the kitchen and dining room floor, pouring down into the finished basement.

So in addition to all the theft, I had damaged flooring, water-soaked insulation in the attic and ruined sheetrock.

But wait wait wait! It gets even worse!!!

Ready for this?

After I got over the shock of the sheer screwing over that I just received, I finally settled down and said to myself: “No worries. I have insurance. I am covered”.

Oh boy how wrong I was!

I called my insurance company who promptly dropped another bomb on me (that seemed to be a pattern lately): staging furniture, appliances, even heat pumps were considered “personal property” and not part of the structure itself. And my coverage for “personal property” was limited to $5,000.

Read that again. Between appliances and heat pumps, I was already out around $10k. Then I had to pay $3k to the staging company to pay them back for the stolen furniture.

So I was taking an $8,000 hit on this daytime visit from the robbers!

So how did this nightmare house flipping adventure end, you may ask?

I replaced the appliances, paid back the staging company, got an ADT security system, and then had this house sit on the market for another 5 months waiting for a buyer to come along.

That’s what happens when you try to flip in a bad location.

Finally, a buyer came along who loved the house but wouldn’t pay asking. We ended up closing at $142,950 after I gave up a bunch of concessions.

So let’s recap this real estate deal:

Projections:

Purchase: $44,000

Rehab: $27,000

Closing & Holding: $5,000

Resell: $250,000

Net Profit: $174,000

Actual Results:

Purchase: $44,000

Rehab: $80,499.50 (included all the stuff I had to replace not covered by insurance)

Closing & Holding: $8,444

Resell: $142,950

Net Profit: $-2,000 (after commission, concessions, etc)

Not taken into account in this $2k loss: The huge amount of my time, frustration, headaches and more. But also, many, many lessons were learned. They were learned the hard way. But learned nevertheless.

Here’s What Lessons I, and now You, Have Learned From This Nightmare Rehab

Lesson #1: If you’re going to switch strategies and move away from your core competencies, do your research extra carefully and really make sure you understand the numbers and the risks! There’s nothing wrong with expanding your exit strategies – just do your homework and really understand the math. That’s where the Rehab Valuator software comes in!

Lesson #2: It is ALL about the ARV (After-Repair Value). If you get the ARV wrong, results can be disastrous, as in this example. I only lost $2k but it could have been much much worse! Know your market block by block. As you saw, just moving from one street to the next can have a drastic impact on your resale value.

Lesson #3: Learning how to properly forecast repair costs is just as important as knowing your ARV (see Lesson #1). And if something seems too good to be true, avoid it. It’ll bite you in the end.

Lesson #4: Insurance. Review your rehab, new construction, and vacant policies carefully. In my particular case, I got bit in the ass by the “personal property” distinction and the $5k limit. After this incident, I fired my insurance company and switched to a really good local insurance broker who has been doing all my policies ever since 2010. Find someone really good to work with that gets your business. Then ask as many questions as possible: “What if x happens?”, What if z happens?”, Etc.

Lesson #5: Bad, frustrating, unexpected things will happen in this business. They happen in any business. You have to learn to take it on the chin, adapt and keep going. Period.

Lesson #6: No matter how many stupid mistakes you make and how many bad, unexpected things will happen during your project (like robbers taking everything inside and outside the house), you will greatly protect your downside if you buy cheap. In my case, I only lost $2k because I got the house at the right price. So know your values, learn to negotiate and always buy right.

Oh and by the way, whatever happened to Ricco Suave Bill the Contractor you may ask? Well, I went to the local DPOR, filed a major complaint against him and they took away his contracting license. I saw him at Lowes a few years later and it took every bit of self control not to body slam him into the power tool isle. But I took satisfaction in knowing I already gotten payback against him.

This nightmare real estate deal took place a long, long time ago (2010 – seems like a lifetime), but since then I’ve made many other mistakes. And that’s ok. The key is not to not make mistakes. Everyone does. The key is to learn from them and not repeat them. My goal every day, every week, every month, every year has been to get just a little bit better and a little bit smarter than I was before. As long as you’re constantly improving your skillset and your knowledge-base, you’re moving in the right direction!

If you enjoyed this cautionary house flipping story, hit the button below and share it on social media. Then leave me a comment below!

Next Articles

“Simple” vs “Easy”

3 Must-Haves for Flipping Houses

This is a great story that I think is worth at least a Thank You for sharing it. I read every word of it and find it so valuable because something similar happened to me in my first investment purchase, not so severe and drastic, fortunately, but similar in the form and content. And the lessons shared (thank you so much!!) by Daniil come very handy because almost they all applied to what happened to me. Gee! Just reading Daniil story is an education in itself and by itself, and I personally find it very constructive due to the fact that what happened to Daniil can easily happen to ANY ONE who is starting to invest, especially for flipping. Daniil story is something that really needs to be shared as much as possible to help those, like me, to avoid these type of pitfalls. My hat goes off to Daniil for sharing it. Thank you.

