How to Calculate an Accurate After-Repair Value (ARV)

How to Calculate an Accurate After-Repair Value (ARV)

In this post, I’m going to give you a roadmap for how to calculate ARV for a property. Because if you don’t have this skill, nothing else in real estate matters. This is something that will be paramount to your career as an investor. The ability to determine a property’s value quickly and effectively is nothing less than essential to any investor’s ability to even turn a profit.

I often see people speculating on the value of homes, and it’s just not a good path to go down – trust me. You want to make your decisions based on rock-solid data and (when available) expert input.

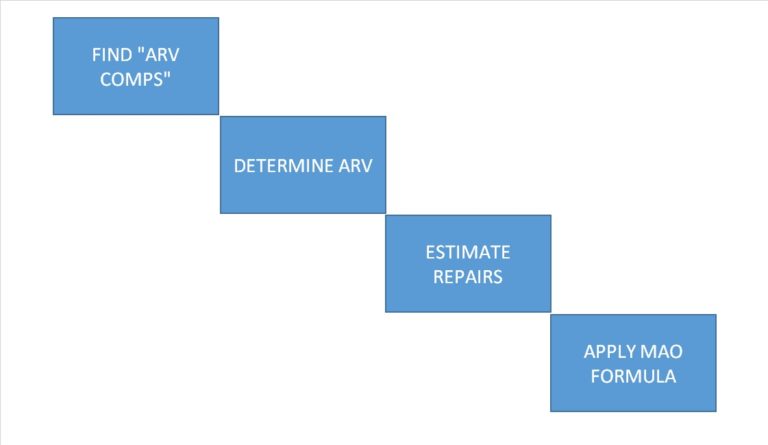

So let’s get going. Here’s the process flow of figuring out what to pay for your real estate investment property.

Figuring out What to Pay for a Property

-

- Find the “After Repair Comps” – What will the property be worth AFTER it’s built or renovated?

- Analyze the Comps and Determine the After Repair Value (ARV).

- Estimate Repairs/Construction Costs and other expenses.

- Apply the Maximum Allowable Offer formula to determine the max offer you can make. Learn how to do this here with our real estate offer calculator.

And let’s be clear, when we talk “Value”, there are really only two numbers that matter:

-

- Current as-is Value: What you pay now (your MAX offer)

- After-Repair Value (ARV): What you can resell the property for when you’re done rehabbing or building it

If we limit our conversation to looking at houses that need work, to either wholesale to other investors or to buy yourself and renovate, then my recommendation is to ALWAYS figure out the ARV first, then work your way backwards to the As-Is Value to determine what to pay for a property.

Read that part again – it’s important!

Knowing the Accurate After Repair Value is extremely important – you really have to nail this down! If you underestimate a property’s ARV, someone could easily outbid you and snatch up a house you were eyeing… or you could end up paying way too much for a property and losing your shirt on the deal. These are some pretty big risks and highlight just how critical it is that you become adept at effectively getting to an accurate ARV.

The 3 ways you can Determine a Property’s Value

There are three main ways to go about determining a property’s value:

-

- Do it yourself using some online resources and some math

- Use a realtor – have them supply the comps and possibly have them generate a CMA (Comparable Market Analysis)

- Use an appraiser

If you are out there looking at 20 potential deals a day to buy, you’re not going to consistently be able to use options two or three. Realtors won’t generate 20 CMAs a day for you no matter how good they are. And appraisers are expensive and take time, while you have to make an offer quick! So this post will focus on number one – determining value yourself. This is a skill that, in my opinion, you absolutely must learn!

Now, if you’re rehabbing a house and need to determine what price to list it at, then that’s a different story. Find a great realtor to help you, put together a CMA and come up with the optimal offering price!

But if you’re out there making 5-10 offers a week, then you need to move quickly and be able to do this yourself on the go. So let’s talk about how to do that.

How to Calculate ARV

Step One

Your starting point should be comparable sales. Find actual sales data within the last 6 months of similar houses to your subject property. The properties that sold should be similar to yours in:

- Size (square feet)

- Bedrooms and baths

- Stories

- Location – should be as close as possible. Same block, same neighborhood, etc.

