Is Housing Crash Coming?

The “in” thing lately for everyone seems to be calling for the next housing market crash.

Almost everyone missed calling the last recession and nobody wants to seem stupid this time around by apparently being the only one not to predict the next one.

So now everyone is walking around yelling about the impending, massive, gigantic housing market crash that’s inevitably coming in 2018 that will be just like 2008.

But is a housing market CRASH really coming soon?

I’ve been thinking about this a lot lately and so should you.

My business revolves around 2 main strategies: accumulating higher-end rentals and building spec houses to sell to retail buyers.

A real estate downturn would affect each part of my business differently:

My rental portfolio would likely benefit in the event of a housing crash as rental demand typically goes up when housing sales decline.

The house flips and new construction, on the other hand, would naturally suffer.

But is the big housing market crash that so many people seem to be predicting really coming?

I am no economist and I have my doubts that we’ll see a big real estate market crash anytime soon.

A downturn, or a slowdown? Very likely real estate market predictions.

But a housing market crash like 2008? Not happening anytime soon in my opinion.

Let’s talk purely in terms of real estate first (then we’ll talk about some outside forces that may mess things up long term):

Certainly every market is different and there are some Tier 1 markets that may be overheated (Miami, NY, etc)

But overall here’s why I don’t think we are NOT anywhere in the same situation as 2008:

[1] Inventory:

There is a massive lack of inventory almost in every market, especially in affordable product.

This applies both to retail sales AND rentals.

Rate of new retail construction hasn’t been anywhere near pre-2008 levels.

Many homes that fell into foreclosure in 2008 have been bought up by investors and turned into rentals.

And existing homeowners aren’t selling because there’s a lack of options to move to.

All this spells a lack of inventory and an ongoing high demand for houses, especially in the affordable category.

On the rental side, even with the high amount of new apartment construction concentrated in the Class A category and tier 1 and tier 2 markets, there haven’t been enough housing units created vs. new jobs being added.

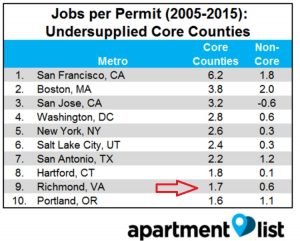

Here’s a very interesting article that illustrates this and may speak directly about your market. According to this report, from 2005 to 2015, new housing permits in many core markets have not kept up with job growth.

I quote: “The problem is particularly acute in many of the nation’s largest cities, including San Francisco, Boston and New York. As the most desirable jobs cluster in these metros, restrictive zoning and bureaucratic hurdles slow the pace of new construction. With supply failing to increase in line with demand, rents have been increasing to levels that are only affordable to those with the highest-paying jobs.”

[2] Levels of sub-prime lending over last 5-7 years

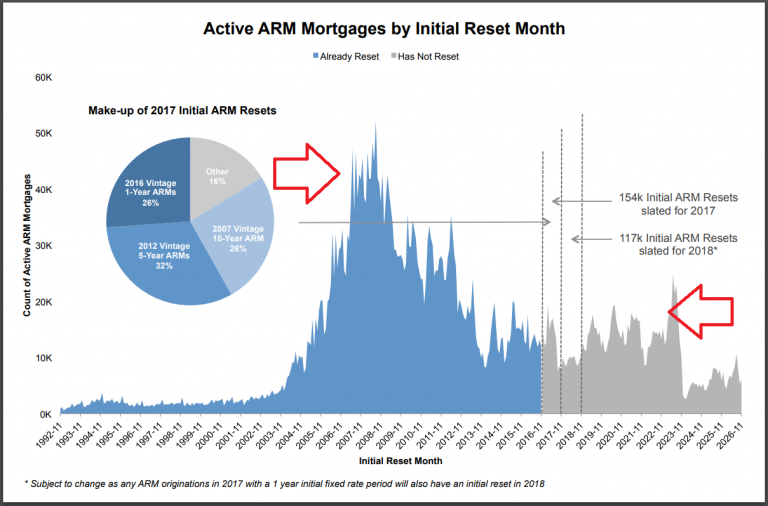

A huge factor in the 2008 mortgage crisis and housing market crash was a giant spike in ARM resets, especially sub-prime ARM resets.

