Demo: Create a Lender Draw Request in 3 Minutes

If you borrow money for rehabs or new construction from hard money lenders and banks (and even some private money lenders) then you're familiar with the concept of “Draws”. And you're likely familiar with the major pain of having to generate these Draw Requests in Excel every time you need to request money from a lender. Well no more! Check out the quick demo below. And scroll below the demo for a more thorough explanation of what Draws are and how they work!

What are Lender Draws and How Do They Work?

When you close on a renovation or construction loan, no professional lender will advance you money to do the actual work these days. Some inexperienced private lenders may. The reason for this is that the lender wants to protect themselves from having you simply walk away with the money instead of putting it into the property! It's simple common sense. So what happens instead?

You need to perform some of the work first and then send a Draw Request to a lender asking to reimbursed for that portion of the renovation or construction. Your Draw Request will show the lender the line items that have been completed. Your lender, in turn, sends a 3rd party inspector to your job site to verify that those particular line items have all been completed. The inspector sends a report back to the Lender who then wires you the money (or cuts you a check).

Does that mean you have to come out of pocket first? Not necessarily. You should have ability to pay your suppliers on a 30 or even 45 day delay. Same thing with your GC or subcontractors. There will be a delay between when work is done and you have to pay for it. This gives you enough time to generate a draw request and get paid by your lender, then turn around and disburse that money to your suppliers and subcontractors.

For Example: You are approved for a $250,000 new construction loan. You dig and pour footers, build foundation, and frame up the building. You submit draw request to your lender for that portion and pay your bills. Then you put a roof on, install windows, doors, do electrical, plumbing, and HVAC rough-in and then submit another request. You do this monthly until you've tapped the entire $250,000.

The Problem: doing this in Excel takes time and is a major pain. But now, with Rehab Valuator Premium, you can literally create each request in a few minutes and generate a PDF or Excel file to send to your lender. All your draws are organized in a chronological fashion in one place, easy to find and track!

Here's How it Works:

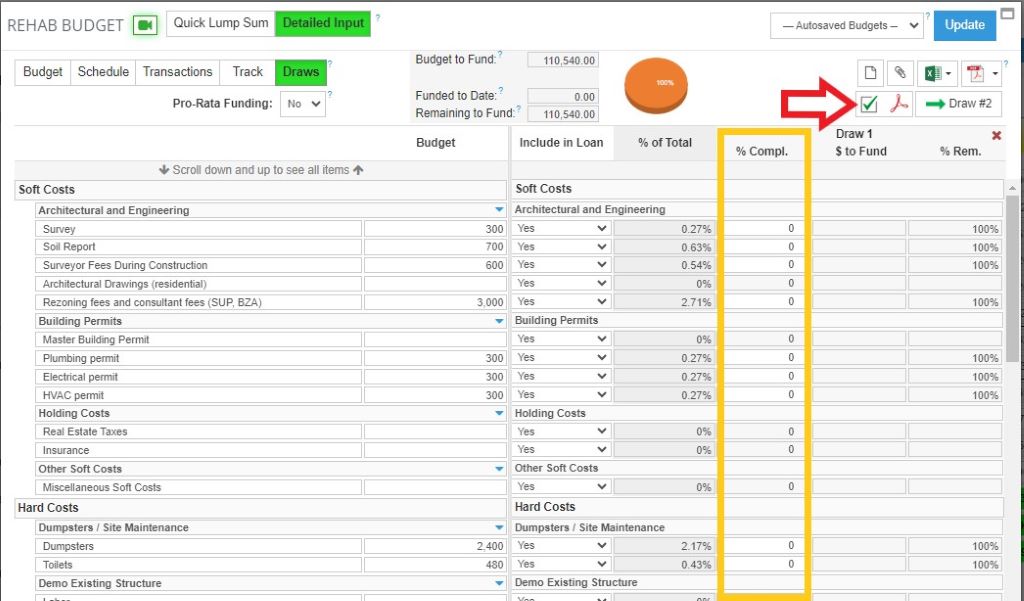

Step 1: Generate a Budget to Send to Your Lender

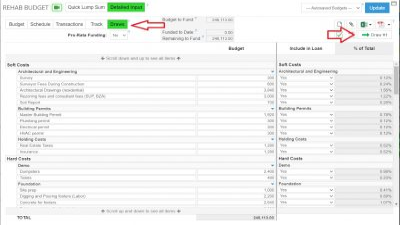

Inside the Project Management Suite in Rehab Valuator Premium, you can either create a budget from scratch or use one of our drop-down Templates to get a head start. You can include this Rehab or Construction Budget along with your Funding Proposal for your lenders.