Thank you for sharing Caesar! This is exactly why Daniil shares his story – to help others learn from his pitfalls. Let us know if you have any other tips of course 🙂

Great story , very realistic and educating . Thank you for sharing . Even though with today’s technology and automated day in day out practices , your story once again points out the reality of getting off the desk and the screen and actually go down the field take a walk around block to do your TRUE due diligence , not just relying on data . Oh yeah , and those gcs … Some of them are characters out of a 5″ thick book , lol..

Sometimes we learn a lot more from our own mistakes, unfortunately than from others 🙂

Hi Daniil,

At $2,000 that’s probably some of the cheapest (and best) education you ever got.

Hi John. real-world experience is priceless for sure!

Hi Daniil

That was a hard lesson to learn. Thanks for telling us about it so WE do not make the same mistake.

thanks again for a lesson learned.

Susan S

Thanks for tuning in Susan.

I have a friend who’s nephew talked her into flipping a house because he could do all the work himself, told her not to tell anyone because they will try and talk you out of it, she is sorry now that she didn’t confide in me. I’m no expert by any means, made many mistakes and keep learning everyday but I would of told her to not buy a 156 year old farmhouse on a busy street three doors down from the shopping mall. This bozo nephew of her’s told her he could do it by himself for $30,000 and finish in six months while working his full time construction job six days a week. They did not hire any professional contractors to do plumbing or electric, he watched youtube videos, nothing can go wrong there, right? They have no money to finish, the work is shoddy, no garage, basement or driveway, when it rains it’s all mud. I don’t see how they will ever get rid of it or pass any inspections. I have people all the time telling me they want to get into rehabbing and once I start answering their questions or telling them some of the things we have encountered it’s a game changer. It is not, find a cheap house, fix it up and sell it for big money, it’s all the stuff in the middle that you need to know. You have to learn by your mistakes and you have shown just how to do that. Thanks for sharing!

Thank you for sharing your experience Kimberly. I think you have hit the nail on the head. It is so important to learn from other people’s experiences, especially their mistakes.

Hey Daniil. Thanks for giving us a valuable lesson. Did you have builders risk insurance then or now? Is that the difference? Is that sufficient to offset theft and vandalism? Or is some form of security system is needed as well in addition to the insurance, if so what security system do you recommend?

I get builders risk now and pay attention to my coverages. They don’t require a security system but in certain areas it’s a good idea. Don’t get ADT. They lock you into a long term contract

As I was reading your story I had a tight smile thinking of thefts, vandalism and arson I’ve experienced in my properties. I think my worst was a home I bought that was going through foreclosure, occupied by some rough motorcycle gang members in Los Angeles. These knuckleheads were so pissed they tied chains around window and door openings at the back of the house. Attached the three heavy chains to the back of pickup trucks and literally ripped the back side of the exterior walls and parts of the roof off Then the morons took sledgehammers to all the drywall, tile, cabinets, windows and doors.

Luckily this was just one of dozens of homes I just bought, and bought cheap. You roll with the punches, tip a drink or two and have a good laugh. But your main point, buying right, cures so many ugly things that can happen after the sale.

Ok, Micah – that story definitely beats mine! 🙂 you win. That’s wild!

Great piece, very eye opening. Thanks for sharing. Who is your new insurance agent?

Haha- let’s just say I got a much better agent since then who I am still with!

Great story! Good info to share with a newbee.

Thanks for the compliment Derek!

Thank you for sharing! Wow! I will keep these points and your experience in mind on my first flip.

Welcome! Hopefully it will help you avoid some of the same mistakes.

Lesson learned. But what I do like, is: As long as you’re constantly improving your skill set and your knowledge base, you’re moving in the right direction!

Exactly right, James!

Thanks Daniil,

It is very refreshing to know that as Real Estate investors we will make mistakes but we need to learn from those mistakes and move on.

I am very glad you didn’t give up on your Real Estate dreams.

I love this illustration because it shows that sometimes a bad deal is best resolved by taking a small loss.

Mistakes are priceless educational opportunities. In that, there was a wealth of wisdom that arose from a bad transaction. What i take from the ordeal……close before you open. Anything you intend to expect to happen such as projected rehab cost, future sales price and contractual performance…MUST!!!!…be calculated before writing and submitting a purchase offer. Short example: If the terms and structure of your financing are not confirmed by way of conditional commitment by the lender, many potential pitfalls will arise that may go beyond what an addendum can fix. That can equal legal problems by breaching contractual performance. So terms of financing means EVERYTHING to fore fill your ability to close. With all i have said….a profitable deal is 90% preparation. The other 10% goes to performance…managing professionals, time and money.

Great read, always can learn from other’s wins and losses.

Hi Lincoln,

You are absolutely right! I am glad you found this educational.

OMG daniil. Sorry but i laughed until i cried. Best story ever. The reason i can laugh is because i’ve done this several times over and over. I’m a slow learner. I don’t do this crazy stuff (as often) anymore but you made my day by telling this story. Thanks for the story.

Hi Dan,

No problem! The key is certainly learning from those mistakes and using that knowledge to kill it on the next deal!

Wow! Scary story

Excellent lesson to learn.

