How to Analyze a Buy-and-Hold Rental Deal in Rehab Valuator (Case Study)

Use this case study to walk step-by-step through a clear, repeatable workflow for analyzing a buy-and-hold rental deal in Rehab Valuator – including small multifamily and already-rented properties.

- Enter the property address and open your analysis

- Create your deal under the Rent/BRRRR tab with no rehab and no short-term financing

- Enter the current purchase price and closing costs

- Build the rent roll

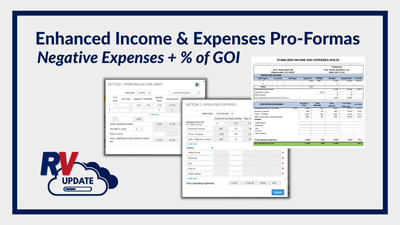

- Add estimate operating expenses

- Apply permanent financing

- Evaluate cash flow and returns

Watch Daniil's case-study above, then skip straight to modeling your next buy-and-hold rental deal.

Use this case study to walk step-by-step through a clear, repeatable workflow for analyzing a buy-and-hold rental deal in Rehab Valuator – including small multifamily and already-rented properties.

- Enter the property address and open your analysis

- Create your deal under the Rent/BRRRR tab with no rehab and no short-term financing

- Enter the current purchase price and closing costs

- Build the rent roll

- Add estimate operating expenses

- Apply permanent financing

- Evaluate cash flow and returns

Great video! Could you accurately use this for larger multifamily deals?

David, great question and YES!! This particular case study is for a turn-key, smaller multifamily property, but you can accurately use this for larger multifamily deals as well. If you wanted to see this a type of analysis, adding in budget and financing, we do have a case study for a larger multifamily development. Check that out here: 31 Unit Apartment Ground Up Deal Structure & Financing Case Study

If you have any questions on structuring your deal and would like some one-on-one help from our support team, please reach out and we can schedule a call!