Build For Rent Duplex Case Study: How One Deal Equals $40k/Year Job (without going to work)

Video Transcript Below

All right. Hey, Daniil Kleyman here. This is going to be a pretty detailed, nuts and bolts case study on a deal I'm currently building for rent. This is four duplexes built for rent, and it's a case study of how one deal replaces a $40,000 a year job for life, except for, you don't actually have to go to work. So, we're going to cover a lot of ground. My name is Daniil Kleyman. Just really briefly, I live in Richmond, Virginia, I build real estate. I know that's vague, but I build houses, I build duplexes. I build apartment buildings, I build mixed use projects. I also built software for real estate investors. Rehab Valuator is a tool that tens of thousands of investors across the country, now across the world, use.

Let's talk about why we're here. All right? First of all, nobody teaches real estate when it comes to wealth building. You might be watching this on YouTube, you might be watching this on our website, but very few people teach real wealth building. Most of what you're being taught is how to make quick money. Because real wealth building in and of itself is not sexy in the short term. It takes effort, it takes some money, whether it's your money or somebody else's money, it requires patience, it requires time, it requires perseverance, and it requires some hard work.

It's much easier to go after the quick $5,000 wholesale checks, and there's nothing wrong with that. But real wealth building takes time and effort, but then it… As I'll show you, you do the work, and then it keeps paying you. Real, true wealth building means acquiring assets and holding them. That's the important distinction. Most of the education that you're getting is on how to buy something and sell it, whether it's wholesaling, rehab and flipping, et cetera. But real, true wealth building means acquiring assets, and then holding onto them. It comes from ownership and the long-term benefits of that ownership, which are appreciation, depreciation, amortization. A lot of [-ations 00:02:10], right? And cashflow. The cashflow is the sexiest part of this. You do a deal once, and you can literally get paid for decades.

So, why are we talking about new construction, and why do I like new construction? First of all, new construction, in many ways, is easier and more predictable than rehabbing. I started my career out rehabbing houses, and primarily what they did was gut renovations. I would go in, I would buy an old house, something that was 80 to a hundred years old, I would completely gut it down to the studs, and then redo everything, inside and outside.

Well, new construction, is actually easier, it's more predictable. You get a set of blueprints before you ever break ground, and you just follow the blueprint. There is no surprises, there is no opening up walls and discovering mold, or anything like that. New construction also allows us to have brand new, thoughtfully designed, well-built, maintenance-free, easy to lease, attractive Assets as rentals. A lot of people get into rentals and property management, and they get burned out because they buy the wrong assets. They're unattractive, they're hard to lease, they're hard to manage, they come with a lot of deferred maintenance. Well, they're doing it wrong.

We designed floor plans, features and finishes very carefully, and because we do that, our units lease up very fast, they command top-of-the-market rents, and then they stay leased. So this a typical kitchen that goes into one of our duplexes. For a two-bedroom apartment, this is a massive kitchen. Look at that island, look at that wine rack, look at the cool light fixtures. Leathered granite countertops.

In a lot of my units, we do walk-in closets, with double shelving. Open cabinets in the kitchen, massive. For a two-bedroom apartment, these are really nice, big kitchens. Big pantry, storage, attractive bathrooms. This is finishes that you typically find in a for-sale product, but it doesn't cost much more to put this into your rentals, and the result is incredible, because people walk in and they lease them and they stay leased, and you attract good quality tenants that take really good care of your place.

Big outdoor decks, outdoor ceiling fans, we started adding recently. We used to do six foot decks, now we do at least eight or 10 foot balconies on the back of these duplexes, so that people have lots of outdoor space. So, why duplexes? Duplexes can be built by a residential building code, which keeps the dollar-per-foot cost down significantly, and that keeps down your ongoing operating costs, as well, because now you don't have to pay for a fire monitoring alarm, for a sprinkler system, you don't have to pay for common area electrical meters. There's a lot of ongoing operating costs that come with building by commercial code that you don't have to do with duplexes.

But you still get to amortize the cost of land, cost of all your site work, cost of your foundation, cost of your roof over two units instead of a single family house, where the numbers don't pencil out as well on the rental. So a lot of people, when you hear the term built for rent or build to rent, people talk about single family houses, but in my market, the numbers don't really pencil out on doing single family houses for rent. It is much more profitable for me to build duplexes, because again, I get to amortize that cost over two units.

These duplexes are bread and butter of a wealth-building strategy that I've been employing for many, many years. Right now, as we speak, I'm building 12 duplexes. So, if you've done a big rehab before, you can build a duplex, and it doesn't take many of these to completely change your entire life. If you have 10 duplexes, like the one I'm going to show you right now, cash flowing $600 a month per duplex, you now have six grand a month, almost tax-free, coming in. That's $72,000 a year. For most people, that means no more job, no more worrying about bills. You don't have to work. 10 duplexes, and your life is forever easy now.

They're easy to manage, easy to lease, they stay rented, but now you've got the time freedom to grow, do whatever you want. Grow your business, hang out with your kids, do cool shit. Trust me, it is not hard to get 10 duplexes. So in this deal, I'll show you how I'm building four of them in one deal, and that's going to result me in a net cash flow equivalent to having a $40,000 a year W-2 job, except for, I can just sit at home in my underwear and watch Days of Our Lives instead of going to that $40,000 a year job.

So on this training, I'm going to cover how I found the land, how I rezoned it, and why I rezoned it, the method I use for evaluating land, lots for purchase, and I'm going to go deep into the numbers. So I really hope you're paying close attention and you've set aside some time to really watch this training and not skimp or skip over it, because we're going to go deep. I'm going to show you my deal analysis, how I've calculated the ARV for post-construction, how I'm forecasting construction costs, and I'll show you my budget, how I'm forecasting profitability and cashflow. I'll show you how I'm obtaining short-term financing, and then how I'm getting permanent financing for these duplexes.

