[Part 1 of 4 ] 6 Ways to Structure Private Money Deals

Here’s why…

I want to tackle a chronic, nagging problem that I see a significant number of my real estate friends and colleagues struggling with time and time again: Knowing how to structure private money deals with lenders for your real estate deals.

The fact is, finding a private lender who’s willing to go in financially with you on a real estate deal is one thing, but knowing how to actually structure these transactions with your ‘mattress money’ friend for the greatest possible win/win together… well that’s another thing entirely.

It seems to me that most people in the real estate game know maybe one or two basic ways to structure private lender deals, and in my opinion that’s just not enough. If that’s you, then you’re likely leaving a lot of money on the table.

So, with this 4-part blog series, I’d like to help you change that by walking you through six simple-yet-effective private lender structures with step-by-step instructions. I’ll also include really helpful images from my Rehab Valuator software, which (in case you haven’t heard) is an incredible program I created that can help you easily structure deals and present them professionally to get financing from private lenders. I’ve been using Rehab Valuator with great success to structure and present deals in my real estate investing and development business for more than 7 years now and a few months ago we launched a brand new, property investment software and platform that is simple to use and very effective.

Before we dive deep into methods on how to structure private money deals, we need to begin with a solid foundation.

So to start us off in this Part 1, we’ll begin with what it means to be a transaction engineer and why you want to be one in the first place. In this post, we’ll also cover three types of financing options available for residential real estate deals and which one makes the most sense for your REI deals, plus we’ll discuss risk versus reward, which will impact the way you structure deals with private money.

Sooo much to do, friends, so without further ado, let’s get going…

First Lesson: Start Thinking Like a Transaction Engineer

Maybe it’s my background in finance and financial modeling, but it’s always just made sense to me to look at each of my deals from multiple angles and think of as many creative ways to approach it as possible before choosing one path or another to move forward with.

But after a long time in the real estate trenches now, I’ve come to realize that this way of thinking doesn’t necessarily come as naturally for everyone else in the arena as it does for me. So one thing I want to do here is help you start thinking more like a transaction engineer.

A transaction engineer understands the value of (i) creative thinking and (ii) flexibility in how you approach each deal, because well, every deal is different.

And similarly, no two private money lenders for real estate are exactly alike – each has their own view of what an ideal return looks like for them, and some will have a higher risk tolerance while others will have a lower risk tolerance.

Your best advantage is in knowing how to work with all types of private lenders for real estate investing, and the best way to do this is to understand multiple ways you could possibly structure your arrangement with them. This means stepping outside the “one size fits all” box you’ve been stuck inside, and learning how to structure and present your deals more creatively.

It’s not that hard, you just need a few ‘templates’ to follow, and that’s exactly what I’m about to walk you through in plain English here.

Speaking of “Presenting”: How I Make This Super Easy For You

Before we dive in, here’s something you should be aware of:

Getting your head around six solid ways you can structure your private lender transactions is a big help for sure. But knowing then how to express these concepts to your private lender in a clear-cut, intelligent and concise manner – well, that’s another thing entirely.

In fact, I would contend that your ability (or lack thereof) to effectively present your private lender proposals in a coherent, organized way is something that can set you categorically apart as either a real pro or a total amateur in the eyes of a private lender.

To this end, I’d be remiss if I didn’t let you in on how I’ve flat-out solved the ‘explaining it to your lender’ part for good.

In a nutshell, a few years back I created some simple, user-friendly, property rehab software for exactly this purpose: To make it a total piece of cake to structure your deals, and then present them to your private money lenders for real estate. It’s called Rehab Valuator, and I’ll be honest, it’s completely amazing. ?

-

-

- Calculate offers quickly

- Avoid over-paying for deals

- Market your deals like a pro

- Sell your deals faster, for more money

- Raise private money

- Manage your rehab projects

- Easily create comprehensive (yet clear-cut) deal-funding pitches

-

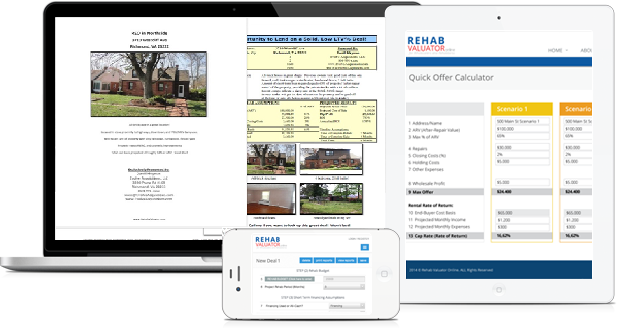

That last part is especially key to our discussion here, because the professional reports you can generate for your private lenders are in an easy ‘plug and play’ format that allows you to be super-flexible with your deal structuring, depending on the scenario and the type of private lender you’ll be presenting to.