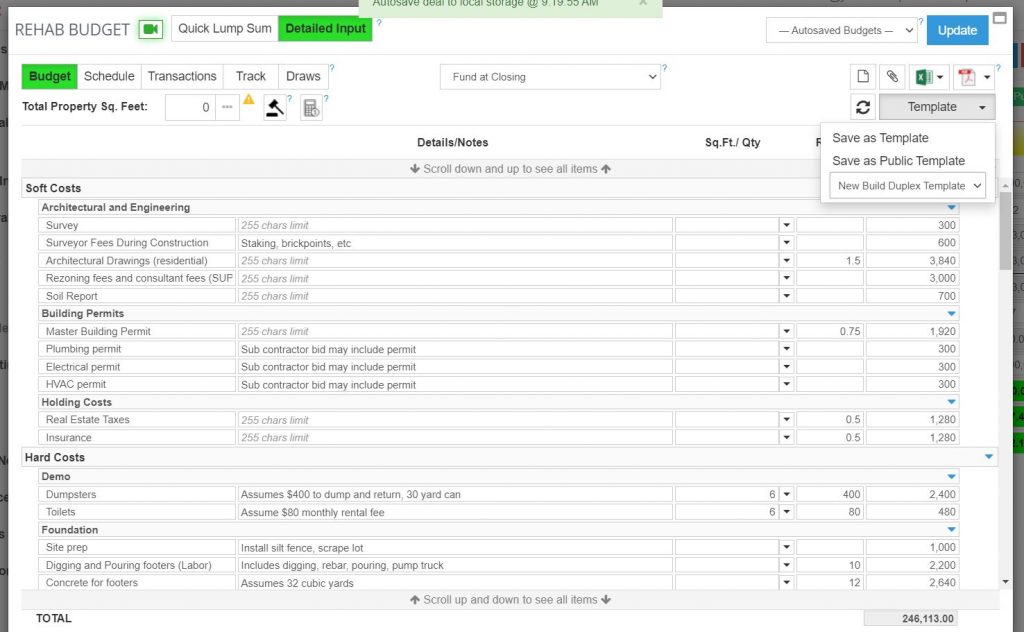

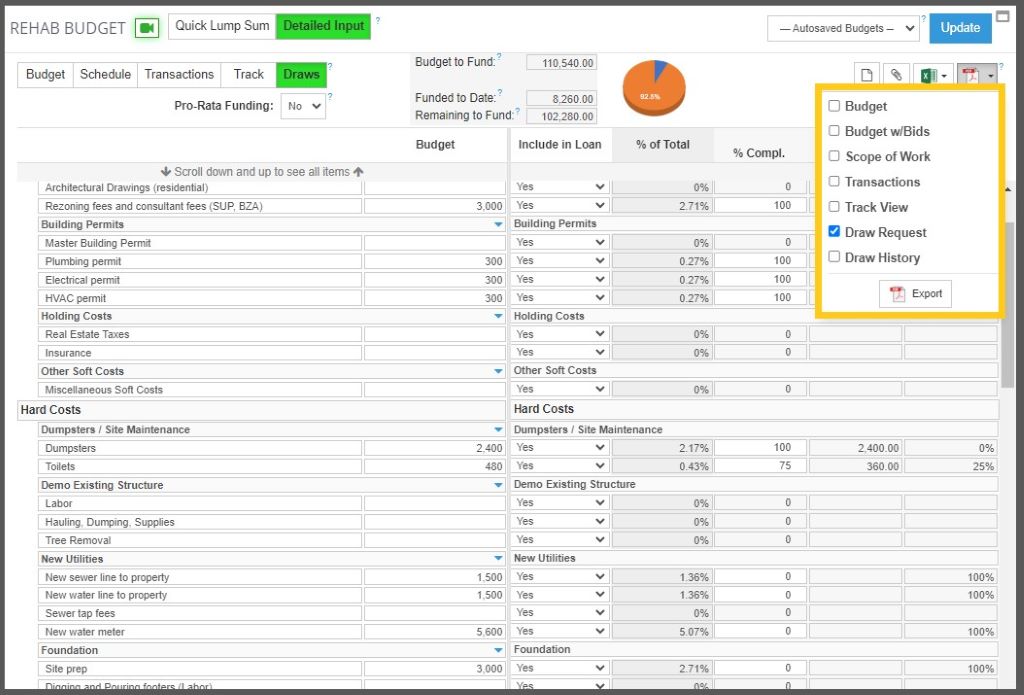

Step 2: Click on "Draws"