I'll also show you how I'm getting 85 plus percent construction financing on this whole project. I'm going to show you the investment criteria that you must have: equity, cashflow, cash on cash. Those are a must. We'll talk about funding alternatives. If you don't have the cash, if you don't have the cash to buy land, what can you do? And then I'll show you project management. I'll show you how we do project management, how we put together budgets, scopes of work, bids, how I'm tracking costs. So there's no questions, there's no variables, there's no what-ifs.

I go into this project, knowing exactly what I'm going to spend, I go into these projects, knowing exactly what the cashflow will be, so there's no surprises. So, this is the process that I'm going to walk you through. So first, you would put the land under contract. Obviously, that includes figuring out the value first, and I'll walk you through that process. Once you have it under contract, you're going to perform due diligence. That may involve getting soil reports, getting a zoning confirmation, having title work performed, all the things that you would normally do before you close.

Now, you can either close on it, or you can work to line up financing your joint venture partners, if you can't close yourself, then you would close on the land, then you design the project. Sometimes with bigger deals, people will design the project before they ever close on the land. But with my duplexes, I'll typically buy the land, I'll take it to my architect, we'll design the project, and then, if needed, I will rezone the land, and I'll walk you through that process, then you get tractor bids, submit for permits, and you're going to, at the same time, lineup construction financing, then you close on your construction loan.

And then while you're building, we usually start pre-leasing while we're in the middle of construction, lease the duplex out, and then the loan converts to permanent financing, either automatically, or we refi. So again, I'm going to walk you through all this, but I wanted to give you the lay of the land. All right. So, lot purchase. This deal came from a wholesaler, and I love, love, love, love buying from wholesalers. I don't do any of my own marketing to sellers anymore, except for certain select occasions. I much rather prefer to just buy from wholesalers.

If you're watching this, or if you're listening to this and you are wholesaling and you're not targeting land, especially infill buildable lots, you're missing out, because there is a lot of buyers and builders like me that are hunting for more land and for more lots. So you should not be ignoring vacant lots when you do your marketing. So this came from a wholesaler, and this came as a single lot. But as you can see on this survey… and that I got the survey before I closed, and I got the zoning confirmation before it closed.

But you can see that on the survey, they've already had four addresses here written. So that tells me that at some point in the past, this used to be four separate lots. As you can see, it's a big piece of land, and it's almost a hundred feet wide, and this is what I paid for it, this is the HUD. So I paid just under $75,000 for this land, and I'll explain to you how I arrived at value.

So let's talk about land use analysis. Again, I really hope you're paying attention, because I don't know anybody that's teaching this, especially in free training. If you understand this stuff, you're going to go far. So, before you buy any piece of land, you should know what you can do with it. Again, before you buy any piece of land, you should know exactly what you can do with it. In this case, I could by right, I could build two attached single family houses, either rentals or for sale. Attached means they're almost like one, separated by a firewall.

Let's backtrack a second, by right development basically means what the current zoning allows you to build right now, without any additional variances, rezoning, et cetera. You file a building permit, and then you go to break ground. That's it. So that's what by right development means. So this will typically also be the main driver of the value of the land, what can be built by right? So, by right, I could build two attached single family houses. By right, I could also sub divide it into four lots, and there is a process involved to divide the lot back into four lots, and I could build four houses. I could get a special use permit, and I'll explain to you what that is, and build potentially a 10-unit apartment building, but there is no guarantee that I could get that special use permit. I could also potentially get a special use permit, subdivide that lot into four, and built four duplexes.

So special use permit… And this is something that exists in my county. It may be called something different where you operate. But this is just one way that our local zoning code allows to change the use of a piece of land. So special use is called that, because you're not changing the underlying zoning of that land from residential to commercial or to higher density designation, you're simply getting an approval to build something that by right development doesn't allow you on that specific piece of land.

So if the site is zoned R5, for example, and it allows you to build one single family house, you go and get a special use permit to build the duplex on it, the zoning stays the same, but there is a special use permit that's recorded that says, Daniil Kleyman can build a duplex on this lot. We've granted him that permission.

So research your local zoning codes and find out what tools you can put in your tool belt, so to speak, for increasing the value of the land. You can rezone it, you can get special use permits, you can get zoning variances. They all work differently, and they all have various levels of difficulty to obtain. There are a lot of factors. When we look at these, we take it to our local planning department, and they have to be onboard. A special use permit goes through the planning commission, it goes through the city council approval, and it goes through neighborhood approval. So if neighbors object vehemently to what you're trying to do, you may have a hard time. So you need to learn how these processes work in your local area.

So again, before you buy any piece of land, you should know what you can do with it. I'm going to break it down again, you should know what you can do with it by right, and you should know what your options are to change the use of that piece of land in order to increase value. So, I can build two attached single family houses, rentals are for sale. The value of a single family lot is basically about $40,000 in my market. That's what I'm willing to pay per single family lot. I'll show you how I arrived at that number.

By right, I could sub divide it into four lots and build four houses. Well, 40k a lot, that's $160,000, potentially. I could have gotten the special use permit maybe and built a 10-unit apartment building, and I typically will pay about $15,000 a door max for land when I can build an apartment building on it. I can get the special use permit, subdivide it, and build for duplexes, potentially, and I'm willing to pay about $40,000 per duplex for the land, which makes the value 160k.