- Note: the condition should be similar to what your property will look like when you’re finished rehabbing/building it! This is important. If you’re buying a property to renovate, comps should be of already renovations properties with similar finishes to what you plan to put in

The comparable properties don’t have to be exactly like yours. You can make adjustments to your value based on differences in sq ft, bedrooms, baths, basement, etc. But the properties should be as similar as possible.

Sources for Finding Comparable Sales

Multiple Listing Service: Your single best source of comps will be from the multiple listing service, or MLS. There is no more complete source of data than the MLS, hands down, in most markets. Unfortunately MLS guards their data very closely and you typically must be a licensed agent in that MLS jurisdiction to access it.

Non-MLS Online Resources:

-

- Zillow Zillow’s data and comps have gotten much better over the last few years. In my market and many other markets, their data is almost or is as complete as the MLS. Unless you’re in a non-disclosure state, Zillow can be a decent source of data.

- Public Tax Records. Every sale that occurs gets recorded in public records and is public information in most states (with exception of non-disclosure states, which are hit or miss). Rehab Valuator Premium sources comparable sales automatically from nationwide Public Records, gives you the best fitting ones and allows you to filter down and calculate After Repair Values and offers easily and quickly.

Check out the short demo:

-

- Trulia: Same pros and cons as Zillow. If you’re in a “disclosure state” you should be able to get good comps data on Trulia.

- Other Free Online Resources

These include:

Now, you can also find some affordable paid online resources that may aid in your quest to determine property value. These are a bit trustier (yes, it’s word, well, kind of) than the free resources, and are less expensive than paying an appraiser:

Ultimately, if you’re an agent then you should be relying on MLS for most complete data and if you’re not an agent, then find a good one to work with some that they can supply you with reliable comps, especially if you’re in a “non-disclosure” state.

Once you have accurate comps, I recommend creating a rough “$ per sq ft” ARV real estate estimation. You can take an average of the relevant comparable sales properties of the $ per sq ft sales prices. You can then add or subtract if your subject property has less or more of something: bedrooms, baths, finishes, amenities, etc. Again, remember, this is as much of an art as it is a science.

Step Two

Now that you know what the property will be worth once the renovations are complete, you have to estimate what it will take to get there. I.E. what the repairs will cost.

There is no substitute here for experience. Read this article I wrote recently on how to estimate repairs on any project for wholesale and rehab deals for a more in-depth look at this topic.

Step Three

So, you know the ARV. You know the repairs. Most of the work is done. From here it’s easy. Whether you’re going to wholesale this deal or buy it yourself, make some guesses about closing costs, assign your wholesale fee (if applicable) and use the Max Offer Calculator to tell you what the Maximum Allowable Offer should be. Check out this video:

I tried to keep this short and sweet, so if there’s anything I left out, comment below and I’ll answer your questions. I’m also going to post a few additional resources for you below to check out! (If don’t want to do the work yourself, you are also welcome to try our real estate comps software, which does the calculating for you).

Remember: “An investment in knowledge pays the best interest.”

~ Benjamin Franklin

Talk again soon,

~Daniil Kleyman

Comments, Questions?

Please share this post using the links below!

Next Videos

How Wholesaling Real Estate Works

Buyers or Sellers First?

Thank you for all the information! I will get started on the free version since I don’t have money for the premium version yet

The Lite (free) version is still a very powerful tool! We also put out a lot of free wholesaling content to help you along. Check it out here: https://rehabvaluator.com/wholesaling-learn

Hi Andre. WHen there are no rehabbed comps, it’s not easy to estimate ARV. After all, how do you know what your renovated house will sell for if there are no houses like it being sold? A better question to ask is WHY there are no renovated houses being sold? Maybe there’s no market for it? Be careful about over-renovating and getting stuck with the property

Thanks, Larrics!

Very clear. Useful and precise breakdown of the entire process. Loved it

Sure thing Evelyn!

Appreciate that feedback, Mandel!

The automation of this software is unbelievable. thanks a million.. Priceless!!!

Hi Cliff. Thanks for your feedback and compliments on the software! Because we use Zillow API, we’re basically giving you whatever data that Zillow gives us. And occasionally, we have seen weird things happen like what you describe where Zillow will kick back comps in a neighboring area instead of your subject area. Super weird and doesn’t happen often, but you do need to do your own due diligence on any comps that come up and verify that they are indeed relevant!

