Building New Construction Rentals Training

RESOURCES FOR YOU:

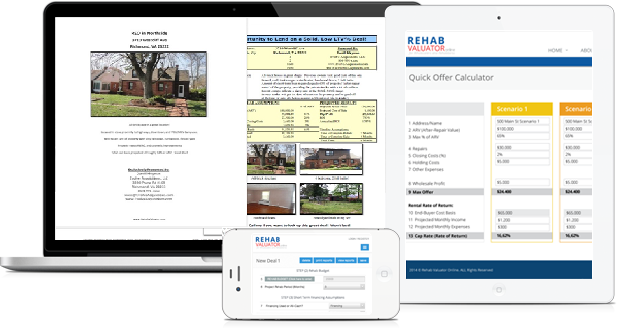

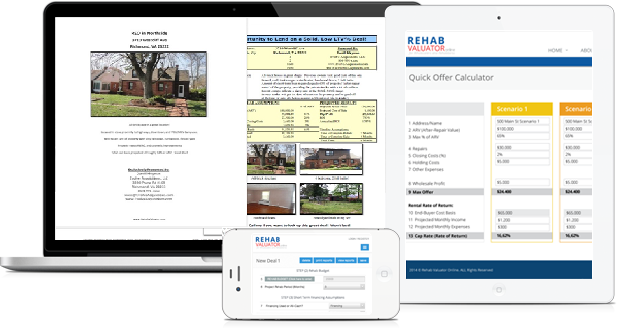

If you do NOT have Rehab Valuator Premium software yet, you can still get it at a HUGE 43%+ Discount Here

If you do NOT have Rehab Valuator Premium software yet, you can still get it at a HUGE 43%+ Discount Here

Anyone know, ballpark, what percentage of total cost would go to a GC when doing a buildi-2-rent duplex on a County lot, infill or otherwise, as an example?

Thanks!

Eddie

Hi Eddie. You’re probably looking at somewhere between 15-20% of cost these days for a decent GC and a small project like that.

yes

I was really enjoying this content of construction rentals. It is just what I am preparing to do. I was left 8 lots which I want to develop as commercial property. I truly appreciate the sharing of your knowledge. Thanks Glenna Bryant

Thanks Glenna and welcome!

On behalf on Daniil and the entire team here you’re very welcome!

What is a good bank to use?

Hi Robin,

Usually local credit unions are the way to go. They have more of an interest in investing in your local community.

Thanks Daniil! great presentation

so great the best software thank you daniil

CANT BUILD FOR $75/ft IN SOUTH FLORIDA

I bet someone can…

The Stained floor is UGLY

To each their own, John. Many of our tenants love the look!

I did enjoy your presentation. Good stuff. Last place I built cost $65/ft.

Thanks Phillip

What are the criteria and metrics to look @ to see if building rentals is viable in my area? Also, is it recommended to have a business plan to give to a bank for funding?

Thanks for all the great free info Danil!

Andrew,

I’ve never presented an actual business plan to a bank, but it probably won’t hurt. As for the metrics, I discuss that in the video in detail, unless I’m missing something?

Daniil, Do you have basements? Your thoughts on 10 feet foundations.

Thank You,

Reginald Scarbrough, Chicago, Illinois

I don’t build anything new with basements. For rentals, especially, here it wouldn’t make sense. I wouldn’t get much extra rent to offset the additional cost

Yes

Pretty informative. Than you so much Daniil! Is the software good for finding lots in Texas? Thanks

Hi Jay,

We are glad you enjoyed the presentation! To answer your question, our software does not locate properties for you, it is essentially used to analyze potential deals and then create reports to wholesale the property or secure lenders. It has the option of either Fix & Flip OR Fix & Hold. These are for deals that use short-term financing or cash up front (less than 24 months). If you have any more questions, feel free to email our support at [email protected]. Thanks!

Great presentation and content. Well worth the time. Thanks!

