September 2023 Software Update

Our recent software update made two small but mighty changes to the Rehab Valuator software! Whether you're a Lite user or a Premium user, it's now easier than ever to calculate After-Repair Value (ARV) and As-Built Value (ABV) for Commercial real estate deals. Premium users, you may have noticed the Revamp to your Reports Menu as well!

Calculate ABV and ARV for Commercial deals fast!

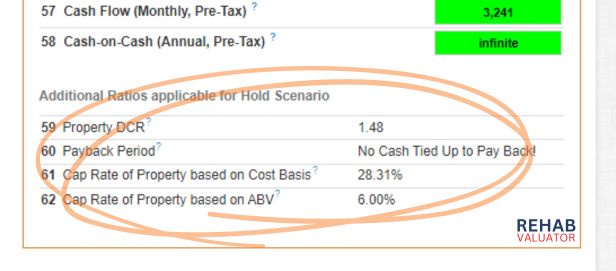

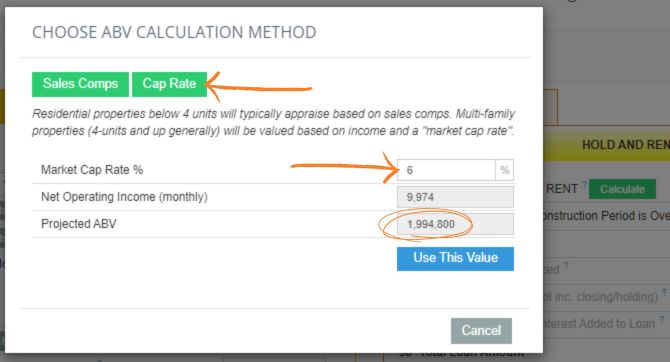

When analyzing rent or BRRRR deals, whether ground-up or rehabbing an existing property, we showed you how to calculate ARV & ABV by hitting your market Cap Rate.

The same goes for Commercial deals. When analyzing Commercial deals, the ARV or ABV isn't valued based on comps but on your Net Operating Income (NOI) and market Cap Rate.

Now, instead of having to guess and check, enter operating income and operating expenses to find your NOI and click Calculate. If it's a residential property, you can still access the sales comps as usual. If not, click Cap Rate, enter your Market Cap Rate % and your ARV or ABV is INSTANTLY calculated!

So, whether building ground-up or rehabbing an existing property to hold, it's ten times easier and faster to calculate an accurate ARV and ABV that you're confident in.

*This next software update is only available in the Premium version of the software.

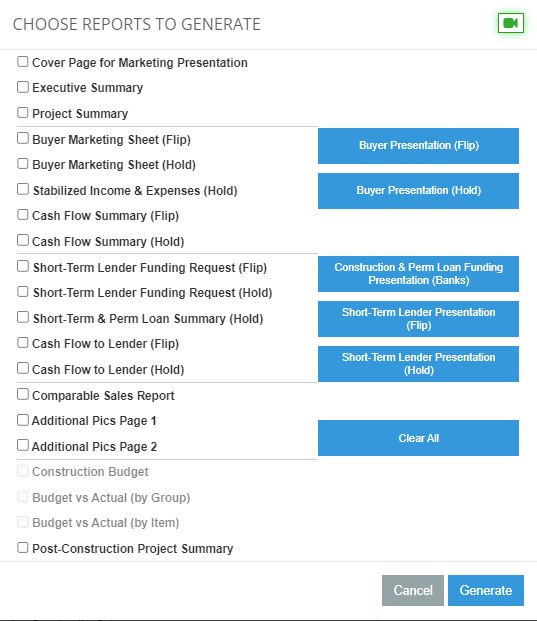

Reporting Revamped!

Clicking on Reports brings up a completely revamped menu. We've made this more directive so you quickly know which report type to choose based on your project!

Wholesalers – use the top two buyer presentations to sell deals to buyers and build your cash buyers list.

The three options below those will bring up Lender Funding Presentations. Whether Private Money, Hard Money, Banks – these are for investors raising, you guessed it, money. Money to buy, renovate and hold a house, apartment building, commercial property, etc.

If you're doing ground-up development to hold or BRRRR, there's now a Construction & Perm Loan Funding Presentation (Banks) option. It has everything a banker wants to see when deciding to fund your deal!

Only seeking funding to cover Purchase of the Property and Construction/Rehab Costs? Raising money from a Private Money Lender? Use one of the Short-Term Lender Presentation options. These are for those short-term loans that are paid off on the refinance or sale.

Thank you Daniil! Finally Im figuring out to get into tutorials?after years of premium member but still have to take effort to learn this software.

Really appreciate your hard work & generous effort providing tons of knowledge and time in teaching to make it easy for everyone!⭐️⭐️⭐️⭐️⭐️????

Awesome , just what I need and more. My prayers are becoming reality. Thank you.

Yay! Reach out to our support team if you have any good suggestions for the next update 🙂

How do I add the new updates?

Hey Clyde! Your Rehab Valuator software is cloud-based. This means that as we roll out updates, they are automatically applied to your account 🙂

It gets better and better!

Getting the “premium” version should be a no brainer. You have to have it to market your deal and sell it quickly.

We’re happy you think so too Harold! Our goal is to always keep making it better for our users 🙂

Like the additions Daniil. Super useful.

Thanks for checking them out Thomas!

What’s the name of the app?

Hey Chris! Your Rehab Valuator software is cloud-based. This means that as we roll out updates, they are automatically applied to your account 🙂

Great improvements, I always feel that your software is well worth the investment.

It just keeps getting better year after year 🙂

??DANIIL!

I’ve been a premium member since 4-5years but never got serious to use it as I couldn’t figure out how to use it, but now that I’m ready to utilize it but don’t have idea how to other than filling informations. My main question where can I find step by step understanding how to and what for… filling out the and the meaning of every lines/correspond of the forms of new deals and related pages. PS: training videos?!?!!!

Thanks for reaching out Pallavi! When you sign into your software, down the left-hand side, there’s an option labeled Tutorials. Click there and select the option labeled Software Fast Track. That will give you a great deep-dive of the software. Be sure and reach out to our support team with any questions and they’ll help you along 🙂