WHAT IF YOU HAVE DONE ALL OF THIS WORK AS STATED AND THE MARKET STARTS DECLINING AS IT IS NOW????

ARE WE STUCK AT A LOSS ????

THANK YOU

You’re welcome, Darrell! Thanks for reading!

Glad you enjoyed everything! If you ever have any questions or need help with anything, please reach out!

The document regarding “how to learn to properly evaluate a property” during a walk through inspection was phenomenal.

Insight provided on using GC’s for quotes is perfect.

I assume that it could be a good idea to have the seller available for that walk through because it could be effective when negotiating.

Thanks!

Glad to hear that, Jose! We definitely take our software AND support very seriously! Appreciate you spreading the word about Rehab Valuator!

You’re welcome!

Excellent info. Thanks!

Hi Jim,

You have closing costs to buy and closing costs to sell. Closing costs to buy I usually estimate anywhere from 1.5% to 2% depending on the price range of the property if I’m buying with cash. That covers general closing costs but doesn’t take into account any special circumstances like liens or back taxes. Closing costs to sell, when using realtors, you can usually estimate at 7%. That’s my opinion and what I usually use for my own estimates.

Hi Dale,

I’m glad the info is helping and that it aligns with your real world experiences.

Im a contractor with 30 years experience and have listed to alot of different scenarios on rehab budgets based on sow, and always thought it was to low.

And by your explanations of the markets and your numbers are more accurate, to real world circumstances and evaluations.

How do you figure your closing costs?

Glad you got value out of it, Jody!

No worries, Terri. Upgrade to Premium when you can afford to. In the meantime just keep using our free software, learning and implementing!

Hi Michael,

You must be part of Bank Elimination Blueprint as well. That’s where James Ingersoll comes in if anyone is curious. We happy that you’re loving both programs and we hope that you’ll be a big part of your success in this business as you move forward with confidence. If you ever have any questions please let us know.

so far so good!!!! This is the part I’ve been missing…. I can flip, I can jump, I can hire I can paint I can rehab, hence the name Rekindled Spirits Restoration LLC, WHAT I can’t (I hate using that word, so lets change it to what it really is)…I’ve been fearful of approaching the investor side, rumors of lending sharks, that are just waiting for any violation that voids your contract and allows the ‘sharks’ to come in and retain the ownership of a job I’ve spent much time and money on…

Just from what I’ve viewed, in the short time I’ve had the full program (I encourage anyone, and everyone, get away from the free version and take a leap of faith to the full version) THis baby comes fully loaded, with sensible easy to follow information…Daniil and James have gone to great lengths to simplify and energize those like me who are intimidated, and fearful of J.V.ing with the wrong lenders!

You’re welcome, Zaid and I appreciate your compliments and support!

I do not have buyer’s remorse. Your tools and information are real-deal quality. Thanks for delivering valuable content.

information is short and sweet. goes right to the heart of any deal.

Please watch this: https://rehabvaluator.com/case-studies/wholesale-case-deal/

How do I determine the equity of a potential flip, as it sits now?

Dave: 1) Don’t wholesale MLS-listed properties that you’re looking at with agents. I know some people do it, but in the eyes of most legit real estate investors, you’re just crowding the marketplace when you do that. The whole point of wholesaling is to find OFF-market deals. That’s how you bring value to the marketplace. 2) It’s always best to disclose your intentions to sellers. Even if you don’t say you’ll be assigning a contract, at least let them know it’s a possibility. Honesty is always the best policy and it avoids confusion and hurt feelings down the road. As part of your bonuses for Rehab Valuator Premium, you have a Purchase contract that allows assignment and Assignment of Contract that you can use.

Daniil, I have an agent to work with me on making offers and talking to sellers/agents. If I decide to wholesale a property, doesn’t that eliminate any fee percentage my “buyer’s agent” would receive? Also, when wholesaling, I don’t want the seller (or his/her agent) to know that I am “assigning” the deal to someone else, correct? Do we have an assignment contract available to us here?

