How Seller Financing Works and Why You Should Consider it as a Strategy

—————————————————————————————————-

PLEASE NOTE: This is meant to be a surface level primer on how Seller Financing works and not a full-blown course. The idea here is to make “some major light bulbs go off in your head!”. We are first and foremost a software company but we also aim to educate our clients on real estate investing, so that they stay ahead of their competition. Seller Financing is, these days, a highly regulated field, so if you engage in these deals, make sure you have proper legal representation review your docs and deals!

——————————————————————————————————-

Being a landlord can be a rewarding career for many people. But for those of you who are burnt out or frustrated with landlording, there are alternative solutions.

So today, I want to talk about a specific real estate exit strategy to renting: selling with financing, more commonly referred to as seller financing.

This is a good option to consider if you want to diversify your business and offer a more creative solution. In turn, this will help you get more deals and can make you a more successful and satisfied investor.

What is Seller Financing?

Seller financing is a real estate agreement in which the seller handles the mortgage process instead of a financial institution.

Because the topic of seller financing is a super-specific one, I knew I needed to consult with my friends Mark Stein and Terry Lewis – so I could give you guys an accurate, well-rounded guide to how seller financing works.

I had a chance to chat with Mark and Terry about seller financing a while ago, and they shared a wealth of information that I know will be beneficial to you.

Mark and Terry are especially knowledgeable in all things related to:

- Buying and Selling with Seller Financing

- Note Creation

- Note Brokering and Buying & Selling

- Dodd-Frank Compliance

During our conversation we talked about:

- Doing deals creatively

- Being able to offer more to sellers

- Win deals and still make money

- Standing out from your competition by offering owner financing

- Tapping in to a huge pool of potential buyers who can’t get conventional financing

- What Dodd Frank means to seller financing and navigating the new rules

Keep in mind, though, that I won’t be able to cover all of these interesting pieces in today’s post, but what we can’t cover in this particular post, we’ll cover in future ones (linked to at the end).

Seller Financing 101: What’s In It For Me?

Ever since the Dodd-Frank Act was passed, seller financing has become a bit more complicated in terms of regulations, especially when selling to owner occupants. But anytime a topic or a business becomes harder to understand and execute, it also presents tremendous opportunities for those able to make the extra effort. And it can be a win-win option for landlords who are ready to explore other options.

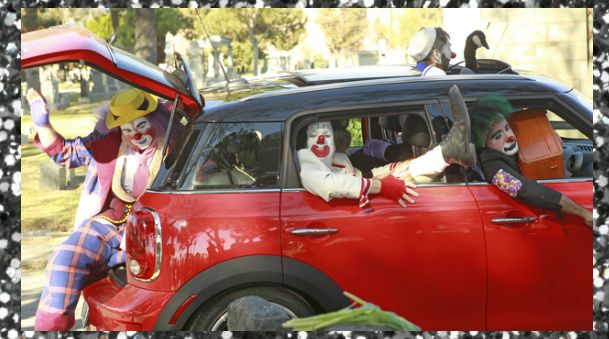

The real estate business has almost become like a circus – where all the clowns are crowding into a small car together (Can you hear the circus music?). And really – we need to get away from this “me too!” attitude, which Terry and Mark also believe is important.

It’s important to separate yourself from the crowd!

“Creativity is seeing what everyone else has seen, and thinking

what no one else has thought.”

~Albert Einstein

If you’re a landlord and you enjoy it, than that’s great! Maybe seller financing is just another “tool” to put in your tool belt.

But, by large, landlording and wholesaling are really under attack. Too many people are doing it and competing for the same deals.

So, getting out of this commoditization of the real estate industry is really what seller financing and notes is all about – creating and providing solutions that few others know how to.

Look at wholesaling, for example. It’s become VERY competitive.

- The margins are often paper-thin

- You have a ton of competition

- You’re often limited in what you can do

So then you say: “Ok, everyone is wholesaling and making 1-time checks, I’m going to be a landlord and create monthly cashflow!”

Well, that’s definitely a step up in every way, as far as I am concerned. But landlording comes with its own drawbacks: taxes, tenants, termites and toilets.

Property management is not all roses and sunshine!

So, if you’re a landlord and it’s just not working well for you – look at doing something else!

And that “something else” can be selling on seller-financing instead of keeping the property and renting it!

You also want to examine your overall strategy – are you out there providing solutions for people? Mark and Terry operate by “the bank of you” – which means that you don’t need to buy a property and put a bunch of money into it; and you don’t even necessarily HAVE to have a private lender to fund it. With seller financing, you’re the bank now and the bank ALWAYS makes money!