You simply enter numbers into specific fields (which you can change as needed), and it does the math for you instantaneously. Once you’ve dialed in a deal structure you want to roll with, you’re just one click away from the most impressive-yet-straightforward private lender proposal you’ve ever seen.

In other words, it’s all about working smarter – not harder. As a highly active investor and developer myself, I approached Rehab Valuator knowing exactly what I needed this software do to for me, and I’ve worked very hard to ensure it’s entirely flexible and comprehensive, while still ridiculously simple and easy to use.

Rehab Valuator does the ‘heavy lifting’ for you and gives you instant credibility by establishing you as a total pro in the eyes of your colleagues and private money lenders for real estate.

Recently, I opened up a dynamic, cloud-based version of the software, and people are absolutely loving it. If you want to check it out, you can set up a free account (no strings attached) and give it a try yourself.

So as we walk through this together, I’ll also be touching on how you could leverage Rehab Valuator to easily apply each of these six private lender structures to your deal in a snap. You’ll be amazed at how simple and easy it can make the whole process.

If you have your own free Rehab Valuator account, feel free to follow along with the examples I present – plus, I’ll include some screenshots throughout that should be helpful. Soon, you’ll be structuring deals in the same way that I’m showing here.

For those who know me and are familiar with my style, you know I don’t care too much for fluff. I prefer to just give out solid, proven information you can put to use in your business immediately, and that’s exactly what I aim to do for you here.

So, let’s get to it…

The Basics: 3 Primary Types of Financing for Residential Real Estate Investing

Before we get into the nuts and bolts of working with private money lenders, I want to do a quick review of (i) the types of financing that are out there, (ii) the differences between them, (iii) and the pros and cons of each.

Once you get the clear picture of the types of financing, you will more fully understand where private lenders best fit in, and why they’re so key to your real estate business.

Primarily, there are 3 major types of financing for residential investment real estate. They are:

-

- Bank Financing

- Hard Money Lenders

- Private Money Lenders

Are there other sources of capital? Sure! But these are the three primary ones and the ones I will be explaining.

Please bear in mind that it would be practically impossible for me to cover every funding scenario for all the different types of niches in real estate investing, so for our purposes, we’ll focus just on residential real estate that you’re either rehabbing or flipping. The good news is that these same principles can be applied to other types of deals.

Type 1: Bank Financing: ‘Conventional’ Bank Financing

In my experiences, dealing with conventional bank lenders almost always means experiencing all sorts of unnecessary hassles and painful issues – especially for investors.

First of all, there’s an automatic limit to the number of properties that conventional lenders will allow, which is typically 10. I’ve heard of them going back and forth between limits of 4 and 10; I actually don’t know what it is now because I just don’t deal with these lenders anymore myself.

The bottom line is their guidelines are extremely strict, full of hassles and require a ton of paperwork. You also must have a sterling credit rating as well, and they’ll almost always require you to sink 20%-30% down. Basically, they’ll want to know everything about you, and it’s just very difficult to qualify and a real pain overall. If you’ve ever tried to go this route, you know exactly what kind of a nightmare it is.

Type 1: Bank Financing: ‘Portfolio’ Bank Financing

The second group under bank financing is portfolio lenders. This group includes local community banks and credit unions. From an investor’s perspective the most prominent difference between portfolio lenders and conventional lenders is that portfolio lenders are far easier to deal with.

The reason they’re called “portfolio” lenders is because their loans are mostly kept in their own portfolio rather than being sold to the secondary market, which means they are not subject to the strict guidelines that govern entities such as Fannie Mae and Freddie Mac.

Since portfolio lenders loan their own funds to you, they can be much looser with their lending guidelines, which can often create a path of much less resistance for you to borrow from them.

You still must qualify based on income, credit, global cash flow, and balance sheets. These lenders often add weight to their assessment of you personally and your business rather than just what your credit score and financials say on paper. They will, however, still examine everything you have such as your assets, other properties, and balance sheets.

Generally, these loans carry short-term calls, which means they may expect your loan to be repaid within 3, 5, or 10 years.

I presently have a very large number of loans with this type of lender, which tells you that I like portfolio lenders and tend to use them a lot. I find that the interest rates I get from portfolio loans are much lower than what I would otherwise pay a hard or private lender – and I’m a fan of cheap money when I can get it.

If you’re unable to qualify for either the portfolio lenders or the conventional lenders, another option to consider is to go with a hard money lender.