Regards,

Dave

Hi Juan,

All you need to do is take the sales price and divide that by the number of square feet. That will give you the price per square foot per comp. Do that for each one. So for a $100,000 property that is 1,000 sq. ft. you would take 100,000 / 1,000 = 100. Then you add up those per sq. ft. costs and divide by the number of comps you have. That will give you the average per sq. ft. cost.

So our first comp is 100/sq. ft. (as calculated above). Lets say we also have a comp that is $200,000 and 1,000 sq. ft. so it ends up being $200/sq. ft.(200,000 / 1,000 = 200) You would then add those together 100 + 200 = 300 and divide by 2 (the number of comps we had) to get the average which is $150/sq. ft. I hope that helps.

I would like to see a case scenery on how to calculate $/ square feet from comps to arrive to ARV?

Thank’s Juan.

I certainly hope so! 🙂

Looks interesting and helpful……Thanks

I appreciate your tutorials and look forward to any and all future improvements to an already useful tool. Great! I look forward to using this tool for my presentations to buyers.

Excellent tools to calculate ARV, cap rate max offer. The instructional tutorials are really good to learn to operate RehabValuator while learning real estate at the same time. This is great.

Thank you

Hi Seyed,

Rehab Valuator will evaluate all cash deals or deals with financing (including hard money lenders).

Thanks!

I am assuming the calculator is based on cash money not provided by a hard money.

You are the BEST.

Thanks, Jay!

Daniil great information straight to the point..

The system is the key….

Hi Juan,

You already have our Rehab Valuator program. If you need help accessing it please email us at support@rehabvaluator.com

How can I get a link to the flipping software, and how much it cost? Thanks Juan.

Note: Your articles are very helpful and clear….

Thank You for Your inside about calculating ARV it was very helpful. specially, how the rehab-valuator software bring into the software comps from Zillow. Great. Best regards, Juan.

Marian – it depends on the CMA methodology, but yes, that makes sense. To me what’s more relevant is always the ARV. Not the current as-is. That is always too hard to pindown. ARV is actually easier!

The information was very helpful.

Besides being unrealistic to expect realtor to do multiple CMAs every week. I’ve yet to find realtor that can do an “after repair” CMA for a rehab property or sold as-is. They say the CMA is generated from the subject property which if its a rehab, the system will only generates like kind.

Has that been your experience?

Hi Michael,

Purchase contracts are available to premium members are part of the bonuses package. Even then we still recommend you have an attorney look them over to make sure you’re complying with local, state, and federal regulations. In regards to lenders we don’t get involved in that aspect too much. We do have a Get Funded button inside the program for premium users. That allows you to match your deal with a list of 150+ hard money lenders to see if any are a good fit.

Hi I’m Michael I just joined up I’m honor to be apart of your team of students I’m a novice investor and I’m finding this tool to be very insightful I look forward to finding all the necessary tools in order to be successful at wholesaling and flipping as well as purchasing and holding ! One thing I don’t see and would like to see on your sight in purchase agreement contracts. Also I’ve ran into a few would be private money lender on this site who are very very questionable, how can we find reliable source of funding ?

thank you I look forward to seeing you on the other side of success !

Sincerely

Michael Sims

Hi Mr. Evans,

I’m glad you’re enjoying the content. In regards to your video issue I emailed you some things to try. The first being a simple reboot. The second is trying a different web browser. Look through those tips from my message. If you continue to have trouble let us know.

Thanks!

This was a very informative tutorial. Why didn’t the videos play?

Hi Cory,

You’re very welcome! We like to try and make things easy to understand. Information is power and understanding how to implement what you learn is the key to success. Rehab Valuator is designed to help do just that. Execute.

great job! thanks for breaking down for us. I still have questions but in time like anything new will learn more. You do a really good job breaking it down for people and you software does all the hard lifting for us!! thank you very much.

Cory

Pierre: There are a number of ways you can track down these owners. First thing to do is access your county tax records and find the mailing address for the owner. If these properties are vacant or investor properties, mailing address will generally be different than the property itself and you should have decent luck sending a letter or a postcard to that address.

Next, you can try to find the owners on social media. Many people don’t think about this, but it works! Send them a message on Facebook or LinkedIn if you can find them. Or maybe you can google their phone # and call them.