Now, if you're paying close attention, you're going to say, “Well, why is it $20,000 a door here versus $15,000 a door for an apartment building?” Well, it's because in my duplexes, I typically build bigger units that fetch more rent than my smaller units in my apartment buildings. So I'm willing to pay more for that land. But again, all of these options are on the table, but you shouldn't be valuing the land based on what you can build by right. Because then, when you go through the process of getting a special use permit or getting it rezoned, you should be compensated. You should not compensate the seller for that. You're doing the hard work, so you should benefit from increasing the value of the land.

So, how do they know these values? If you're paying attention, you're asking that question. How did I know 40k a lot, 15k a door, 40k a duplex? So first of all, it comes from comparable sales and knowledge of my market, but let me also show you how to back into these values if you don't have this information. So this is the land value analysis process. Always, when it comes to anything, you start at the end. What will this duplex be worth, or what will this house be worth when it's built? What will it sell for? What will its value be? That's the ARV. You can call it something other than after repair value, because you're building. So you can call it post-construction value.

Then you need to figure out your desired profit margin, then you need to know approximately where your cost to build will be, other costs, and max value of land. So, after-repair value or post-construction value, decide on your desired profit margin, 25%, 30%. Back out your cost to build, back out your closing, financing, holding, and selling costs if you're selling, and this gives you the max land purchase price. So if you're lost, let's go through an example. Let's look at an example for a single family.

You've got an 1,800 square foot single family with after-repair or post-construction value of $325,000. Get your calculator out if you're watching this, and let's go through this together. Your cost to build is $90 a foot, which is $162,000. You're closing, financing, selling and holding costs are 10% of your ARV. A big chunk of that is the 6% that you're going to pay to the agent to sell it. So ballpark of the 10%, that's 32 and a half thousand dollars, and you need a net profit margin of 25% for doing this deal, for building this house and selling it.

So this is your max value of land. Take 325,000, multiply it by 75%, which is 100% minus your profit margin. Then back out your cost to build and back out all of your closing costs to buy, financing, holding costs, and then cost to sell, and that's the maximum that you can pay for that piece of land in order to achieve a 25% profit margin. That's the maximum. If you're wholesaling, you need to take your fee that you want to make and back it out of that $48,750 number. So if you want to make five grand, the max you can offer the seller is 43.75.

But ideally, you should be building a little bit of cushion. That's why I say I'm willing to pay $40,000 max instead of 4875, because it gives me some cushion. Let's look at a duplex. Same analysis. 2,500 square foot duplex with after-repair value of $350,000. Cost to build 90 bucks a foot, $225,000 cost to build. My closing, financing, holding costs are 4%. Because I'm not selling it, this is a lower number. I don't have to pay a realtor $14,000.

My desired equity. How much sweat equity do I want to have when this project is built? It doesn't make sense to build something if you've invested equivalent to what the market value is. So my desired equity is 20%. So my max value of land is 350 times 80%, minus 225, minus 14. That's the maximum that I can pay per duplex for land. If you remember, I said $40,000. So we're right on the money. $40,000 max is what I'm willing to pay. Take a screenshot of this slide, save it. If it doesn't make sense, go through this exercise again, rewatch this. If you understand how to value the land, like I just showed you, you're already ahead of 97% of other wholesalers and investors, because most people do not understand how to figure out value of land.

So, based on my analysis, $80,000 max is what I can pay to build by right, without me having to do they need additional subdivision or variances or rezoning. I paid just under $75,000 in cash. So, subdivision, then if went and filed a subdivision, which takes a little bit of work, it instantly doubled the value of the land, because now I have four lots that I can build four houses on. Around the same time, a similar-sized parcel in the neighborhood, not far from here, sold for $220,000. Then they filed a special use permit to build 10 houses on it, increasing the value to over 400,000.

So initially, it seemed like they were crazy to pay 220, but they took a risk, they got it rezoned, and they increased the value of the land to almost double. So if you understand this process, you can just… If you don't want to build, you can buy the land, or just put it under contract, get it rezoned, increase the value, then flip the land to somebody else. There is a lot of ways to make money here. But rule number one that I have, which is by right [inaudible 00:22:07]. All right? Yes.

So, as you remember, I had four options with this land. I could by right build two attached single family houses for resale, by right, I could subdivide into four lots and build four houses for resale, I could get a special use permit and build a 10-unit apartment building, which would be a rental, or I could get a special use permit subdivide and build four duplexes. So, I wasn't interested in doing for-sale product here, I only wanted rentals, because I want cashflow.

So, why did I decide to do duplexes instead of a 10-unit apartment building, even though it's more units? Doing duplexes allows me to build by a residential building code. It's much cheaper to build versus multi-family. It is much cheaper. It also, interestingly enough, gives me a more liquid asset when I go to sell. If I go to sell a 10-unit apartment building, I'm only targeting investors, somebody that can come up with enough money to purchase a 10 unit apartment building. Instead, because these are duplexes and they're deeded individually on four separate lots and they looked like single-family houses from the outside, I can sell these…

If I want, I can sell these as duplexes to individual investors, I can sell them to owner occupants who will live in one unit and rent the other, and it's also going to be easier for people to qualify for financing for these. So I have a lot more exit strategies here. It also helps that the comps are going to be based on residential sales, so my value, when they go to sell, is likely going to be higher than as an apartment building.

So, this is the site. As you can see, right here, this is where the duplexes are getting built as we speak. This is a rendering that my architect did, and this is what they're going to look like on the outside. Kind of modern looking, but still something that fits into the historical context of the block. All right. I'll show you some additional pictures, but let's talk about additional analysis you have to do before you buy the land. So before you ever close on the land, you need to know that what you will build will: one, cashflow well. You need to have a minimum dollar per unit in clean net cashflow in mind.