Hard money lenders are in the business of making higher-risk loans, and they’re adept in their business. This method of financing works great if you need money fast and for only a short time. These lenders are very expensive, and the way they make their profits is by turning over their money quickly. Typically, they won’t lend on a deal for more than 12 months, because they make much of their money on points.

“Points” is another way of saying a certain percent of the total loan. One point is the same as saying 1% of the loan amount.

Most hard money lenders charge a 12% to 16% interest rate and typically also charge the borrower to pay 4 to 8 points up front. So if you’re borrowing $100k from a hard money lender, it can cost up front anywhere from $4,000 to $8,000. (In some instances, you may get them to agree to tack your points onto the backend of the loan so you don’t have to pay them up front – it’s all up to how they do business and what you’re able to negotiate with them.

But again, this is very expensive money. If this is the route you choose to take, you will need a very solid deal and a secure exit strategy. If you can’t get out of that loan in 12 months, you’re in trouble. The lender could raise the interest rate, charge you another heap of fees and points, or even foreclose on the property.

I’ve seen in many cases where the hard money lender states in a clause in the contract that if you don’t get out of that loan in 9 or 12 months (whatever the contract says), the interest rate suddenly skyrockets to nearly double what you started out paying. These guys are serious about keeping their money moving in and out of deals, rather than sitting parked in a single property for an extended period.

Think about it – if you’re paying 15%-20% annualized on your money, that’s going to eat into your profit margins bigtime.

So my general philosophy is this: Unless you have a strong, secure deal, it’s best to steer clear of hard money lenders.

This brings us to private money lenders, which is obviously our core topic here.

When dealing in this arena, you contend with far fewer rules and regulations. The regulations that are in place really have more to do with how you solicit private money as opposed to how you structure your private money deals. That’s really an entirely different conversation for a different time.

Private lender terms can be as flexible as you can imagine. About any structure you can create (and that you and your private lender agree on) is possible.

Overall, my view is that private money is by far the most flexible money that you will find. Most of the time, you’ll need to pay a higher interest rate than you otherwise might with a portfolio lender, but it’s still a heck of a lot less costly than your typical hard money lender, and it’s just about impossible to beat the flexibility factor.

How It Can Play Out in Real Life

So now that you have an overview of the 3 basic types of financing, let’s briefly take a closer look at how you might consider each one in a real-life deal.

Let’s say you want to buy, rehab, or flip a house and you’ve decided to go to either a local community bank or credit union. The first roadblock will be that conventional lenders will almost never finance a renovation. (That is, unless you are going to be the occupant, which you are not.)

One option will be to get a construction loan. I actually get these from time to time on bigger projects. Even with these types of loans you will still need to qualify based on income, credit, assets, and so on. Additionally, you might get a 5%-8% interest rate, and typically a 6- to 12-month term after which the loan will be called (or will roll over in what’s called a mini-term).

Personally, I like construction loans for my bigger projects because it’s not expensive money. However, the borrower still must be able to qualify, and the qualification process can be pretty intense even with portfolio lenders.

You can go to a hard money lender if the deal is strong. In this case, you don’t need to have good credit, income, or assets. Hard money lenders almost always look purely at the deal. But as I stated previously, it’s very expensive money. You must be able to rehab and sell the house under the terms specified or lose the house to the lender – or possibly risk paying even higher interest rates.

The next option, of course is to consider a private lender. The terms between you and your private lender are completely up to the two of you. Here’s how it plays out…

You, as the borrower, receive a loan for X amount of money from the private lender in exchange for a monthly interest payment based on X percent. In most cases, the lender receives a deed of trust or a mortgage on the property. There is also a promissory note for the amount of the loan, promising to repay the loan after the agreed term.

You, as the investor, find the deal, rehab and flip the house, while the lender funds either all or most of the purchase and renovation. (Later, I’ll show you how to present your deals to these potential lenders.)

The 4 Main Scenarios

Before we dive right all-in to the nitty-gritty here, it will be helpful for you to understand that all six of these specific private lender structures can be categorized under four broader private lender scenarios.

A: Lower LTV Debt Scenario

“LTV” stands for loan-to-value, and it refers to the ratio of debt compared to the value of the property. So in this first scenario, a lender hedges their risk by keeping a relatively low LTV in your deal.

We’ll discuss 2 possible private lender structures under this type of scenario:

Structure 1: Your lender funds 50% of both your acquisition and rehab costs.

Structure 2: Your lender funds your acquisition, but not the rehab.

B: Higher LTV Debt Scenario

In the “higher loan-to-value” scenario, the lender would be willing to take a little more risk with you and fund more of your deal – which is always great if you can get it.

I’ll cover 2 private lender structures under this scenario:

Structure 3: Your lender funds everything with a straight interest rate.