Homeowners bought houses with low teaser rates and when their payments reset, they could no longer afford the house payments. A large # of these happening at the same time drove up defaults and contributed to a massive foreclosure crisis.

We are not quiet in the same boat right now though.

For one, amount of ARM resets coming down the pike over next few years is much lower. See this helpful chart. It’s not the easiest chart to interpret but just compare 2008 mortgage resets to what’s forecasted for the next few years.

Secondly interest rates are still low (much lower than in 2007-2008) and in my view won’t jump much higher over next few years. So those loans that DO reset will reset into a lower rate than back in 2008.

Non-real-estate issues:

Even though the real estate market itself to me doesn’t seem like it will collapse anytime soon, there are broader considerations happening in our economy that could contribute to a financial crisis in the near future. And a general financial crisis will no doubt then negatively impact the real estate market around the country.

Just a few points of concern:

Student Loan Bubble: Future household formation will be done by millenials and the generation after them – the kids coming out of college. But they’re so burdened by student debt, which they can’t discharge via bankruptcy, that fewer and fewer of them can afford even entry level housing. This will significantly affect the housing market over coming years on and will put a ceiling on appreciation.

Margin Debt: Margin debt is when owners of stocks or stock portfolios borrow against those stocks. They then use that debt to either buy more investments or spend that money elsewhere: consumer goods, vacations, etc. With the stock market run-up, margin debt has climbed to all-time high levels. This is leverage and works just like any other leverage: in good times it’s fine, but as the stock market shifts back down, those with high margin debt will get wiped out. Very simply put, the higher the margin debt out there, the broader the implications of a stock market crash or downturn will be on stockholders and the overall economy.

Car Loan Market: Another market where there is a serious binge on debt over last few years.

Soaring National Debt: I don’t even need to explain this one at this point. You know what’s up.

Other Countries’ Real Estate Bubbles: Also, even though we may not be in a bubble, other markets are: Canada and China. And as their housing markets crash, the rest of the world’s economies will be impacted.

So what does this all mean for you?

First of all, let’s all stay calm and not give into fear mongering. As I said, I don’t think we’ll see a housing market crash like 2008 happen but we need to structure our businesses to be prepared for anything.

My real estate market predictions and takeaways for my own business are as follows:

[1] I will continue to accumulate high quality rentals into my portfolio. Current demand is strong and if the retail sales side crashes, demand will only go up. Long term, owning good quality rentals at a reasonable cost basis and leverage is a no-brainer to me. Mailbox money. All day long.

Key being: reasonable leverage. The biggest mistake everyone seems to be making in this market is leveraging their rental portfolios to the tilt to keep buying more real estate. Those who don’t watch their leverage will get crushed in the downturn instead of benefitting from it.

I am also looking into building “workforce housing” – something cheaper than Class A but geared for working people making between 60-100% of average median area income. There’s a huge need in most markets for this as most new apartment construction has focused on Class A luxury rentals.

[2] On the flips, my main objective is not to get overextended. I will keep building 3-4 houses at a time that all fall into the “affordable” category under $400k or so. If the market slows down, I won’t be stuck with a huge inventory.

I think we easily have a 12-24 month runway of selling affordable houses like hotcakes to people. If you can rehab or build affordable retail product, you’ll do well in most markets.

Now you have to figure out your own takeaways and how you will structure your business to both maximize profits and make sure you’re protected if the downturn or housing market crash does come!

Look at your downside. If you’re holding rentals, look at your leverage and de-lever if necessary. Don’t cash-out refi everything you can just to grow. Raise private capital that won’t have calls built-in. Form joint ventures where your capital is patient.

As I said, holding affordable, high-quality rentals long-term is a no-brainer to me. But you have to have great management systems and a debt structure that won’t collapse with the market!