7-2-16 I HAVE A 12-UNIT MOBILE HOME PARK UNDER A PURCHASE AGREEMENT AND AM IN NEED OF EITHER AN INVESTOR OR A PARTNER TO CLOSE. I ONLY NEED $27,000 AND THE BUSINESS WILL BE PAID IN-FULL AT THE CLOSING. THIS PROPERTY HAS A GOOD CURRENT CASH FLOW AND INCLUDES MANY POSITIVE UP-DATES, SITTING ON 450+ FEET OF STATE HIGHWAY FRONTAGE INCLUDING 10.5 BEAUTIFUL ACRES FOR FUTURE DEVELOPMENT. THIS IS A SUPER OPPORTUNITY AND I HAVE A VERY SOLID BUSINESS PLAN TO BUILD RENTAL HOMES ON THIS PROPERTY. PLEASE CONTACT ME QUICKLY AS TIME IS OF THE ESSENCE TO CLOSE ON THIS 12-UNIT MOBILE HOME PARK WITH A TREMENDOUSLY HUGE FUTURE RETURN. THIS IS A GREAT OPPORTUNITY. THANK YOU FOR YOUR CONSIDERATION. SINCERELY, MELVIN JERRY 651-738-1355

Many thanks for your awesome online presentation. Great information

Atasha Murray

Atlanta, GA

Thanks!

Please be assured your valuable info will be examined fully.

Have a great day.

John

Your ARV calculation doesnt make sense at 38 minutes. How an increase in cap rate decrease the ARV? it should be the opposite

George. Thanks for your comment, but you’re wrong. As the market cap rate for the property rises, it’s resale or market value decreases. Do some research to properly understand how cap rates work and you’ll see that I am right.

Great info Daniil as usual i am learning a great deal of info and with your software RV I will be doing projects in the future.

great training.

Thanks, Douglas!

Thanks Daniil,

I like the demonstrations for building new constructions, apartments esp for rental property ongoing income for furure investments. This may be my niche.

Thanks again for this great presentation.

Hi Jeanese,

We are happy that you are finding our content to be so helpful. Please reach out if you need anything.

Thanks!

very good information !!!

Thanks! Glad you like it.

Thank you,Daniil,

I wanted to thank you again for all your wonderful information,I have enjoyed it a lot, I had not thought. Thanks again.

Wanda.

You’re welcome, Wanda!

Good Afternoon Daniel,

I just bought your rehabvaluator.com premium tonight and started tonight with your building New Construction Rentals Training. I am real excited at this training as you are doing an awesome job with your constuction projects and want to pattern after you. Glad I spent the money with you. I am going to watch every single training you have. Thank you for putting this training site together for us.

I want to ask you a question.

I am in New Orleans, Louisiana Market.

You stated at the end of your video that if we are not in the same market that you would be willing to share your duplex building plans and want to know if I could get an pdf copy emailed to me?

Thanks again for all you do!

David Wyman

email:[email protected]

I have a home that will become available for purchase. The home is a bi-level and needs work. I was wondering if you had any thought on where to obtain funding besides banks. I have a good credit score of 760. Any help would be appreciated. My cell # 610-996-1940

I have done a rough rehab cost and came up with $60,000. The comps in the area are around $240,000. I had mentioned to the owners son a tentative offer of $150,000.

Bo,

The other way you can go if you don’t want to go to banks is either hard money:

https://rehabvaluator.com/access-funding-inside-rehab-valuator

Or private money:

https://rehabvaluator.com/content/private-money-explained

Do you have a program looking for land, for some one to buy?

Howrd – are you asking if we have a course on buying land? Not at this time. Or am I misunderstanding your question?

In financing what a about tile, appliances, etc…

Thanks, Daniil

awesome presentation is this the same software that Viking Properties uses

Hi Lloyd,

That’s not a company I’m familiar with so I couldn’t really say.

how much plans and artutecks charges is it base on square footage ? and do the deal with city as far as zoning and construction

Hi Anandkumar,

That is a very subjective question. Architect fees vary widely based on the cost of the project and what type of project it is. However, it’s usually a percentage of the construction cost. A very standard rate is 10% of the construction cost but it can vary from 5% to 20% depending on what is to be done.

For construction permits and zoning issues all of those permits, applications, etc. have different fees from city to city. You’ll need to check with the municipality or county you live in to find out those costs.