Lastly if none of this works, you can use skiptracing services to locate the owners. And last last last thing to try: take a “For Sale” sign and stick it in their front yard with your phone number. See how quickly the owner calls you to find out what the heck is going on! 🙂

Hi Daniil,

I found ten properties yesterday that I can consider as wholesale deal. I got the physical address, but how can I find the property’s owner? Could you please help me in that particular case. Thank you in advance for your support.

Best regards,

Pierre

Thanks, Bertrand!

Rehab evaluator is a great tool very helpful and makes the process clean and easy to manage.

Very good article. I appreciate the lists for companies other than Zillow.

Hi Danna – that’s correct! Comps won’t work for Texas deals likely, but everything else in Rehab Valuator will work just fine!

Since I am in Texas, does this mean that Zillow is the only one mentioned that will not be disclosed?

I can still use the Rehab Valuator though, can’t I?

Hi Daniil,

Extremely helpful article, thanks. I have been using Redfin for sold comps, so I am interested that you think Zillow is better. Why?

That’s what I like to hear!

Danii You explained this so perfect. I have asked these so call gurus to help me make offers. No one have i gotten a phone back.

Lets Work

Jai Thompson

Ben – closing costs really vary by transaction, whether it’s cash or loans, etc. Everything in my videos is just an example and not a guideline.

Am I missing something? In the video, why is the closing costs on the buy side $2k? We’re not buying it at $100k we’re buying it at the MAO so wouldn’t the buy-side closing costs be more like $1000 or less?

I really enjoyed reading your post, it’s packed with a lot of useful information.

I am definitely ready to take my first action in real estate investing in my first flip

property. Thanks

hi, thanks for the article. Very instructive, but unfortunately, I live and active Dominican Republic online resources so that you sent me can not be used here …. In any case very instructive material. If somehow you need a representative here. Call with confidence …

Thanks so much Daniiil.. it was truly a blessings to find out about you. Thank you and I look forward to your your next post

very helpful info

Great Points! I need a quick refresher since it’s been a few years since I invested. I almost thought about purchasing another 4 figure course until I read this. Got me back on my bike…at least to help me hit the ground. Great work! Will check out the calculator.

Daniil you crazy man rock star like John Elton said your a rocket man dam your a pimp in this field wow man I still can’t figure out how you do it but after seeing your education I see why you give what you give sincerely yours JJ the kid.

Amazing software. Yes of course i need this.

Very helpful information. I have not setup a website yet.

VERY INFORMATIVE!!

Really great stuff..thanks

Thanks, Daniil I always wonder how that was done. I thank you for the information you have provided for us to use. If I could only get a copy step by step I strongly appreciated it. Once again Daniil I Thank You

Hi Brenda,

No. The video is working all the time and I just double checked and it’s working great on this side. I’ll email you some suggestions that might help.

The video doesn’t play. Is there a time frame that it doesn’t? This is the meat and potatoes.

Chris: I actually talk about estimating repairs here: https://rehabvaluator.com/content/wholesaling-101/how-to-estimate-repairs-on-any-project-quickly/

Hi Daniil

I have tried FindCompsNow several time, and find it the worst website looking for comps. After registration, you should be able to pull comps, but after logging in, it keeps on declining your access. On facebook there is several people that has and still is voicing their dissatisfaction with this website. When you enter the address in the search bar, it recognizes it, but will bring up $0 as estimate. Is this an indication they don’t have the property on their database? Surely not for properties that has been build in the 60’s or 70’s. Been contacting their support team and even trying to call them, but no response at all.

I would therefore not recommend this site as a reliable site. If it does. on the odd occasion, give you an estimate on a property, it is most of the time the same as on Zillow. Only difference is,that it gives you options on the Offer price based on 60%,65%,70%,etc.) you use. Which can be great if the site is more user friendly.

This is where I give Rehab Valuator 100% for being such a user friendly site.!!!!!!

This was very helpful and detailed all investor need this information. Thank you so much taking time out of your busy scheduled to teach all of us this.

Hi Dale,

Absolutely! What you will need to do is sign up to be an Affiliate with us. You can make commissions this way by sharing your unique Affiliate link once you sign up. Thanks!