If you have loans with community banks with calls or resets coming up in the next 2 years, re-negotiate those loans now and extend them out further.

Pay off debt, stockpile some cash so that when the market dips you can take advantage and pounce!

If you are holding inventory of houses to rehab/flip, I would work that inventory down to a level that you can live with if the music stops. We may not crash, but a slowdown and pullback is absolutely inevitable! Be ready for it.

Happy investing!

Daniil Kleyman

Next Articles

Are You Ready for the Change in the Market?

My Motivation

“I am also looking into building “workforce housing” – something cheaper than Class A but geared for working people making between 60-100% of average median area income”

Love this write up Daniil. I Think most people calling for a downturn are very leery about the “last time” and can’t imagine it won’t happen again since we did see asset price inflation not commensurate to wages and corporate profits. I’m sure you agree that monetary policy has played a roll in that inflation.

So may I ask what your ARV is, on the housing you focus on above? Sounds low as the median income is astonishingly low. It’s 48K in Florida, DOWN from 52K in 2008(+/-).

I agree with building entry level housing but only in the south east. I have to say to the fellow Daniil fans out there a MUST read if you want to freak yourself out about the future is “Homo Deus”. Crazy.

I digress, ASL facilities will be big money as predicted by perma bears. Also may I ask do you think this A class MF will go condo? Or at least most of it?

Michael – I am still figuring the “workforce housing” model out on my end. So far what I’ve built ground up is more Class A in terms of finishes, sq ft, etc. I think getting to the right cost basis to make the lower rents work will require: 1) stick building, no elevators 2) saving money on finishes 3) limiting common spaces and amenities that drive up operating costs.

As for MF buildings going condo, I know a lot of them were built over last few years with that in mind. But to my knowledge, condo financing is still pretty hard for retail buyers

Help! house under contract and now all the sudden cant find funds

Hi Daniil,

It’s a well thought out article, great job!

. The only thing that seemed to be missing is the geopolitical concerns especially with N. Korea acting up, the other issues associated with Brexit and European instability. The new tussle along the border between India and China. The reason I comment on this is because, although the VIX which is the volitality index is hovering around 10, it doesn’t take much to turn the market around.

Globalization brings benefits. Free trade makes more products available to consumers and reduces costs.

However, globalization also increases business cycle correlations. If the United States enters a recession, for example, production of low-cost goods in other countries declines. Now, those countries suffer recessions at the same time as the U.S. Most will also recover at the same time.

Stock market trends reflect business cycles. A growing economy should produce a strong stock market, while economic contractions bring bear markets. Increased globalization led to an increased correlation in stock market movements. Now, there’s nowhere to hide in a bear market.

That makes a recent sell signal in major U.S. and global stock market indexes even more alarming. This trend seem to effect the Real estate market.

This is an interesting point Kris. Thanks for the thoughtful contribution.

Daniil– great article– having had our $3MM RE business wiped out overnight by hurricane Katrina 11 years ago taught us to make sure we keep diverse revenue sources coming in and to hedge against risk as much as possible

we have a few different revenue buckets– fix/flip houses (Md), flip vacant land (FL, GA, NC, TX), development (local and in other states). We also buy pools of non-performing notes and invariably end up with an REO inventory that we rehab/ sell with owner financing–

Also use your RehabValuator when raising money– closed on about $1.1MM the past week using that tool.

a partially completed condo project fell into our lap in TN (entitled for 98 units)– we closed on the land ($500k) this past Friday and are in development mode now to get it built/sold as fast as possible.

While I was in TN 2 weeks ago to get the lay of the land I was told there was real need for the workforce housing you talked about. We have a few more parcels that lend themselves to that use.

Would you be willing to share your workforce housing pro forma as I don’t think we are competing in same market. Would gladly pay for consult if you are further along in bringing this product to market than we are.

Thanks

Todd Wetzelberger- reply email should be in the post info

Todd – love hearing that you raised over $1 million in private money using Rehab Valuator recently! That’s amazing!