What do I mean by clean net cashflow? I mean after paying your debt service, which is your mortgage, after paying your real estate taxes, insurance, setting aside some money, either for a maintenance fund or for reserves, for future capital improvements, even if it's new construction, after paying your property manager, basically after paying all of your costs and setting some money aside for future costs… So even on my new construction projects, I will typically set aside 10% of gross rent into a reserve fund to serve for future maintenance and for future capital improvements.

Because for first three, four, five years, I expect to spend very little on maintenance, almost nothing, but there will come a time when I'm going to have to make significant capital improvements, and I want to start building for that now. But after all of that, I want to have a minimum dollar per unit in cashflow. But just looking at cashflow by itself is not enough. What kind of cash on cash return will that cashflow give you based on the money that you've left tied up in the deal?

So obviously, as with any deal, you want to leave as little cash paid up as possible in the deal, but there are limits. So with new construction, you're probably going to have to leave some money in the deal. You're not going to be able to fully refi. At least I'm not able to fully refi and get all my money out. So I'm leaving some cash tied up in these duplexes. So what kind of cash on cash return am I earning on that money?

So just looking at high cashflow without analyzing your cash on cash is very dangerous. You need to have cashflow, and that needs to give you a significant return on the money that you've invested in the deal. And then you need to look at your desired sweat equity. It doesn't make sense to build something if you've just spent between land and all your costs and construction, a hundred thousand dollars to build it, and it's worth a hundred thousand dollars. That doesn't make any sense. You just spent all of this time and effort to build something which you could have just bought from somebody else at retail.

So just like if you're flipping, you want to have a profit, you want to have sweat equity. So if I invest a total between my land, my construction costs, all my other holding costs, if I invest $80,000, I want it to be worth a hundred. So the good news is once you've created your typical duplex deal, the numbers become predictable. You can just replicate this process over and over and over, like I did, and I'm going to show you how to do that. Then you can bid on land over and over again, and know exactly what you can pay without needing to go through this entire analysis process every time. That's why I love duplexes, because they're predictable. I've built one, I can build 20. They all work the same way.

So, hear my investment criteria. I'm looking for a bare minimum of $250 per door, per apartment net cashflow. That means net of all my expenses, including 10% of the reserves. Paying my management company. We have an in-house management company that I own, but they still take an 8% fee to manage my assets, just like any third-party property management company would. So $250 clean in my pocket per door, minimum. I'm looking for a bare minimum of 10% cash on cash returns first year, once the building is leased and we've converted to permanent financing. Minimum 10%. I want a minimum of 20% sweat equity. So if I pay, again, 80 to build something, it needs to be worth 100.

Let's talk about project design. Again, I'm going to show you how to run all of these numbers very easily in a second, and a whole bunch of other cool things. But let's talk about project design. I get this question a lot, how many bedrooms? I don't believe in cramming as many bedrooms as possible into the square footage that you're able to build. My typical duplexes are what's called over and under. That means there's an apartment on the first floor, there's an apartment on the second floor. So they're one-story units, and we do that because it's a more efficient design, it requires less staircases, and my air conditioning costs are also lower than having to do two zones per apartment.

Each one of my apartments and my duplexes are typically two bedrooms and two baths. Average square footage is 1,150 to 1,275, which means these are very large, two-bedroom apartments. You could fit a three-bedroom apartment into 1,275 square feet, and a lot of people do, but I choose not to, and it's for a number of reasons. Yes, I would get a little bit more rent for a three bedroom, but it will have a lot more turnover. Three bedrooms typically attract roommate situations, and those apartments turn over a lot more frequently. There's nothing that's as expensive in property management as turnover, because now you have to spend time and money to lease the apartment, you have to spend time and money turning it over for new tenants. We want retention, we want people to stay as long as possible, and two bedrooms have far better retentions.

So we attract better quality tenants, because twos typically have… It'll be a couple that wants a spare bedroom or a home office, it might be two roommates, but there is less disagreements than in situations where there's three roommates, and they take better care of the apartments. So we get better quality tenants, they stay longer, there's less wear and tear, and we have a product that's very hard to compete, because these are spacious, spacious, two-bedroom apartments.

So, if my market sees over-saturation of big box apartment buildings, with small units, and those start to see vacancies, I'm going to have two-bedroom apartments that people will continue to rent because they have lots of storage, big closets, big kitchens, lots of space. This is a superior product that is very hard to compete with. We pay attention to details. So this is supposed to say closet sizes and storage space. Whenever possible, I do walk-in closets, or we just do really big closets in general, lots of storage space. We do top-of-the-line finishes, quartz countertops, true three-quarter inch hardwood floors, wherever possible, good quality cabinets. Sometimes we do soft-close drawers, nice tile in the baths.

Pay attention to putting bedrooms next to each other. I'll show you the floor plan of these units in a second, actually. But a common mistake that a lot of people make is they put bedrooms directly next to each other, only separated by a thin wall, and that creates problems. Because if you have roommates living next to each other, they're not going to be comfortable. So pay close attention to that. We provide a lot of outdoor space, big decks, plenty of parking, soundproof between each floors. I put Rockwool insulation between the first and the second floor, and then we usually will do two layers of 5/8 drywall and suspend the drywall on what's called an RC channel that creates an air gap. All of that works towards soundproofing, because you don't want your upstairs neighbors bothering your downstairs neighbors and vice versa.

We've started implementing smart home automation, Ring cameras and doorbells, Ring flood lights. I'm going to start testing out smart thermostats on this project, actually. So we're starting to do a lot of things that our tenants are valuing and they're sticking around for. So this is the project as it stands now. We started framing it a couple of weeks ago, and it's two duplexes attached to each other. This is the view from the back. This is a little bit later on. A lot of lumber. This is what it looks like now, as of me recording it, and there is actually… So roof going on next, and we're going to start adding windows and doors.