Daniil,

I have a young Investor that wants to start doing deals with me (I will be wholesaling to him), I believe he needs this information. Can we work a deal, where I get a little commission if he purchases from you?

Thanks,

Dale

Hi Mr. Bowles,

I am having a little trouble understanding your comment. My guess is maybe you’re using speech to text or something. In regards to troubled neighborhoods there can be great opportunity there for investment but it is very dependent on the neighborhood. In the end, if the numbers make sense, you can get the profit you want out of the deal, and you’re confident you can accomplish your exit strategy I say go for it.

Thank you for the information and I’m striving to learn everything bit of it. My issue is that I’m in the st. Louis city market and most my comps sold are already low. Like sound for 22 to 40 thousand. My issue is that use I can make a offer which will mostly lead to a very low offer but it sold it would be 20 to 30 thousand sold to a buy. Should I simple avoid troubled neighborhoods or just choose a different market?

Thanks, Sheila. I’ll work on adding something about this!

You have the free version. There’s nothing to cancel. It’s not a 14-day trial – it’s free permanently 🙂 If you want the 14-day trial of the Premium, it’s here: http://www.RehabValuator.com/try-it

Just wanted to make sure you canceled my 14 day free use of your product…

Thank you Bill Ross

727-412-3744

Good Job Danil….Thank you for the video! I would like to have an example regarding the $ per sq ft in adjusting or adding or subtracting something in the comps and subject property. Thank you.

Thanks, Kahl! Always great to hear from you and appreciate the compliments!

Glad to hear it, Joyce! Thank you

Good point! Always include insurance in your holding costs calculation!

One expense that can really upset a deal is insurance during the rehab period. You can take the risk and not cover the property but if you are in an area that has a lot of tornadoes or subject to hurricanes, depending on the time of year it may not be prudent to not have coverage. These policies are called builders risk and typically are for a 6 month period minimum. They are also very expensive….therefore don’t forget to include that in your COR – Cost of Rehab!

Daniil

This is very valuable and helpful information. Easy to learn.

I work Kansas and Missouri but this is info that will work very

well for me..

Thanks very much

Daniil….. Your latest email, above, deserves to be ENSHRINED as the best guidance any ‘newbie’ R-E Investor may encounter. GREAT JOB, Kimo Sabe! (BTW, ditto your RehabValuator software which is an essential tool for both learning, calculating and presenting to seasoned professionals.)

Excellent Daniil. I was looking for an easy Rehab calculator for such a long time. This is a wonderful software and support is amazing… I will recommend this to all who would like to invest in Real Estate deals

Mark Washington here thanks for the info question I have not had good progress in wholesaling how do you find

Motivated sellers and real buyer’s

Can you steer me in the right direction

Thanks

That’s good info thanks I have been trying to wholesale a deal keep coming up short, need to find motivated sellers and real buyer’s what’s your method??

Hi Jay! That’s great to hear! Thanks for kind words and good luck on your deals!

I loved it , it made a lot things much clearer for me in coming up with quicker calculations.

Glad to hear it Dickson! Make sure you check your email (we resent you your login credentials for the free version of the software).

Hey Danii, this educative and a quick decision making tools. I love it and would like to use it for start of my new business.

Hi James,

What specifically are you having trouble with regarding ARV?

Thanks!

i seem to got lost on the arv part

In the process of offering on several properties!! Looking forward on using your rehab program!! Thank you for taking out the guess work!!???????

Hey Daniil, I’m really enjoying the information videos and all in between. The software is awesome. Could you help me in this are, what are the best resource to find motivated sellers? Thanks

Estimating is critical good information

Hi David,

You can see the pricing information for Rehab Valuator Premium here: https://rehabvaluator.com/pricing/

Please reach out if you have any questions. Thanks!

I am interested in this software but money is beyond tight. I am having some vision issues right now.What is the cost?

James, There is no easy answer to this question. You should be as exact as you can be knowing that any cash buyer you find will be doing calculations on their end. We always recommend, if at all possible, to have someone look at the property in person. There are some things you just can’t estimate with percentages and photographs.