As for workforce housing, I am not far along enough to have proforma’s yet. Sitting on some land where I am looking at developing this, but still exploring. I think the key is basically going to keep your construction costs about 20-25% below what the Class A luxury multi-fam product is costing. Maybe even cheaper. I can share my thoughts more as we develop

What is your opinion on the effect on a lease/option – rent to own approach?

Even though I don’t personally allow rent to own on my properties, I have nothing against the strategy if you want to exit in the next 3-5 years. I think there are a lot of benefits to it actually. The reason I don’t use it is because I hold long-term and have no intention of selling most of my rentals anytime soon

Daniel, my thought is residential prices are at levels and some areas exceed the levels before the last crash. Is there a bubble forming, you bet there is…..and i dont want to be left holding the bag when it pops.

I am focusing on land flips right now to builders in a hurry to build while the market is still healthy.

They also know this cant go on forever.

A bigger threat is the consumer debt bubble in this country at 70-80 Trillion, Its ready to explode

thanks to greedy bankers getting ready to call in their markers and crash the economy. That will take everything down with it, including the dollar.

If you can flip lots right now, that’s a great business to be in. And agreed – consumer debt is a huge risk factor.

Thank you Daniel, for keeping everything understandable Love your blogs!

Daniil,

I am very new to the investment side of the housing market. I started building Manufactured Homes around 1996 and had great pay with minimal hours. Sweeping up and fishing by lunch time. Since then the pay is cut in half and the times doubled at most places.

I appreciate all the guidance you have freely offered. I will agree with you and possibly copy your strategy very carefully. I just started college at 46 years old to be a computer engineer. It takes most of my time actually to learn the material and get the A average. I would rather do investing full time possibly because that is where my passion is. I wanted to learn the computers to keep the advantage and have success eventually to rely on my education if needed or to help others.

Your plan is somewhat what I was thinking. I wanted to have the rentals for cash flow and equity, and I don’t have the experience yet to have 3-4 flips going at a time, but I have to start where I can ASAP. One good flip could pay off the college debt, some of which I used to get started with Josh and your help. I want to get that first big profit flip, pay off the student loan and I could stop college after the term of school I have now. I just don’t think I will have time to give 100% to both. It is too much change all at once.

I am just happy to have the knowledge of all your experience to get me started on a great path. Again I can’t thank you enough.

Jeffrey Ellis

I am not one to sit and just read everything that comes along, yet your wisdom in what you said right-

on, your insight to the future ingenious.

I sit here reading this in my own quandry having an elderly mother in the hospital that I have to closely guard to see she gets proper care. When she was at home, I was paid under the “In-Home Care” system which has stopped along with management problems at our mobile home park.

It would be nice to get hold of a rent-to-own property in the near future and a #4 on my fico score,

after not having a credit card in use for several years is no fun.

Otherwise, I sure enjoyed this article, keep writing them.

Sounds good!

Daniil

Very sound guidance and great insight. I agree we will not repeat 2008 and caution is always good for understanding your market. People will always need a place to live so affordable quality rentals will always be needed.

We are returning this month to the states so it is time I get back into the game.

As always I appreciate your guidance.

David

Welcome back to the States, David – you were gone for 3+ years if I remember correctly?

Great message Daniil, It is truly more about the Economic and Political forces having an effect on Real Estate than Real Estate itself.

Thanks, Bennett!

Thank you Danill, for such a well thought out and broad look. My take away is that you never just stand still anyway. Investors should continually look a year or two down the road, growing and readying for market changes. If that’s the case then change is just change.

Great insight Daniil thanks for the professional input.

Daniil,

Good thoughts. I’m particularly interested in hearing more about your thoughts on providing quality housing for folks below the median income. It is a tremendously underserved group as you’ve observed.

Aaron

Aaron – my interest is not in targeting people below median income. That’s what Low Income Housing Tax Credit projects are for. Those address and incentivize developers to target people below 50-60% of average media area income. My interest is in providing housing for people that earn above 60% and can’t qualify for assistance but less than 100% so can’t afford all the luxury rentals coming to market. HUGE need there!