This is the floor plan. So here's what I want you to pay attention to. I personally like two types of floor plans. My favorite floor plan is where a bedroom and a bath are on opposite ends of the apartment. They're basically suites, with the living room and the kitchen in the middle. Here, this design forced us to put both of the bedrooms towards the back, but look at how they're separated. Pay attention here. Here's a bedroom, here's a closet, and then we stacked bathrooms between them. So if you've got somebody in this middle bedroom, hanging out, listening to music, watching TV, there is a lot of space between them and the person in the rear bedroom.

And then we have an open floor plan. As you walk in, there is a big living room, big kitchen, big island, where people will congregate and eat, big closets, lots of storage space, eight-foot deck on the back. This is a pretty luxurious two-bedroom apartment. This is the typical finishes that we use. I love, in these bigger kitchens, doing wine racks, big island, stainless steel appliances, quartz countertops. In our closets, we do two levels of shelving. People really love that. I'm shocked when I see people not doing this.

I don't tile my showers. I use single piece fiberglass surround tubs, because they're cheap and they're low maintenance. If you do tile, you will always have to [inaudible 00:34:17] it. It's a lot of maintenance. But we do nice flooring, LVT flooring, nice vanities. You have to pick your battles where you're going to invest the extra money. But I do brushed nickel fixtures, curved shower rods. It's the little things that make a difference. Again, outdoor ceiling fans, big eight-foot balconies, where people can set up lawn chairs and relax, cool light fixtures. They don't have to cost a lot of money. You can find a lot of really cool, cheap stuff on Amazon and Wayfair, versus getting just really crappy, boring-looking light fixtures from Lowe's or Home Depot, which is what most people do. Spend a little bit extra time sourcing your materials. You don't have to spend more money, but you will find really cool stuff.

All right. So that's the project design. Again, I'm going to walk you through analysis, budgeting, costs, getting funding in a little bit here, but let's quickly talk about how to purchase land if you don't have cash. If you're watching this and you're saying, “Well, that's great, Daniil, you paid 75 grand in cash for this land. I don't have that.” Well, if you don't have cash, that's okay, we all started there, you've got a couple of options. Get the seller to seller-finance you the land until you close on the construction loan and can pay the seller off, make your closing contingent on getting your special use permit approved. This buys you a lot of time, but the seller has to be motivated.

Not every seller is going to want to seller-finance, not every seller is going to want to let you tie up the land for six, nine, 12 months in hopes of getting a special use permit. So it may be situation where you come to the seller and you say, “Look, I can pay you 60 in cash, or if you seller-finance it to me, I'll pay you 75.” Or, “Hey, I can pay you 50 in cash, or if you let me put it under contract and go and get it rezoned, maybe we can make the contract 75.” Put the carrot in front of the seller for them to do what you want them to do.

You can make your closing contingent on special use permit approval and construction loan closing. This buys you even more time. Before you ever have to put any money into it, get a private money loan to close on the land. Or, find a joint venture partner to fund the land with you. “Hey, I found this amazing piece of property. You put up the cash, we'll close on this land, I'm going to go do all the work. I'll have it rezoned, I'll lineup construction financing.” Be creative. You can get into these deals without having deep pockets. I'm showing you four duplexes. The numbers on one duplex, you would need 20 grand, 30 grand to buy the land. You can easily find a partner to go in with you.

My construction financing and my permanent funding. My construction and permanent financing comes from local community banks. I love working with local community banks. They are flexible, they know me, they understand my business. Once they do the initial underwriting on you, they are very easy to work with. I bring the land as equity. Because I paid cash for the land, I bring the land as equity into the deal, and typically, I'm able to fund close to 90% of my construction, sometimes even a hundred.

So instead of me having to bring cash as down payment for the loan, the bank says, “Okay, you own the land free and clear. That can serve as your equity and your down payment, and we will fund as much construction as it makes sense.” The construction loan is typically interest-only for six months or sometimes nine, when they need it. And then what we do is… It's called min perms, which means that this construction loan automatically rolls over into a permanent loan without me having to refi.

I hope you're following me. These are pretty cool loans, and a lot of local banks will do this, where once I secure a construction loan, that loan will automatically, after I've built and put tenants into the property, convert to a 20-year or a 25-year amortizing loan, and it will typically come with a five or seven-year call or reset. So the advantage here is I don't need to refi. My construction loan doesn't run out, it simply converts. So I don't have to go and do a separate refi and spend more closing costs to refine the permanent financing. Once you lock in construction finance, and you're done, it converts. The downside is if I don't refi, I'm not pulling any additional cash out of the deal, but I have the flexibility to refi.

So I hope this makes sense. Go back and rewatch this if doesn't. Let's take a closer look at deal analysis and how to do all of this quickly and accurately, and I'm going to show you how to easily raise money for this deal, as well. So I'm going to log into my Rehab Valuator account. For those not familiar with the software, this is the software that I originally built for myself to use in my real estate business to do deal analysis, to raise money, to manage my projects. Since then, we've made it available to other investors, and literally thousands of wholesalers, rehabbers, builders, and developers like me around the country use this software.

I'm going to go here into my active deals, and I'm going to click on my eight-unit project. I'm going to walk you through, first of all, deal analysis, so that you make sure that you're going into each of these projects prepared and not overpay. I'm going to show you how I can almost instantly now calculate my budgets for these projects, how I've raised construction financing, and how I'm managing these projects on a regular basis. But I would say, the deal analysis is the most important thing. This is what the majority of investors don't understand how to do.