Daniil, this is a good presentation on how to calculate ARV. I have always had problems trying to figure out how to calculate ARV and determine the maximum allowable offer. With your software this is easy to calculate. As for estimating the repair costs, how exact does one have to be in order to be accurate. Now that I am in the State of California and looking for properties in Georgia of Alabama. I am not in that area, how do I estimate the repair costs?

I love the mapped comps reports that automatically populate in the Rehab Valuator software!!

This was a great video. The cap rates that reflect an attractive percentage return on an investment can be a deal maker.

DONE WORE MYSELF OUT, TAKING A BREAK FOR THE REST OF THE WEEKEND. GOOD STUFF. THANKS AGAIN.

Hi Sid,

Definitely. Comps are going to be your main driver when calculating ARV.

I am a newbie and hope this information makes it easier for me. It certainly seems to be easy to use. Thank you for sharing it.

Thanks Ray!

Thank You I enjoyed the article.

This was very helpful Daniil. It she’d a little more light on the difference in what is input for wholesales (flips) and your holdings for rentals.

Excellent very well represented. Have a clearer understanding,

I am now learning all over again how to purchase and sell and make money. In the past I have bought using my own funds repairing keeping or selling and move to the next. I need to preserve the other cash therefore I am looking to see how to structure so a funder and I both make money . This one I have used and I am learning how to use the rest of your program to exceed and so for it has been rather simple which is great KISS.

Jerry

This information is very clear , thank you

how do you determine your ARV if Theres no Rehabbed Comps in Your Target area or Zip code? for example My target has 5 bedrooms 1 bath and the comps in the area that is sold in the last year is 4bd 2 baths and they are not that updated with different price pr sq

Hi Veronica! While we don’t have a specific resource on this topic, you could reach out to your local realtor for assistance with comps if you really are having trouble finding comps with the resources at hand.

What if there are no comps sales in the area how do you figure the arv

thank you so much for allowing me to view your free content.

You did a very good job on this. I have rehab valuator and love it. The only problem I have with it is for at least the one property I just worked on the comps in the software for this property were for a completely different area than the development I was in and the comps is this development run $158.00 to $167.00 a square foot vs $125 To $130 a sq. ft so warn your users to do their do dilegents and make sure the comps are valid. That being said I Love the software and I’m sorry I didn’t invest in it sooner. I have used it to evaluate 3 properties this week alone.

buying from a wholesaler who presents the total picture ARV, repairs, and profit,

how can I determine if his figures are accurate. And can you expand on this topic?

Thank You,

Mike

Good Stuff!!!!!! Very Informative

Great info Daniil. As usual. Consistently simplistic and thorough, minus all the rocket science.

Very Blessed to have crossed your path. I’m on a mission to reach the top of the ladder to success, however long it takes. With your input and unlimited info and direction, we will make it happen. First week has been very positive, and the pieces are beginning to fit together. My immediate goal is to get a deal done. Any deal! Wholesale, Rehab to Flip or Rent. That’s when my confidence will soar.

Your interviews posted on you tube are priceless. The insight and experience your successful friends so freely share, is extremely motivating.

Looking forward to working with you and your team.

Very good addition to RehabValuator

Hi Glyn,

Great question! We do have some great tutorials on hold exit strategies. I will send you an email with those links!

This is a nice informative video training. However, this is great for single family, what about multi family? I know the value of multi family properties is determined by the income that a multi family generates. But, what does that look like in a scenario for training purposes, for review and study.

Short and sweet……..

Thank you for the awesome training and mentoring that you provide!

Yes! Very cool stuff.

I love how the terms MAO, ARV & others originated with Ron LeGrand, who got his start in RE investing after attending a Robert G. Allen seminar. R G Allen is who I got my start from, but didn’t take it and run with it as far as did Ron.

Hi Janice,

Yes, and there is more info you can look at as well. I will send you an email right now with some more info.

Thanks!

Is the ARV determine by the average comps in the area?

I Learned A.R.V. at VestorPro but Your simple Explanation was way better. You Get your ARV of 100,000 from your Comps ??