Thank you Daniil, That was a good brief analysis of our pending economy.

Made a lot of sense, I will be sticking to your Build n flip of units and houses.

Thank you

Thanks, Ken!

Great insight Danill. Thanks for the advice. I have really appreciated your knowledge you have given to us over the years.

Always good hearing from you, Tim! Hope you’re well – I know you’re probably wheeling and dealing as always!

Very astute and reasonable evaluation. Two things I consider:

1. Mortgage-backed Securities Have Returned. Similar Junk, New Day? At the end of the film “The Big Short”, (based on the book of the same title) the warning message that appears on screen cautions us that the same types of financial ‘bad actors’ who created the toxic mortgage-backed securities that led to the crash in ’08 are creating virtually the same “securities” products again, just with a different, prettier name. Given the tighter lending standards and lesser number of mortgages included in this scheme, the impact of another crash won’t be as dramatic or deep, I would expect those junk-level securities to impact the financial markets and ultimately, the investor community again.

2. Auto Loans – Loosened Credit Standards – this is likely to result in an increase in loan defaults, which will most likely benefit the vehicle repossession business and possibly auto re-sale businesses.

How that might directly impact RE investors is unclear, and might be negligible, unless you are also an ‘auto nut’ and are building/have built a collection of rare/valuable vehicles that you bought with borrowing rather than cash…

The auto-loans and student loans are both huge concerns

Newbie here, thank you for sharing this. I like to get educated and get prepared. Daniil kudos to you for keep going at it.

Danill, I think this was an awesome post and I agree completely. I plan to follow your lead on the rental/note side. I am working on the wholesaling thing to get started.

Dave – nothing wrong with wholesaling right now. Huge demand from buyers and you get in and out of the market very quickly!

I’ve disabled Facebook comments since they were malfunctioning. If you tried to comment via FB, please write your comments here again! Thank you!

Danil, excellent level headed advice! Thank you!

Thanks, David

Thank you for your insight Daniil….Too bad there aren’t more guys like you around sharing and caring about their people… or ( TRIBE ) as they say! Have a great day and May God Bless,David B. Christy 😉

Appreciate the compliments, David!

I believe you gave good strategic advice,

Thank you, Ron!

Well stated. I have been through four of the real estate downturns. This last one was the longest and the worst one. Our concerns must be to watch the global economy. A bad economy elsewhere may bring American Dollars home to roost.

Good job

Agreed! Other housing bubbles in other parts of the world, when they burst, will have an impact on our economy and real estate market

Edson – The equity in your rental far outweighs the amount of rental income you are currently receiving on that property. Can’t imagine you are making more than $18k/year NOI (guesstimate) based on your criteria of $2200/mo gross rental income, $80k loan amount @ 4%. Decide if you believe you can make more than 3.5% on the $500k in equity if freed up. Give me access to $500k at 3.5% and I’ll do some serious damage! Sell that rental.

THIS IS THE FIRST TIME I WRITE TO YOU:

WE HAVE TO HOUSES, ONE WHERE WE LIVE AND ONE WE RENT

THE RENTAL HOUSE HAS A 500K EQUITY AND WE OWE AROUND 80K ON IT AND ONLY PRODUCES $2200 A MONTH RENT.

THE HOUSE WHERE WE LIVE IT HAS A $200K EQUITY. BUT WE LIKE IT AND WE WANT TO KEEP LIVING THERE.

WHAT WOULD YOU DO IF YOU WERE ME TO MAKE MORE MONEY OR TO GET MORE PROPERTIES.

SHOULD WE SELL THE RENTAL, GET A LINE OF CREDIT AGAINTS THE HOUSES AND BUY OTHER ONES TO RENT OR KEEP RENTING THE WAY WE ARE DOING.

How about houses for vacation rental is this a good investment.

All depends on the market and the price you pay!

Daniil again provides great market insight. The economy is truly key.