So let me show you what I've done here. I've entered my purchase price here, and they've rounded up to 80,000, just to allow for some additional costs. I can enter my closing costs as detailed or as a lump sum. So I just put $1,500 in closing costs here. This is my construction budget. I'm going to come back to my budget. If you remember the slides that I showed you, we need to start at the end, meaning what will this group of four duplexes be worth when they're built?

So, I'm going to bypass everything in the left, I'm going to go to my hold exit strategy. You can use this for flips, as well. I'm going to go to my hold exit strategy, and we're going to start with the end first. Now, what do I mean by the end? I mean, let's start with income. When these are rented, what will they rent for? So, I've gotten here, and I've entered eight units, they're two bedrooms, they're roughly 1,250 square feet, and I'm projecting that they will fetch 1,399 a month in rent, which is actually pretty affordable compared to what a lot of two-bedroom apartments in my area cost, especially in bigger apartment buildings.

Now, I can obviously use this for a thousand-unit apartment building, and I can enter as many units as I want here, and I can keep adding different layouts and unit types and price points. I can use this for commercial, I can use this for mixed use. But this is what I have. Eight apartments, two bedrooms, 1,399 each, and I've gotten here and I've entered the 5% vacancy. Because when my bank looks at these numbers, they typically look… We don't really have vacancy with this product. We never have vacancy. But my bank will make me put a 5% vacancy in here.

So I've clicked update. You can see this is my monthly income after vacancy, this is my annual income from this project after vacancy. Next, I'm going to go into my operating expenses, and I can itemize my operating expenses once it's built. My in-house property management company takes an 8% fee. I can enter my costs here as a dollar per unit per year, monthly or annual. So on an annual basis, I'm projecting my insurance will cost me $3,000, landscaping, a hundred bucks a month. I'm going to put away 750 a month into repairs and maintenance and reserves. Most of this will end up going into reserves for future maintenance.

And then I've projected my property taxes, and my only ongoing utility bill is going to be for… I may not even have to pay common area electric meters, because everything is wired individually to each unit, but I've put in 50 bucks here, just in case I have some common area lights outside that I have to pay for. So these are my operating expenses. So you can see monthly, this is the income, this is the expenses. As a sanity check, if you're around 30 to 35% on this type of product, expenses versus income, you're in the right ballpark.

So this is my net operating income every month. What I'm going to do from here is I'm going to say, “Well, what will this be worth?” If a bank is looking at this as a set of eight units, they will assess it based on the cap rate. Let me approximate value. So, I will go in here, and for ARV, I'm going to change this number until I get to roughly a 6% cap rate. If you don't understand this, then I have other videos that show you how to use cap rates to value multi-family buildings.

But I also know that each one of these duplexes will appraise for approximately $350,000. I've looked at comps, and each one of these duplexes is going to be worth about $350,000, which puts the value at 1.4 million. So, now I know what my income will be monthly, I know what the approximate value of this project will be, and now I can back into… If you remember, 350, it's right in line with our… with our analysis here. Let's go back to my slides. 350, approximate cost to build, 225, I paid the right amount for the land. So we're staying consistent here.

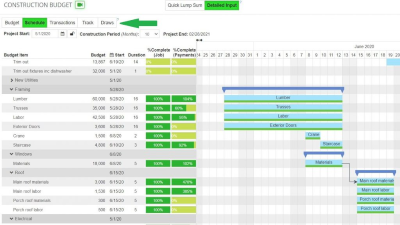

So, now I know my value, I know my projected income, now I need to go back and I need to see what is this going to cost me. And then how am I going to finance it? So I've already built my budget here. With the premium version of this software, not only can I build detailed construction budgets, but once I do this once, I have this in my system as a template. If I'm starting over, from scratch, I can click template, load template, there are some public templates that we've made available to you. So my duplex template, with my costs, is actually available to our premium users.

But here's my template, new build duplex Daniil, and this has all my costs pre-populated. So I simply select this duplex, I update some measurements here, and my budget is built. All I have to do then is just change some quantities and square feet, and my budget gets built for me. Not only that, but I can store bids here. So I can store bids and copies of bids. So all my numbers are at my fingertips here. This is my budget. Once you do this once for the next duplex and the next duplex and the next project, this can literally cut down your time to create cost estimates down to minutes.

Of course, from here, I can actually… If I want to go and take the [inaudible 00:46:38] bid, I can print scope of work, print blank scope of work. There is a lot of cool things here that will save you massive, massive amounts of time. But when I was evaluating this duplex deal, it took me about five minutes to come up with my budget, and you can see, everything is itemized, I have flexibility to insert rows, delete rows. I'll show you the transactions and tracking in a second, but this is my budget.

So this is roughly going to cost me $921,000 to build, or about just a little over 225 per duplex. It's going to take me six months to build. So now what I want to do is I want to go to my financing. So instead of cash, I'm going to click financing, and I'm going to say, I'm comfortable borrowing about $800,000 to build this, or $200,000 per duplex. I'm going to borrow based on ARV, or I can just say based on cost. Let me back into my loan based on the cost here. It's just a little under 80% of cost. That's from my banker's comfortable lending. They typically won't go above 80 or 85% of total cost of the project.

So, I'm going to say, to get exactly the 800,000, because that's my loan… So I can play around with these numbers, and to get the $800,000 loan, just under 80% of cost. One origination and discount point, I'm going to pay my closing costs upfront on closing. The rate that I've gotten for my construction loan is 3.5%, which is amazing. I have to make payments during the rehab, interest payments only during rehab. So this is my construction loan. So now I go in here, and my loan is $800,000.