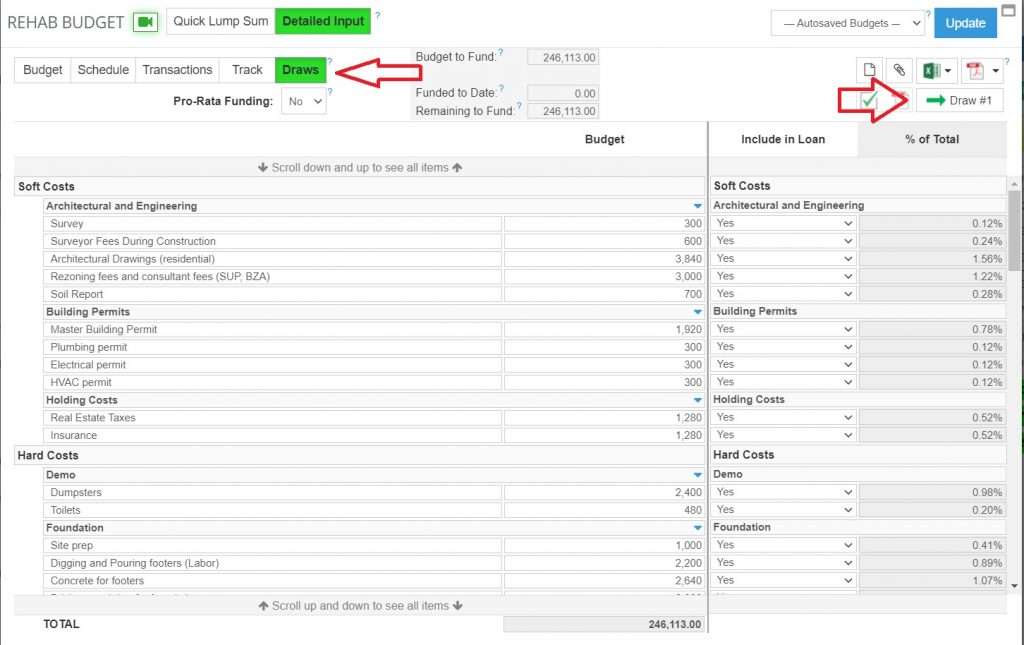

Step 3: Fill out "% Complete"

Simply go down your budget and fill out % complete for each line item. This lets your lender know what portions of your project have been done and require reimbursement. Once you're done, simply click the green “checkmark” button to generate your Draw Request.