Thx Sid

Thanks Daniil for this information. I had used the calcuator before i viewed this video and it really works well with Zilows Comps. The reports are first class. Now I’m working on securing “Hard Money” for my deals. Thanks. Steven

Enjoyed the tutorial for ARV. Very well explained and informative. I have a basic account, but will upgrade to premium once I make a deal.

great tutorial and tools make everything easier thanks. How do I used these tools to start making deals. what do I have to do first so i do not get burn. I’m new at this game.

Welcome 🙂

Thank you Daniil. You always have great info.

Hi Bob,

Use the Quick Offer Calculator inside of Rehab Valuator to help with that. It’s under My Resources. You put in the ARV, enter in the rehab costs and other costs, then set the max percentage you want your cost to be (probably 80% to 85% in a really competitive market) and you’ll have a Max Offer.

If the property is listed on the mls for example 265,000 and the ARV is around 290-295,000 but needs 40k to renovate it how much should I pick that property up for in a hot market?

Welcome 🙂

Most invaluable sir. Thank you.

Daniil, I agree that it is essential for investor’s to accurately figure out a property’s ARV prior to entering a deal in order to maximize profitability. However, I don’t recommend using comps to determine ARV due to its speculative and perceived nature. Using comps to calculate ARV may work well for flips or wholesales however this can also limit profitability. While I love Appraisers, Realtors, Lawyers and CPA’s Because they help my bottom line, they are not Investors.

Using comps to determine ARV can lead to over paying for a property, the very thing that we as investors want to avoid. Using comps lends to the creation of housing bubbles where housing becomes over priced due to economic expectations in the labor market which is more volatile. Let us remember that it is the labor market that decides what people are willing and able to spend. The method I use in determining ARV is to determine the current Fair Market Rental Value (FMRV) of a property and multiply that by 12 and then by 7 that provides a more stable MOP.

(FMRV x 12 x 7 = ARV)

I have found this formula to be more accurate and more profitable than using comps to determining ARV. That said, when it comes to selling the property if comp prices are greater than that determined by using FMRV to determine ARV that is icing on the cake, added profitability. On the buying side if comps are lower than ARV determined by FMRV again, you have leverage to secure the deal because you will have a greater MOP than those using the comp method knowing the real value of the opportunity. If you’re able to secure an opportunity using comps lower than ARV determined by FMRV that means even more profitability.

Personally, I like the security FMRV provides in securing opportunities given that if the opportunity does not sell short-term, it is sustainable long-term maintaining my profitability through rental income.

Hi Eric,

We’re not legal experts. As far as I know, there is no limit on such transactions but all legal questions should be addressed to a local real estate attorney that is familiar with your local city & state laws.

Dear Daniil,

Sense 3/9/13, I decided to pursue a Wholesaler/Bird-doggier career. By figuring out my fair assignment; double closure fee, I was trained what ever the cash buyers/investors ARV is appropriate to use in different property situations, the percentage of the ARV as well as their profit and mine. According to the training I received, they said by looking at the cash/buyers profit, it gets divided by 3 which is my profit that’s applied at the low end of the ARV. I did an intensive research on laws on what’s the limit on what a wholesaler/bird-doggier receives. So far, nothing came up that’s concrete. So the way I’m thinking is due to the fact there’s no laws on how much the wholesaler/bird/doggier receives, numbers just can be picked at random. My question is is this right or fair? Thank you.

I have never done a deal and I have no idea how to apply this information

Welcome! Glad it helped 🙂 Please let us know if you have any questions.

Thank you for the information. Great job!

Good for beginners.

Great video on how to calculate ARV and what your all in cost would be thanks for making this video ..

You might consider me a wanna be investor. I am definitely a novice. I’ve been studying and I am so grateful for your free lessons. I am trying to get some cash investors to allow me to do a walk-through on a live ARV/MAO estimation. Watching video is good, better than reading about it but the walk-through is what I need. I live in central Los Angeles close to Hollywood.

I do want to get the RehabValuator but my budget is shoestring type, for real. I hope I can get it before the price goes up. Please give me advance warning.

I am really appreciative that you are being so helpful.

Hi Patrick,

Good tip! Luckily, Rehab Valuator takes that into consideration when you go to do your analysis. It lets you enter in things like interest rate, points, profit split, etc.

Very important and valuable information, like it very much. Another item need to be added to the cost calculation is the financing cost if it is financed.

Realtor