In total, between my land and additional cash for construction, this is… and interest payments on the loan, this is how much cash I'm going to need. You can see here that based on these numbers, my total cost will be 74% of value. So when we talked about sweat equity and I said I need a minimum of 20% sweat equity here, I am achieving 26% sweat equity. So then the next step is going to be, to look at permanent financing. Because until we model what permanent financing looks like, we won't know what our cashflow will be. Because right now, all I have here is a short-term construction loan.

So here's what I'm going to do. There is an option here, under 45, refinance into permanent financing. I'm going to select yes. What I've done is… Here are my inputs. I'm basically saying that my permanent loan will be exactly the same amount as my construction loan, 800,000 versus 800,000. Same rate, three and a half percent, amortized over 20 years. Oop. There is no additional closing cost, because it automatically rolls over into permanent loan.

So this is my new mortgage payment, and let's look at our results. This is how much cash I'm leaving tied up in the deal, $229,000. Again, remember, this can be your partner's cash, this can be… This can come from any number of sources. I have $600,000 in equity on paper. Because my loan is $800,000, but the building is worth 1.4 million between all of them. So I have $600,000 in equity, in addition to the cash that I have left in the deal. This is my monthly cashflow, almost $2,600. That's total, for all four duplexes, and this is my cash on cash return.

So remember my investment criteria, I needed $350 per unit in clean cashflow. So if we open up our calculator, let's take $2,600 Dollars and divide it by eight. I'm almost there. Or no, I'm sorry. My investment career was $250 per unit. Here, I'm cash flowing, clean, 325 a door. My cash on cash return, first year, my minimum was 10%. Here, I'm achieving 13.5. That coverage ratio of my loan, of my permanent loan is 1.56, which is very healthy. But now here's something else I could do. Maybe I look at this and I say, “I don't want to leave 230 tied up. Can I refi more money out?”

Remember, the debt coverage ratio is the constraint. The debt coverage ratio will tell you how much income you have coming in versus your mortgage payment. So banks will typically want to see at least a 1.25 to 1.3. So here's what I can do. I can go here, and instead of this number, I'm going to select 65%. Now I'm getting $110,000 back, I'm still cash flowing almost $2,000 a month, and I'm earning almost 20% cash on cash return.

So, $2,00, now I'm hitting 250, that's my minimum cashflow per door, I've only left $120,000 in the deal, and my cash on cash return is almost 20%, and it's still a healthy loan at 1.37. So think how powerful this is. So now, remember at the beginning of this presentation, when I told you that this deal would pay me… Let's go back to my original scenario. $2,600 a month. So, $2,600 a month times 12 months equals $31,200. That is how much cashflow I will collect every single year.

Now, most of this is going to be tax-free because of depreciation. So, if you take a $40,000 a year job, and you take 30% in taxes, you get $28,000. That's your take-home pay. That's your take-home pay, $28,000. While this building, without me having to go to this job, will pay me 31,000 plus every year. So this one deal is equivalent to me having a 40k a year job, except for, I don't have to go work 40, 50 hours a week. Do you understand how powerful this is?

But now let's look at the next step. How did I get money? How did I get my construction loan? Here's where the software gets really powerful. Now, I want you to pay attention. Because yes, part of the reason why I do these case studies is to teach, and part of it is to show you how powerful this software can be for your business. I've already showed you the construction budgets, I've already showed you the templates that you can select from the ones we give you, and unlimited amount of cost templates you can create yourself to estimate your construction costs.

But when I go to secure this $800,000 loan, I click on view reports, and I'm going to select cover page, executive summary, marketing sheet hold, income and expenses. Let me show you the presentation that I sent to my bank, and I get… I can literally line up unlimited funding with these presentations. Here's what it looks like. I can click show PDF, and it creates this PDF presentation, which I'm going to mail to my bank.

So this is my cover page, and I can upload my logo there. So my executive summary, where I told the bank the basics, the details about the project, I can tell the bank if they're familiar with me, a little bit about my company. And then this is where the rubber meets the road. This is automatically generated for me by my software. So, I am showing the bank what the short-term construction loan will look like and what the permanent loan will look like. So, “Hey, Mr. Banker, this will be worth 1.4 million. I'm buying land for this much, here are my projected…”

So let me go back and change this, because it shouldn't say Rehab. I can go back to inputs, and I can hit this dropdown and change this to construction, and now all the language in my reports will say construction. So let's do this again. I've literally used this to raise over $10 million for my projects, and so I have our appliance. So, again, let's zoom in, “Hey, Mr. banker, this will be worth 1.4. I'm buying land for 80, this is what my construction costs will be like. I'm looking for a loan for $800,000.”

This will be the income, expenses, and net operating income when I've built this and leased it. My value is based on the 6% cap rate, roughly, my short term loan will need to be for eight months, and then this will be the permanent loan. This is the debt coverage on the permanent loan. So I'm showing my bank exactly the numbers that they need to see to make a decision, along with some pictures, and then an income and expense report, which they'll want to see. This is my proforma, automatically generated for me. This little four-page presentation, gives my lender exactly what they need to know about the financial feasibility of this project, and I've used this to raise this $800,000, I've used this to raise a three and a half million dollar loan, which I'm about to close on as of this recording, and countless others.

We use these same presentations for raising private money from investors for flips, for new construction flips, for rehabs, any kind of deal you can imagine, and what I'm showing you here, just scratches the surface. But this is what I sent to my bank, and the bank said, “Here's $800,000 to build this.” I could have raised more than $800,000. If we go back to our analysis, you can see that I could have gotten the loan for more.