Read that last part again.

A Look Back: The History of Seller Financing

Let’s have a little seller financing history lesson, shall we?

In the ‘80s, we saw the market absolutely erupt. Pretty much, 1 out of 3 transactions were done with seller financing.

When the subprime loan market came back, there was less need for seller financing. But, as Mark and Terry point out, we’re going “back to the future,” because this strategy of seller financing is on the rise again.

There are so many buyers right now who simply do not qualify for conventional mortgages. Plus, a strict regulatory environment will probably never allow the sheer number of buyers to actually become qualified for a regular loan as before the 2008 crash.

So what we are experiencing, and will continue to experience, is the perfect storm of all the environmental and macro-economical factors to support this concept of seller financing.

And, as Mark explained, when we think about all the retirees – these are the people who tend to be interested in this idea. In many cases, retirees don’t want to put their money in the stock market (too risky), and they don’t get much return from putting it in the banks, so the benefits of seller financing are definitely there.

Sell Me On It: Additional Benefits & Strategies

It all comes back to being more innovative and creative with the way that you do business.

You want to provide more solutions to differentiate yourself from all the other “clowns” jumping in the same car – because that means you’re going to be doing more deals.

So, what’s in it for the seller?

And by “seller” here we can mean 2 things:

- Seller can be someone selling their property to you (investor)

- Or seller can be YOU selling a deal to someone else (another investor or owner occupant)

The benefits of seller financing include:

- Liquidity to properties ineligible for bank financing

- Seller saves on closing costs, repair credits and fees

- Defers capital gains taxes

- Keeps equity working with a high ROI

- Borrower default = return of property to seller

- Fast sale at max price by offering terms

- Cash out through Note Sale

- Not having to do open houses

- Not having to pay commission

Clearly there are tons of benefits for the seller.

SELLER FINANCING STRATEGIES

We’re seeing more loan assumptions, Mark claimed – and this continues to be an emerging strategy.

Other strategies are:

- AITD (also referred to as “Wrap”)

- Title holding trust

- Stand alone second

- Land contract

- Lease option

- Lease purchase

- Deferred sales trust

- Purchase subject to

Mulling It Over

If you’re like me, then your interest should be piqued by this strategy.

Now that you have a basic understanding of why it might be a good idea to consider seller financing, I’m planning to share more about where to find the sellers, why I think seller financing is better than wholesaling, how seller financing actually works and helpful info about Dodd-Frank and note creation.

But, those are details for upcoming blog posts, so stay tuned.

Today, I just want to leave you with this…

Remember to be creative with your real estate investing strategies. The more you can offer, the more deals you can secure. And ultimately, this will boost your success as a real estate investor.

Talk again soon,

~Daniil

Comments, Questions?

What burning questions do you have about seller financing? Talk to me in the comment box below.

Thanks Daniil, Great strategy for newbie investors.

Anyone can do this on any deal much benefit for both parties — just don’t forget to ask!

Get property to understand they can make the 6% interest on being the bank by staying in the deal, and be secured by holding papers on first position in loan, the same way banks require on their home loan… Unless you need additional funds for renovations then Bank may not want to take second mortgage position on asset. Structure your deal right!

Is there anyone training investors in this currently that you could point me toward?

Hi Mike! We’re not endorsing anyone else at this time, but we DO have an entire bonus course in seller financing in our Inner Circle mentorship group. If you want to learn more, check out the Inner Circle Mentorship page.

I like. the way you explain about the seller financing . thanks

Thanks, Fareed!

Would I have a right of first refusal if the seller chooses to sell the mortgage at a discount

I think that’s something you’d be able to negotiate, but I also don’t think that’s typical

I would like info on how to structure a seller financing partnership.

Are used to know a whole lot more about seller financing back in the late 80s early 90s but now with the new regulations and things I have shied away from doing these types of deals. My broker frowns upon getting involved in these types of deals but sometimes it’s necessary because people don’t have good enough credit but have the money to buy the property.

My question is, if a seller has a property mortgaged but wants to offer a two year lease purchase to a buyer, since there won’t be a closing till the buyer closes out and pays everything off is it legal?

Cheryl – yes, that is perfectly legal from my point of view. But I am not an attorney and don’t offer legal advice. Always have a good, knowledgeable local real estate attorney on your team to advise you!

It’s Seller Financing Will I have any personal liability under the terms of the mortgage