After being in the heavy residential renovation business for decades I have seen this same scenario many times. Super low rock bottom bids never ever work and always end with a tragedy.

Yep! If it’s too good to be true, it usually is!

Thanks for sharing, Daniil. Experience really is the best teacher, especially of it’s somebody else’s experience. You know, OPE!

Exactly right, BIll! 🙂

Great stuff Daniil, it would have been much worse for many people.

You’re right, Joe! Could have been much worse. Definitely a great learning opportunity!

Great lessons learned, it’s why i’ve decided to ues your software nearly exclusivly.

I only hope I too can learn from your mistakes.

Thanks, Douglas!

Great article, bad situation. Excellent case study to learn from and to make us a little more aware of WHAT CAN GO WRONG,! Thank you for sharing this story

Truly a great read – full of valuable lessons and details. Thanks for sharing your nightmare. Your lessons learned will be something I’ll definitely look back on as I consider a flip. Congrats on your successes, and demonstrating failure isn’t fatal. Cheers, Michael

Glad you enjoyed it, Michael!

Daniil

Thank you so much for sharing your experience

You’re welcome, Nader!

Interesting story but happens to the beat of us, hopefully new people just starting will read and learn.

Thanks

For sure, Joe! Thanks for reading!

Maybe you should have stuck to the original plan of turning it into a rental.

Cash out on the short term through a mortgage, bringing things to break even.

What’s the rental market like in that area?

And of course, these days there’s AIR-BNB too. 😉

This was back in 2010 🙂 Should have turned it into a rental for sure back then, and waited until now to sell it

That is the perfect scary story to tell on Holloween:0, The Nightmare Flip

On the serious side, thank you for sharing. Defenetly eye opening, and will remember to update my check list. Thank You

I plan on telling my children this on Halloween for years to come 🙂

Thanks for sharing. This is very similar to a property I am currently working on.

Hope you make more money than I did on this one, Wanda 🙂

Daniil,

I want to thank you from the bottom of my heart for the warning. I guess that may have been something good to post on my facebook timeline. I do not have a business website yet. I had issues with work and school. I am just getting ready to start over, and the first thing is getting to know the market which means several things including the neighbors, etc. So your story reinforces the great importance of following the steps as learned.

I am just starting to accept that I have to choose what is of great significance for me (and do it) and I am embracing my future slowly. I may look at your wholesale class to boost cash flow before I am forced to take my eye off the task temporarily.

I am going to try to delete any junk so I can make some headway into an actual deal. I realize that I have been doing everything except what is important for me to succeed.

I am grateful once more,

Jeffrey Alan Ellis

Sounds like you can benefit from reading this: https://rehabvaluator.com/content/blog/simple-vs-easy/

Thanks for sharing your misfortune. That’s really a eye opening for me, starting my new business.

Good luck in your new business!

Sounds familiar Daniil. Thanks for sharing this with us. I was too embarrassed to tell anyone any of my trials and tribulations over the past 30 years or so.

No need to be embarrassed. We all make mistakes

educationsl and tough to swallow

Really enjoyed your story. Hopefully I have learned from this. Thank you.

Certainly hope you did, Roger!

Thanks Daniil,

You have a funny way of explaining a horrible instance. It is really nice to hear you’re still involved in real estate investing. I’m still a novice myself and all though I’ve done several flips from the construction side I’m still really new to the investing part of it. Thank you for your stories and advice; it’s always appreciated. You’re in Richmond VA, right? Do you know Dave & Tom Kern?

Hi Mikey, thanks for reading. We do like to keep a sense of humor about our failures around here.

Mikey – yep, I am in Richmond. Don’t know Dave or Tom

Unfortunately life is a learning process. The better prepared, the better chance of success and reduction of risk. I appreciate your story and will pass it on to my students who are interested in learning how to invest in real estate. I’m a Texas Broker and New Mexico Qualifying Broker for nearly 29 years and a Certified Texas Real Estate Instructor for over 20 years. I concentrate on commercial and investment properties for my clients. I know the successes out weigh the losses, or we would have jumped off that bridge long ago. Have a blessed day. Tony

I’ve only done one flip. Used rehabvaluator.com and #6 saved it in the end. Great insights reference #4. I knew enough discuss it and my GC had some guys sleep on site, so no burglaries. Thanks, Daniil.

Awesome!

Thank you for sharing this with us, Daniil. As you noted, could have been a much more expensive lesson than it was, had you not bought at a price that could (almost) absorb all those mistakes.

Not sure how long ago this was but you have obviously come a long way since then! Congrats on persevering, and again, thanks for sharing!

Thanks for reading Tracy

Wow! You just can’t make up details like this. As I read this blog, I said to myself, this must be about somebody else: this can’t possibly be Daniil.

All I can say is, you are amazingly resilient, Daniil! And thank you for sticking it out and being in a position to pass all this value on to us. I count myself privileged.

Thanks, William. We all make mistakes and start somewhere. Unfortunately the best lessons and ones we tend to remember come from our own mistakes, not someone else’s.