So if I wanted to finance a bigger chunk of this, I could have. I tend to be conservative in how much debt I take on, but if I had less cash to put on the deals, I could get away with putting less cash into deals. So, I hope this has been eye-opening. What I'm showing you here… Here's one other thing, by the way. Now that I've started construction on this project, there is an in-app accounting system here, where I can not only easily upload all of my transactions, along with my invoices, here are all my files stored in one place so far, I have a track function here that will then show me where my project stands in real time, budget versus actual, what I've spent.

So you can see, just as an example, SUP consulting fees, special use permit consulting fees, I had budgeted $500,000, I ended up spending just under 4,400. So I have a positive variance of 612. I can click here, and it'll show me every single check I wrote, every single payment I made for this cost category. The reason why this functionality is really neat and super easy is because every time I enter a transaction, it gets recorded against some line item in my budget. So if I pay for electrical labor, it'll give me this drop down box, and every expense I record has to go against some line item in my budget.

And then I can enter some notes here, phase one, and I have a list of all of my contractors, a list of all my payment methods, and my bookkeeper can log in here and use it, I can export all of this to Excel. Look at this. If I want to share this with my partners or my bookkeeper… But all of my bids, all of my transactions are stored in one place, and it is insanely easy to use. The biggest thing is this, I can click track, and I can see exactly where my project stands in real time.

There is reporting on top of it. I can click view reports, and I can look at budget versus actual by group, budget versus actual by item, and then post-construction project summary. This is the report that I look at in real time, these are the groups, this is the more drilled down report that I look at during my project on an ongoing basis, and I can share this with my partners, with my lenders. After the project is finished, this is the report that I would generate, again, to share with my lenders, to share with my partners, my team members, anybody else.

There is a lot here that I don't have time to dive into during this case study, but if you are serious about this business, this is a tool that would highly benefit you. So, let's go back to our slides. All right. I think we looked at this. So again, here is the process that we just went over. Put the land under contract, perform due diligence before you close, line up financing before you close, clos on the land, design the project, if need be, rezone it, or just built by right, if you can, get contractor bids, submit for permits, line up your construction financing, close on your loan, build, pre-lease while under construction, and then either refi or convert to permanent financing.

None of this is complicated. Start with one house, start with one duplex, and build your portfolio. As I showed you in the very beginning, if you just have 10 of these duplexes, it's life-changing, it's absolutely life-changing. For most people, it completely takes away the need to have a job. It's unbelievably powerful. All right. So I hope this has been helpful. What to do next, leave me your comments, questions, feedback below, in the comments section. Share this on social media with your real estate friends, if you know people that this would benefit.

Again, very few people are teaching development. When I was starting out, I had to figure all this stuff out on my own. So if there was more videos like this, when I was starting out, I think it would've made my life a lot easier. So share this with as many people as you can. If you don't have the software, go to rehabvaluator.com/upgrade and sign up. It's very affordable for everyone. When you upgrade, I'm going to give you the full presentation capability, full project management suite, you'll get my budget and cost templates that I use for my own projects, and you'll get ability to create as many of your own cost and budget templates as you need. All right. Go build something. That's it.

One deal, 4 little duplexes, replaces a $40k/year job. What would 10 little duplexes, just 20 rental units, do?

I'll tell you – give you complete financial freedom for the rest of your life. When I started, I had to figure all this out myself through trial and error.

Luckily for you, you have me. My business is an open book and I am laying it all out in our free trainings. Don't sleep on this. Anyone can do this with enough education and lining up the right resources.

In this training I go through a single piece of land (infill lot) that I bought which I then rezoned and subdivided into 4 lots, on which I am building 4 duplexes for rent. I go through how I got the land, my rezoning process, and my reasoning for rezoning.

I then go through exactly how to calculate value of land for any deal, even if you're brand new. Then we go over deal analysis and the 3 Investment Criteria you must know and calculate to make sure the project is worth doing. Then we cover 5 ways you can buy the land if you don't have cash. After that we jump into project design, short-term construction financing, permanent financing and everything else you need to know to do these deals.

Love the 4plex development model. I need to confirm something. We are looking at 25′ wide old city lots. The City sideyard setbacks are 5′ each side under the by right code. we have an option to buy 6 25 x 150 lots with utilities for at least one house on each existing lot–need to confirm if we will need to pay an additional fee if we put two units on a lot.

Daniil you make the point in your preference for duplexes that you prefer to build to residential vs commercial/MF codes.

One option I see is to build to duplexes on two side by side lots and have a common wall with no side yard setback between the 2 two story stacked duplex units. I then could build a 20′ wide plate on each duplex and have a 5″ sideyard setback on the non common wall sides of the buildings. I assume the common wall would have enhanced fire/sound qualities, in framing, sheeting, drywall etc.

My question for you is, when you build these common wall stacked duplex units on two lots are you having to build each duplex to commercial and/or multi family building codes?

Hi Jeff. I just answered you in another comment but your thinking is correct. Build a duplex attached to another duplex, so they’re each roughly 20′ wide with 5′ sideyard setbacks. If you build on separate lots and with separate permits, there’s a chance you can build them by residential code but it totally depends on your local permitting office and how they interpret your state building code.

This is great, a four plex will be even better. I’m looking forward to building, thank you for that inviting information.

Loving to hear you’re planning a four plex Martin! ??

catherine if we build the 4 plex with common walls will the project be built under residential or commercial/residential building codes?

Jeff – totally depends on your state building code and how your locality interprets that building code. My guess is this would be viewed as a commercial project

Will give it a try!!!!!!

Definitely! Feel free to reach out to our support team if you need any help structuring your deal with the Rehab Valuator software and they’ll be happy to help 🙂