Structure 4: Your lender funds it all (including rolling in the closing and holding costs) and lets you defer any interest payment until after the property sells.

C: Debt + Equity Scenario

The “debt and equity” scenario is a little more creative, in that your lender gets paid two different ways from the deal.

Structure 5: Your lender funds everything, and you give them both (i) an interest payment and (ii) a cut of your end-profits in the deal.

D: 100% Equity Scenario

Finally, I’m going to cover a scenario that’s really more like a single-deal partnership, but viable for sure and should definitely be counted in your arsenal of options to consider.

Structure 6: Your lender funds everything (100% of purchase AND rehab) with only a profit split.

Risk Versus Reward

Something to bear in mind: At times, your lender may not feel comfortable with taking a large risk by funding your entire purchase price and renovation. Instead they may ask you to put some of your own money into the deal as well. This happens if your deal feels particularly risky for some reason, or when your lender simply has a lower tolerance for risk, and they feel like their risk can be offset some if you have some of your own ‘skin in the game’ as well.

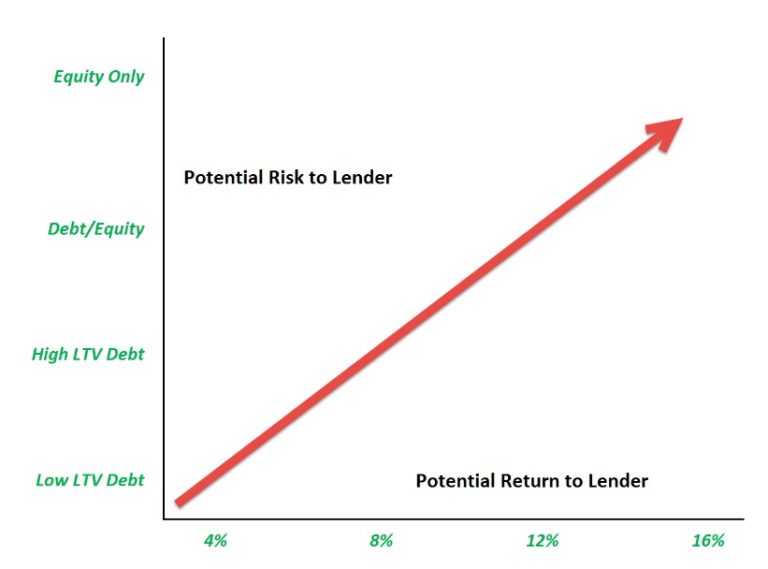

This touches on an important point: When structuring your deals, the return your lender receives should be commensurate with the risk that he takes on.

The graph here shows how the risk/return compensation works in the four lending scenarios we reviewed. You start with the low-risk, low-return scenario of Low LTV Debt. As you go up the risk spectrum, your lender lends you a higher loan, and the potential return keeps going up as well.

Take a look… (the % numbers are just examples and not a guideline)

This concept will become clearer as we now progress through the 6 ways to structure your private money deals.

Coming Up…

Well, this seems like a perfect place to pause… and get super excited for the upcoming Part 2 of my 4-part blog series. With this solid foundation of information you’ve gotten today, we’re now ready to embark into the six private money deal structures.

So next time in Part 2, I’ll start walking you through those six different structuring methods. Using helpful screenshots from Rehab Valuator all along the way, we’ll cover in great detail two lower risk scenarios, two higher risk scenarios, a debt and equity scenario, and a creative pure equity scenario. And I’ll explain it all in easy-to-understand terms. Plus, who knows… I may even share more than 6 strategies. We’ll see.

Stay tuned for more!

Thank you very much that was just what I was looking for.

Clear and accurate. Thank you

Glad you liked it, Eric! Part 2 is available using the link above the comments that says “Proceed to Part 2”

Thanks, Guther. FYI – part 2 is published already and you can access it using the link above the comments section

Danill,

Just getting started in real estate, And this was so great info in part 1. looking forward to part 2.

Great info and thank you, looking forward to part 2.

Thanks, Bill. That means a lot!

Daniil,

I’m reading with interest. Just finished Part 1, which is largely a re-cap of what I already knew, but only in a book learning way, not experientally. I’m looking forward to Part 2.

Of all the big-name RE gurus I have ever run across, you are one of three names who impress me the most, specifically because of your willingness to help those who are just starting. Thank you for your generosity.

I really enjoyed reading the in formation

.the you had to share.Thank,s so much,for sharing.Treena

Hi Bill,

Thanks for the kind words. Great to hear you’re learning and enjoying this case study!

Daniil you do prepares your students well with the best info available, and we need this I too has just finish reading part 1, and it is very interesting I can’t wait to finish finish part 2, if I am too be successful I will have to turn pro at this Lol?