Turn 1 House Into 6 Rentals

with 10% CoC Return

Ground Up Development Case Study

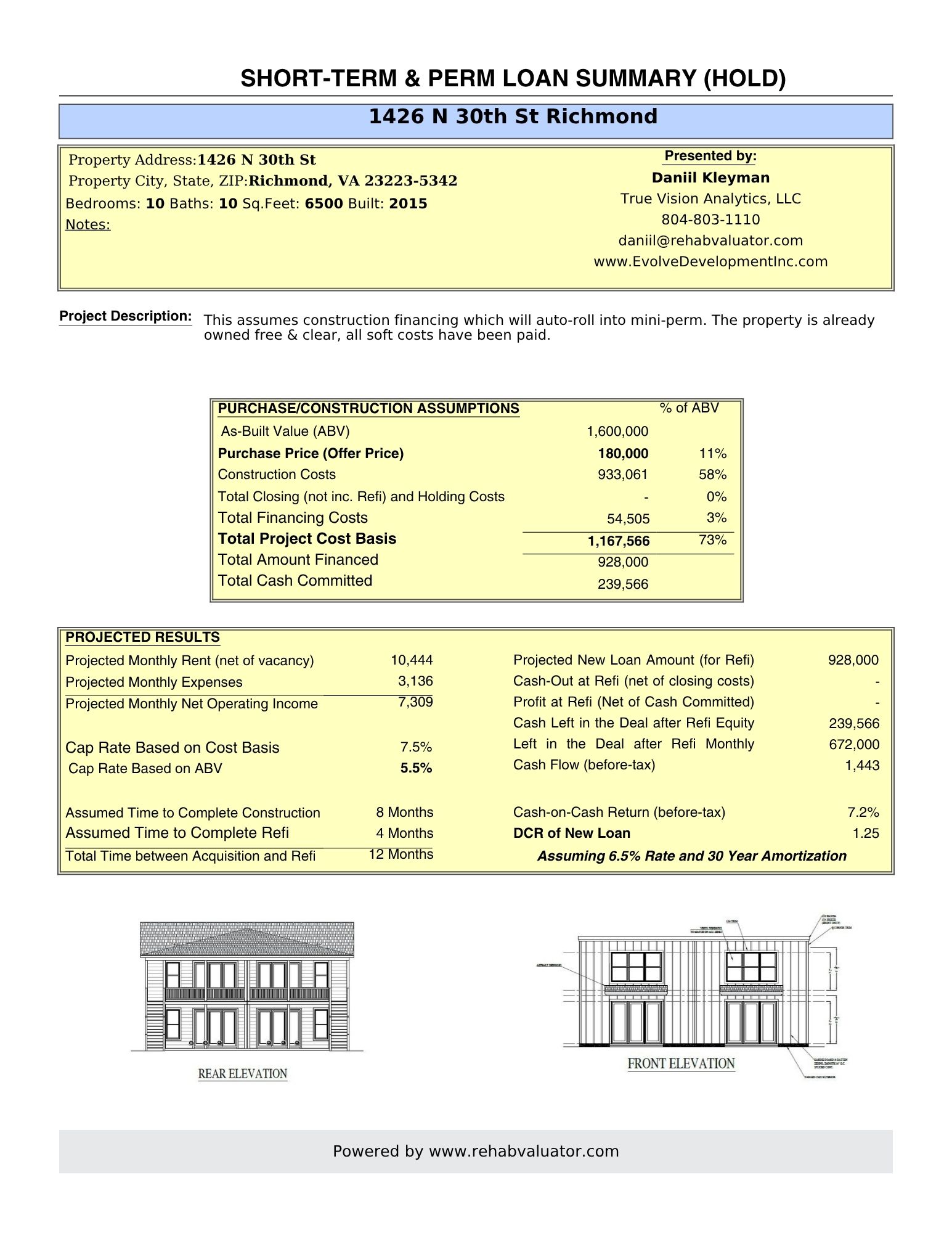

This is a case study of how I bought one overpriced house and got it rezoned into 6 rental units! I am getting my lender to fund 100% of my construction costs and this deal will yield a 10% cash on cash return as soon as it's built!

In this case study, I break down the exact financial modeling you must be able to perform to make sure deals like this pencil out, from determining ABV and building your budget, to calculating cash required and cash on cash return. You can even download the exact PDF Lender Proposal I am sending my bankers!

Check it out and learn exactly how I:

- Got city approval to rezone the lot into two separate parcels

- Designed a project that includes two duplexes and two ADUs (Accessory Dwelling Units)

- Created a shared courtyard layout with smart access and parking considerations

- Modeled the entire project using Rehab Valuator’s deal analysis and financial tools

- Secured 100% funding for construction through a compelling lender proposal

- Locked in a projected 10% cash-on-cash return from day one

Watch the full case study video now and see how to turn a single house into a 6-unit rental machine!

Always enjoy watching you break down a project. When I get an off market commercial property under contract, I can use the Rehab software to prepare my marketing materials to show my potential commercial investors for either JV or wholesaling. Thanks!

You sure can, Joanne … commercial properties, residential properties, duplexes, you name it! Reach out to our support team with any questions 🙂

Show me how to turn my home into a multi unit with an adu

Jean, be sure to watch the case study training video above to see Daniil show you how he did it!!

Any way to get on a call with you Danill?

Or email and text works too.

Hi Michael – thanks for leaving us a comment! If you’re looking to have Daniil help out with a deal you’re working on, check out the Inner Circle Group. Any software related questions or issues, please reach out to our support team for help!!