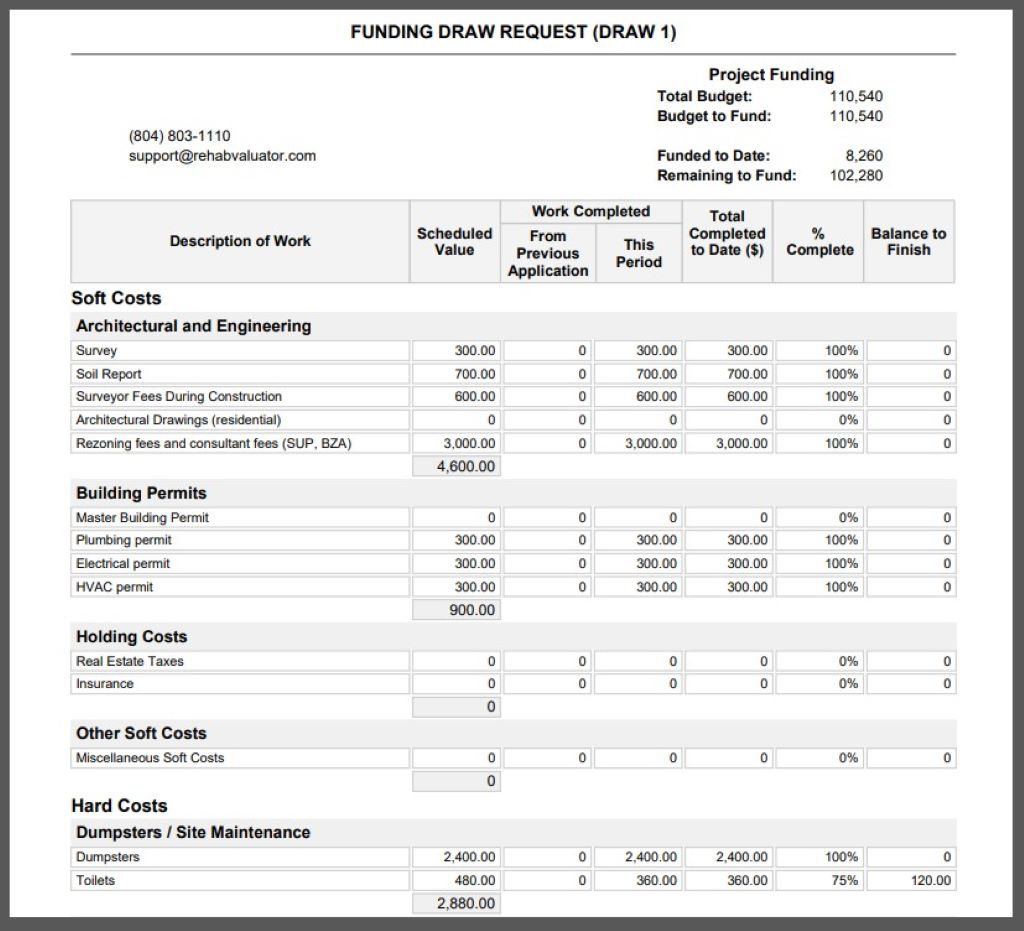

Step 4: A PDF Lender Draw Request is Generated

Instantly, an AIA-compliant Lender Draw Request (or Lender Funding Request) is generated for you in PDF. You can save this on your computer and email this to your lender.

Step 5 (Optional): Export Your Request or Full History to Excel or as a PDF

Quick Demo of Project Management Suite:

Demo: Create a Lender Draw Request in 3 Minutes

If you borrow money for rehabs or new construction from hard money lenders and banks (and even some private money lenders) then you're familiar with the concept of “Draws”. And you're likely familiar with the major pain of having to generate these Draw Requests in Excel every time you need to request money from a lender. Well no more! Check out the quick demo below. And scroll below the demo for a more thorough explanation of what Draws are and how they work!

What are Lender Draws and How Do They Work?

When you close on a renovation or construction loan, no professional lender will advance you money to do the actual work these days. Some inexperienced private lenders may. The reason for this is that the lender wants to protect themselves from having you simply walk away with the money instead of putting it into the property! It's simple common sense. So what happens instead?

You need to perform some of the work first and then send a Draw Request to a lender asking to reimbursed for that portion of the renovation or construction. Your Draw Request will show the lender the line items that have been completed. Your lender, in turn, sends a 3rd party inspector to your job site to verify that those particular line items have all been completed. The inspector sends a report back to the Lender who then wires you the money (or cuts you a check).

Does that mean you have to come out of pocket first? Not necessarily. You should have ability to pay your suppliers on a 30 or even 45 day delay. Same thing with your GC or subcontractors. There will be a delay between when work is done and you have to pay for it. This gives you enough time to generate a draw request and get paid by your lender, then turn around and disburse that money to your suppliers and subcontractors.

For Example: You are approved for a $250,000 new construction loan. You dig and pour footers, build foundation, and frame up the building. You submit draw request to your lender for that portion and pay your bills. Then you put a roof on, install windows, doors, do electrical, plumbing, and HVAC rough-in and then submit another request. You do this monthly until you've tapped the entire $250,000.

The Problem: doing this in Excel takes time and is a major pain. But now, with Rehab Valuator Premium, you can literally create each request in a few minutes and generate a PDF or Excel file to send to your lender. All your draws are organized in a chronological fashion in one place, easy to find and track!

Here's How it Works:

Step 1: Generate a Budget to Send to Your Lender

Inside the Project Management Suite in Rehab Valuator Premium, you can either create a budget from scratch or use one of our drop-down Templates to get a head start. You can include this Rehab or Construction Budget along with your Funding Proposal for your lenders.

Step 2: Click on "Draws"

Step 3: Fill out "% Complete"

Simply go down your budget and fill out % complete for each line item. This lets your lender know what portions of your project have been done and require reimbursement. Once you're done, simply click the green “checkmark” button to generate your Draw Request.

Step 4: A PDF Lender Draw Request is Generated

Instantly, an AIA-compliant Lender Draw Request (or Lender Funding Request) is generated for you in PDF. You can save this on your computer and email this to your lender.

Great content!

Thanks Allie! Keep coming back to check for more updates 🙂

Glad to hear it, Mary!

Excellent stuff. This is definitely my favorite go to software for real estate projects.

I love the program you built. You should be proud of it.

I am a builder myself.

I was born and raised in the industry in Southern California

I would love you meet you one day and share my story.

I will purchase your program one day if God permits and get back doing what I love, building that financial wall around my family so I don’t have to worry about money anymore.

Thank you for all your content. It’s beautiful to see people like you helping others build their dreams and live Free!

God Bless Pal!